For sales people the ocean of online webinars can be a nightmare. So many events but no way to network and get new contacts. In this Superangel Insights we were thrilled to have Piia Sander from Messente to share her experiences how she has solved that challenge.

You’ll find answers to the most burning questions, including:

- How to select the events that are actually relevant to sales?

- How to prepare for online events?

- How to approach people?

- How to follow-up?

- What not to do?

Our key takeaways are shared below.

- Choose events that match your Ideal Customer Profile profile

- Choose events with enough participants that your sales team can handle the preparation work and the meetings

- At the event approach people in a more casual, chatty way – less ’emaily’ and more LinkedIn style. Mention the value to them by explaining why you’re approaching.

- The focus needs to be on “YOU” and how I can help you. And by YOU, we mean your customer!

- Use the Sales Navigator at LinkedIn as a due diligence opportunity and homework tool to find out about for latest activity – learn the company’s news and latest insights

- Keep the focus of the call on listening to the client

- Set up a timeline when you’re getting back to them for a higher chance of reply

- Attendee lists are usually public on social media. Use that for prospecting and sending out a LinkedIn message

- Don’t start talking about yourself and not asking questions

Piia Sander works as a business development manager for Messente Communications, a global smart messaging gateway. Prior to Messente, she worked for over 7 years as a sales manager for Äripäev. With years of experience in active sales, sales management and coaching, Piia has the theoretical know-how and the practice to back it up.

Superangel is proud to have a Superangel Insights session with Hedi Mardisoo, co-founder and CEO of Cachet.

Hedi is among TOP15 women to watch in European fintech by Sifted and her startup Cachet is listed as a future unicorn prediction by prominent Estonian investors. She is going to share insights on building a network of 120+ key people and using it to prepare for a market entry.

In the session we covered:

- How to build a network of key people in your industry?

- How to prepare for meetings with mentors?

- How to prepare entering a new market?

- How to ask help so that it brings results and the intros you need?

Main takeaway from the session: Ask for help and you’ll be served.

- Personal follow-up email is a long term investment. Put together an email that makes sense even when looking back at it a year from now

- Successful ask is a key thing to successful networking. To ask well, you need to make it as easy for the other person to help you and spend their social credit

- Figure out whose problem your product is solving on the other side of the intro

- Start with markets that are not heavily saturated. Where are your key clients today?

- Tap into embassies and use local organisations to help get your foot through the door in new markets

- Hunger to grow, experience in the sector, good network and ability to solve problems, eagerness to build – formula for hiring a country manager in Cachet

- Have a specific person in mind you want in your company? Be bold and ask directly.

- Entering new markets and cultures means listening first and not pushing your ways only

- Check out Global Entrepreneurs Program if you want to relocate and take your HQ to UK

Thank you Hedi for an insightful session! Best of luck building Cachet!

We’re excited to host Meeri Rebane in the Superangel Insights session on ‘How to Skip Your Backyard and Launch in Big Markets’. Meeri is the CEO of INZMO, the #1 insurance startup to keep an eye on in 2021 according to Business Insider.

Find answers to questions like:

- How to enter major markets?

- Why did they as an Estonian startup choose Germany as their first market?

- How did they enter German market without speaking any German?

- How to find key employees in a new market?

“Startup founders have to think about the next fundraising every day. To do that, you need to think what kind of traction gets you there.”

Here are some key takeaways from the session:

- Entering a small market successfully might take more effort than entering a big one. And next round investors don’t care much about successes in small (home) markets

- The most important people in new markets are aggressive salespeople. Everything else you can do yourself

- Hire senior guys. They are motivated to work in a startup as they want to make their mark in the industry

- Launch a market where your valuable clients already are – it gives you credit and increases traction / interest.

- Big clients give you a big opportunity but it also takes a lot of time. It may mean your startup can die 3x during the period. Think – are you financially ready to survive long deals?

- Founders are like psychologists and providers who need to keep the employees motivated and help them do their job

- Find ways how to incentivise corporate partners so that they are willing to open up their client portfolio for you

Thanks Meeri for a great discussion! Best of luck achieving your 10M€ revenue goal for 2021!

How much money can your startup raise after investing 72h into Base Camp hackathon?

The anniversary Base Camp was an epic journey for early stage startups in many ways. Here’s a look at what 29 teams from 13 countries, 35 experts and 68+ hours of mentoring sessions can help startups accomplish.

Finished watching the aftermovie? Well then you’ve got a pretty clear idea of what’s the hype about!

During previous 4 Base Camps, our alumni has been able to raise around 16M€. This time is no different. Base Camp Autumn 2020 startups have raised around 2M€ within 2 months.

Be part of the Base Camp experience and join us for the next hackathon on 18-21st March 2021. Leave us your contact details and be the first to know when applications open!

If someone told you the first step to increase revenue is to understand human psychology, what would be your first reaction? You’d probably think it’s vague. Alright, let’s get more specific. 95% of the decisions humans make are subconscious. Moreover, the attention span is very short: first impressions are made within the first seconds. Now think about your first customer acquisition channel – what would you change knowing this information?

Superangel Insight session with Kristel Tuul, a data-driven growth marketing expert was all about hacking human psychology and turning it to your advantage for nailing conversion . You’d be surprised how much digging into human behaviour can change the way you want to present your acquisition channels. The original webinar or a podcast are available to follow how Kristel thoroughly analyses the website of GDPR Register and VideoCV. Be prepared for a session packed with practical information you can implement already today.

Run a 5-second test to optimise the value-proposition of your product and attract high-quality leads

When potential customers land on your page, they behave differently depending on their awareness level – they may be unaware that the problem exists in the first place or they might already know your brand. Regardless, there are effective ways to optimize the acquisition channels to ensure the conversion of high-quality leads.

Firstly, put on your customer hat and run two tests, 5 and 30 second test, which allows you to understand how well your page communicates your messages. How does it work?

5 second test – watch the page for 5 seconds, close the screen. Ask yourself:

- What do you remember?

- Was it trustworthy?

- How did it make me feel?

Following the 5 second test, you should run the same procedure but this time at least 30 seconds or as long as you’ve managed to cover the content. Now ask yourself:

- What is the most important message?

- What is frustrating?

- What is confusing?

Pro tip! This practice works well as a funnel: start from your ads and continue with the landing page, product page etc. The best outcome comes when you run this exercise on a selection of people at your target group or even at a coffee shop to get a fresh opinion and input – experience shows the discoveries are 2x better with strangers.

If the customer will spend only a couple of seconds on your page, will it be enough for her to understand what is the value of your product?

Here are some practical tips to maximise impact:

- Bring out the value first – why should they use your product? Is it to save time or money or to increase revenue? With this in mind, have a look at what your competitors are doing. Understand how they’re positioning themselves and what’s the value they are selling. Follow it up by bringing out benefits and then functions that allow you to deliver the values.

- People skim read and only read headlines. Put the most important messages into headlines

- For the same reason, put the most important messages into the 50% of your page

- Use simple language and easy to follow structure: use bullets/italic/bold to bring out the most important information and break the reading pattern for the information to be actually noticed.

- Give the image of “easy” even if your concepts are hard – make it as easy for the customer to understand your offer as possible

- Use social proof to build trust – what have your customers or partners said before?

- Find out what’s the main device the visitors land on your page from. Make sure your website is mobile friendly and the message gets over the same way as from a computer screen.

Use mere exposure effect to create familiarisation

Have you ever clicked on an ad and realised you’ve ended up in a completely different place than you expected?

Most probably you left the page the same very moment. The same happens to your customer if you ignore the mere exposure effect – a tendency to develop preferences for things simply because we are familiar with them. In practice it means that the more you perceive a certain message, the more likely you’re to rate it positively and trustworthy. Thus, all messages in your funnel should support each other. Create familiarity through channels and avoid conflicting messages. It does not mean repeating the same message several times on the same web page

Survey your website visitors and existing customers to improve clarity

Getting live feedback from your website visitors and customers is the best way to hack what works well and what you are currently missing. Using questions like ‘what are the limitations of the current solution’ and ‘what matters the most for you in a solution’ is a great way of reaching the customers who are hard to interview. Use your customers also to optimise your tag line and value proposition: what are the 3 adjectives they use to describe your company/product and how would they persuade a friend to start using your product? It’s likely the answer is different to what you thought was important.

Do not multitask. Focus on 1-2 channels

Select active channel as first (e-mails, LinkedIn) and passive channel as second (SEO, content creation, word of mouth). Within these channels, constantly learn why something is working or not working – don’t just copy something from your competitors website that looks nice. You cannot be sure whether the conversion works or not. Instead, focus on your biggest growth opportunity by continuing visiting your prospects and customers for their input.

If you’re keen to learn more, check out these resources:

- UsabilityHub for testing

- Google Tag assistant

- Wappalyzer

- The Bullseye framework: a five-step repeatable process to maximize your chances of getting traction: brainstorm, rank, prioritize, test, and focus.

Books & online materials mentioned:

- Eric Riese “Lean Startup”

- April Dunford “Obviously Awesome”

- Aaron Ross “Predictable Revenue” and “From Impossible to Inevitable”

- CXL.com blog

This article is from a series of sessions between Superangel and brilliant experts & entrepreneurs on the most relevant topics for early stage startups.

In October, Jeff App won Base Camp 2020 global competition for early stage startups by impressing the jury with a strong capability to mobilise as a team and significantly advance the product in just 72 hours. Now raising a seed round, Superangel had a chat with the founder and CEO Toms Niparts on how Jeff App was born, how they plan to continue conquering South-East Asia and what is the most important lesson they have learned in building a fast growing startup.

In Summer 2019, two friends quit their well-established jobs and relocated back to Latvia to focus on building up Jeff – a loan broker for the unbanked. Started in January 2020 – probably the most unique time to launch the startup considering the global pandemic, they’ve successfully established traction in Vietnam with 150,000+ users and revenue growing at a rate of 70% MoM. Today, the app has been used close to 1M times.

Jeff’s success hasn’t gone unnoticed in the startup ecosystem. Prior to winning the Startup Day pitching contest, Jeff App won Seedstars Latvia and CEE, and last month they were also a runner-up in Arctic15. They’ve also been recognised by Forbes USA, Sifted, Singapore FinTech Festival and Slush as one of the top FinTechs to keep an eye on.

‘If you don’t have big audacious goals, it’s extremely hard to build a great company with big success.’ – Toms, the Ceo of jeff

Jeff App operates in a market with high growth potential. With a population of 570 million and a booming GDP expected to reach $4.7 trillion by 2025, the six largest countries in Southeast Asia represent one of the world’s largest and fastest-growing regions. More than 70% of the adult population, however, is either “underbanked” or “unbanked,” with limited access to financial services. At the same time, most banks find it difficult to meet the needs of the underbanked population because of the vast mismatch between traditional bank credit scoring models and the actual data the consumers have at their disposal.

To change that, Jeff has created a loan brokerage app that utilises alternative data to boost financial inclusion in South-East Asia. For banks, Jeff becomes a lead generator that can bring new business and services a much bigger customer base. They provide a large number of new, valuable insights derived from digital footprint and various alternative and behavioural data sources.

Founding the company in Latvia, operating in Vietnam. How does it work?

The global economy is changing and building a company remotely is easier than ever before. Nevertheless, the founders quickly realised that local knowledge is everything – the culture, behavior and customer needs are different. Thus, whilst the technical team is located in Latvia, the customer and partner facing team operates in Vietnam.

It’s clear that the founding team is not afraid to go big – entering the South-East Asian market is incredibly exciting. Achieving a considerable user base would probably take years in smaller European markets but in Vietnam the market potential is much bigger. At the same time, Toms wonders if Baltic startups are dreaming big enough as building a company only in the Baltics diminishes the market size significantly. He follows, ‘If you don’t have big audacious goals, it’s extremely hard to build a great company with big success.’

The most important lesson: People create the business. Make sure they are in for the right reasons

Today, there’re 8 full time employees behind Jeff App in Latvia and Vietnam covering a range of expertise, including digital marketing, design, business development, data analysis and software development. Toms admits that T-shaped skillset and thinking is a very important aspect when putting an early-stage team together. Additionally, they’re looking for strong A players: people that have very strong domain understanding and deep experience in their area. In that way they’re considerably decreasing onboarding time, adding value sooner and maintaining internal communication and simplifying the know-how exchange.

The hiring process has also been the greatest learning point for Jeff’s team. ‘We learnt this the hard way. At an early stage, if someone wants to join your team only for a salary increase, run for the hills.’ In Toms opinion, it’s very important to understand right away what the person is looking for in his/her next challenge and how it aligns with what you can actually offer. ‘Be brutally honest about this – otherwise you’ll waste your key resource: time.’

Base Camp gave Jeff App the opportunity to advance the product and take a step back from day-to-day hustle

Out of 120 applicants, Jeff was one of the 29 teams who was invited to attend Base Camp Autumn 2020, a biannual 72h product focussed hackathon organised by Superangel and Garage48. Toms thought Base Camp to be an excellent opportunity to isolate from the noise and be laser focused on one idea: ‘An early-stage startup always has a great deal of ideas and hypotheses to test. At the same time, it’s easy to float away and shift focus to some urgent things to fix.’

The team decided to work on an idea that they had discussed internally for a while- lender portal. The lender portal is a free-to-use web application for Jeff’s partner banks and lending partners to conveniently access incoming client flow. Considering that APIs are non-existent and exchanging data in South East Asia is currently inefficient, the system not only puts a new, better infrastructure in place, but also helps increase the number of prospects for lenders by 3-5x.

Base Camp also gave Jeff the chance to discuss their business with entrepreneurs who’ve been there before. ‘It can get hard to look at the big picture with a clear perspective.’ reflects Toms. ‘Getting clarity and understanding is hugely important to reset the course again. From tips on UX and UI to high level business talks, sessions with Base Camp mentors were valuable.’

But why should any early-stage startup attend Base Camp?

„Number one reason is focus. Then comes competitiveness and contacts, and besides: Why not? What do you have to lose?”

Base Camp Spring 2021 takes place again in March. Are you an early stage startup looking to work with the best experts and investors, and gain deep knowledge to advance your business and product? Follow our social media and be the first one to be notified when the registration happens.

Check out our posts also on Medium.

Estonian startup growth in the 3rd quarter of 2018

Recently, Q3 revenue, tax and employee statistics were published for all Estonian companies. The Superangel analysts selected 304 Estonian companies in the startup space and dived into the growth numbers. We found some of the usual suspects of fast growth, but also some not so obvious startup runners-up on a high speed growth trajectory. If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

QUICK HIGHLIGHTS

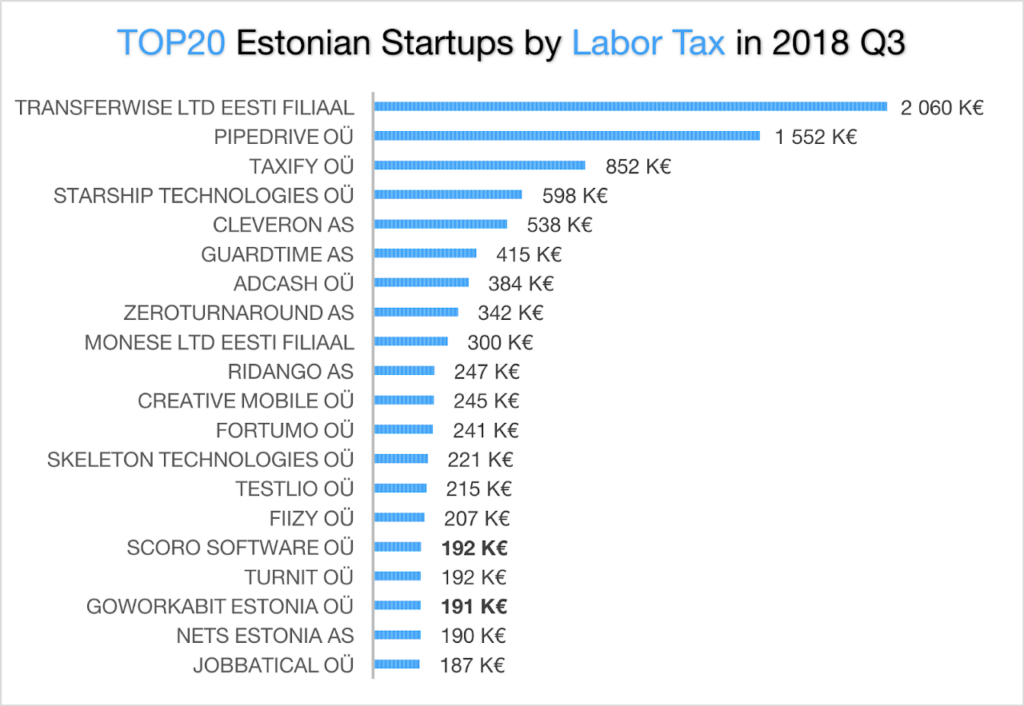

TOP startups by labor tax volume and growth

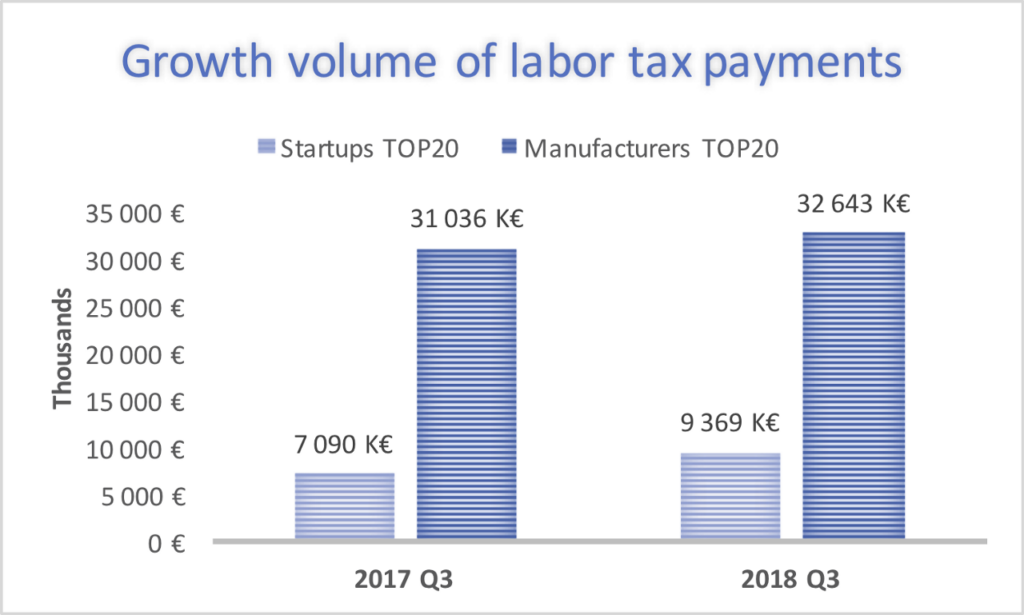

- The TOP20 startups grew the government’s labor tax budget 37% more than the TOP20 industrial manufacturers (+€2.2M vs +€1.6M).

- In 6 years the TOP20 startups total volume of quarterly labor taxes will surpass the tax Euros paid by the TOP20 industrial manufacturers.

- Newcomers to the TOP20 labor tax payers were Scoro Software and GoWorkaBit.

- Based on year-on-year (YoY) tax volume increase the less known outliers are Fiizi and Pipedrive.

TOP startups by sales volume and growth

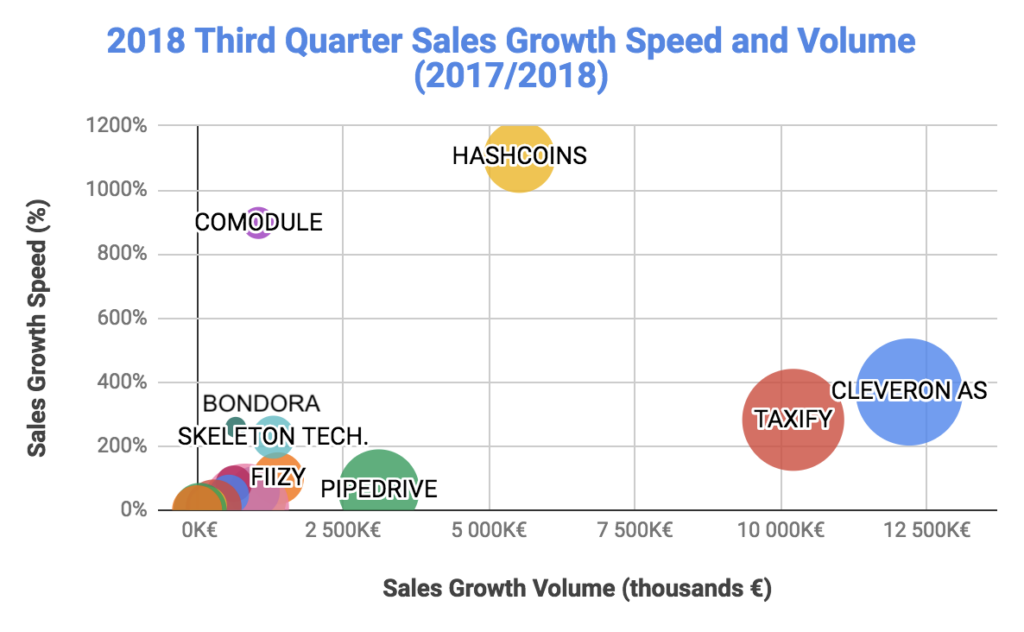

- Two newcomers into the TOP20 startups by sales volume are Comodule and Bondora.

- Two startups in the TOP20 showed over 800% growth on their YoY quarterly sales: Comodule and Hashcoins.

- There were 9 startups, who could show both quarter-on-quarter (QoQ) and year-on-year (YoY) sales growth. The most interesting outliers among these were Comodule, Realeyes, Fiizy and Skeleton Technologies.

- Based on YoY and QoQ growth volume the runners-up reaching to the TOP20 are Fitlap, Funderbeam, and Majandustarkvara.

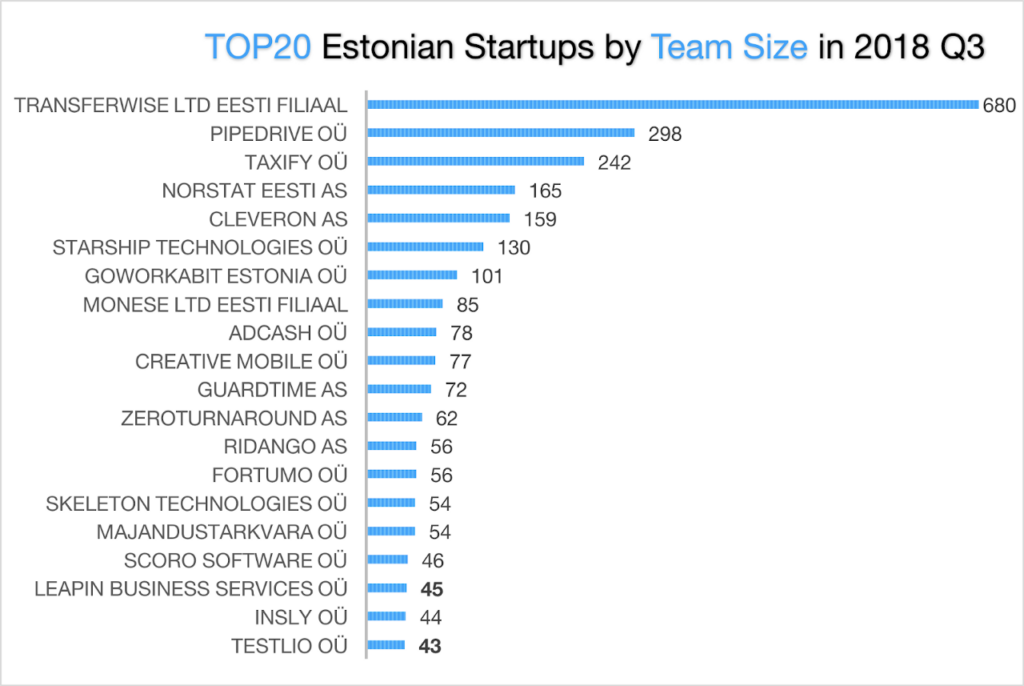

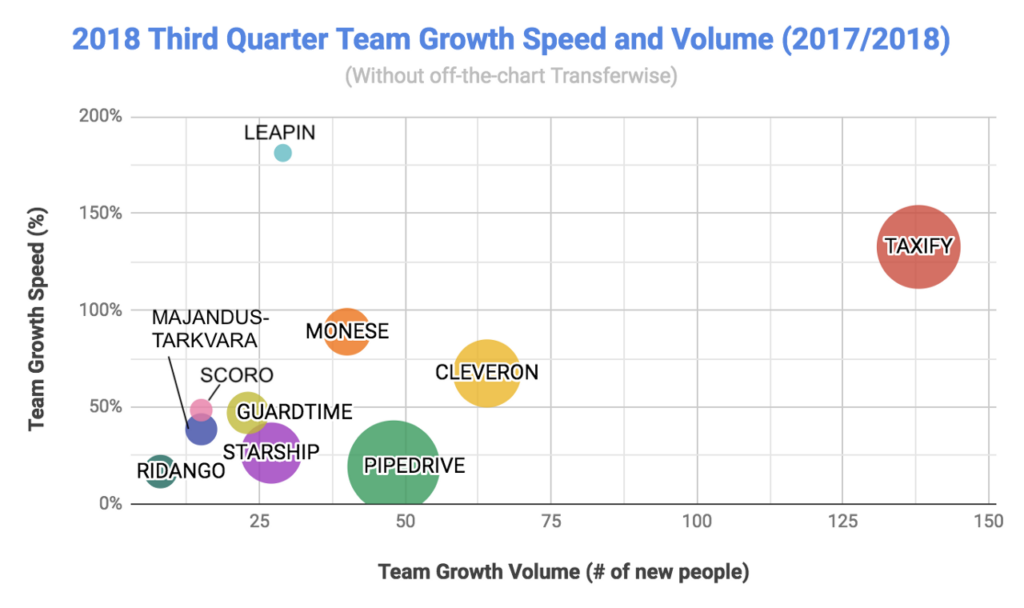

TOP startups by team size and growth

- The newcomers to the TOP20 startups by team size are LeapIN and Testlio.

- In YoY team growth, LeapIN has tripled their team to 45 and Monese has almost doubled their team to 85.

- Out of the TOP20 we counted 9 startups, who have been able to grow their headcount both quarterly and annually. The not so well known startups among them are Guardtime, Ridango and Starship Technology.

- Based on YoY and QoQ team growth volume the runners-up reaching the TOP20 are Veriff, Digital Sputnik Lighting, Click & Grow, SprayPrinter, and Quretec.

Based on the public data of the 2018 third quarter results of Estonian startups(18Q3) we looked for answers to the following three questions

- Who were the biggest taxpayers (most valuable startups for the Estonian government)?

- Who was selling the most (most valued among customers)?

- Who were hiring the most (fastest team builders)?

Yes, we are fully aware of all the problems of TOPs, differences in stories behind similar numbers, and gaps in data making startups not fully comparable. We have listed the main issues in the “Problems with TOPs” section (see below). That said, we will now present you the TOP20s.

In order to analyse dynamics we selected the TOP20 startups according to volume of sales or labor taxes paid or people hired. In each category we looked at year-on-year (YoY) changes comparing current 3rd quarter numbers to 3rd quarter numbers in 2017. We also looked at quarter-on-quarter (QoQ) changes comparing the 3rd quarter to 2nd quarter in 2018 among the TOP20. We also made some predictions on which runners-up will be in the TOP20 in 2019.

In order to know where TOP startups stand among the country’s growth drivers, we compared some numbers of the TOP startups to the TOP industrial manufacturing companies.

The biggest taxpayers among startups in the 3rd quarter

TOP5 biggest labor tax payers are the usual suspects: Transferwise, Pipedrive, Taxify, Starship Technologies and Cleveron. These 5 startups pay 60% of all taxes paid by the TOP20. This is much more concentrated compared to the manufacturing industry, where the TOP5 taxpayers pay 41% of the labor taxes of the TOP20.

There are only two newcomers among the TOP20 compared to the previous quarter: Scoro Software and GoWorkaBit Estonia. Scoro’s business management software-as-a-service solution combines project, time and team management with sales, billing, and professional services automation. GoWorkaBit has built a platform for helping retail, logistics and hospitality companies to find temporary workers. If they keep up with this growth speed, they will definitely start to get more publicity and become more known.

The most interesting tax numbers come from Adcash, who have a worldwide advertising and campaign management platform. While their labor taxes remained around 400 000€ in the 3rd quarter, their total taxes had a 5x spike and reached €2.9M. Most likely, Adcash has paid out €10M dividends in Q3, which have spiked tax payments. Yet, in their 2017 annual report there were no hints about plans to pay out dividends.

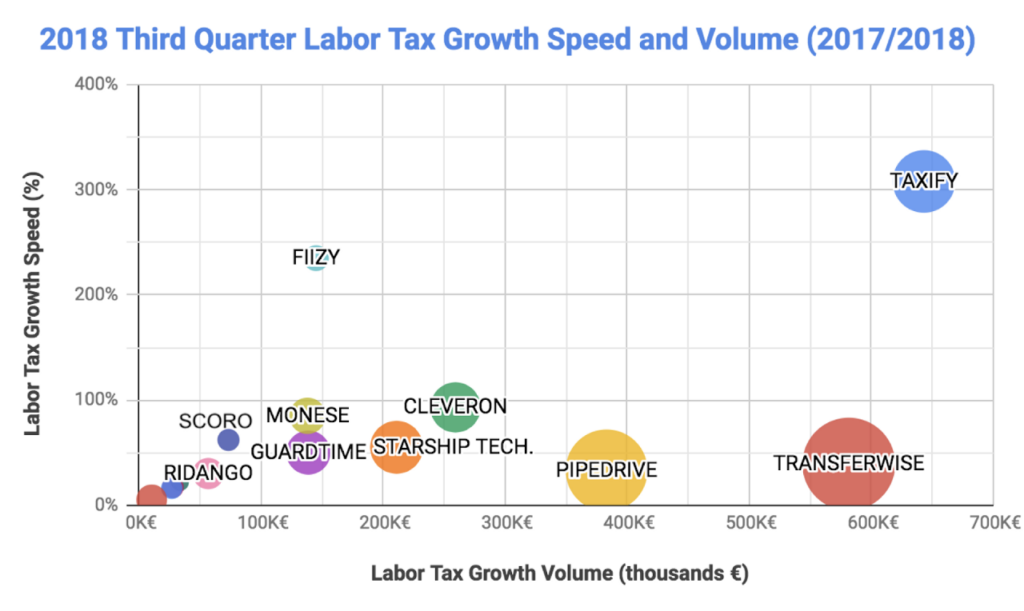

If we look at Year-on-Year (YoY) labor tax numbers growth volume and speed we have 13 startups whose quarterly taxes paid have grown at least 5%. Out of these there are four outliers. Two outliers have shown remarkable speed of tax payment growth on the yearly basis: Taxify (+308%) and Fiizy(+235%). The other two outliers are remarkable on tax payment volume growth. Transferwise’s labor tax burden has increased by 643 300€ and Pipedrive, a cloud-based sales software company, has increased the government’s tax budget by 383 000€.

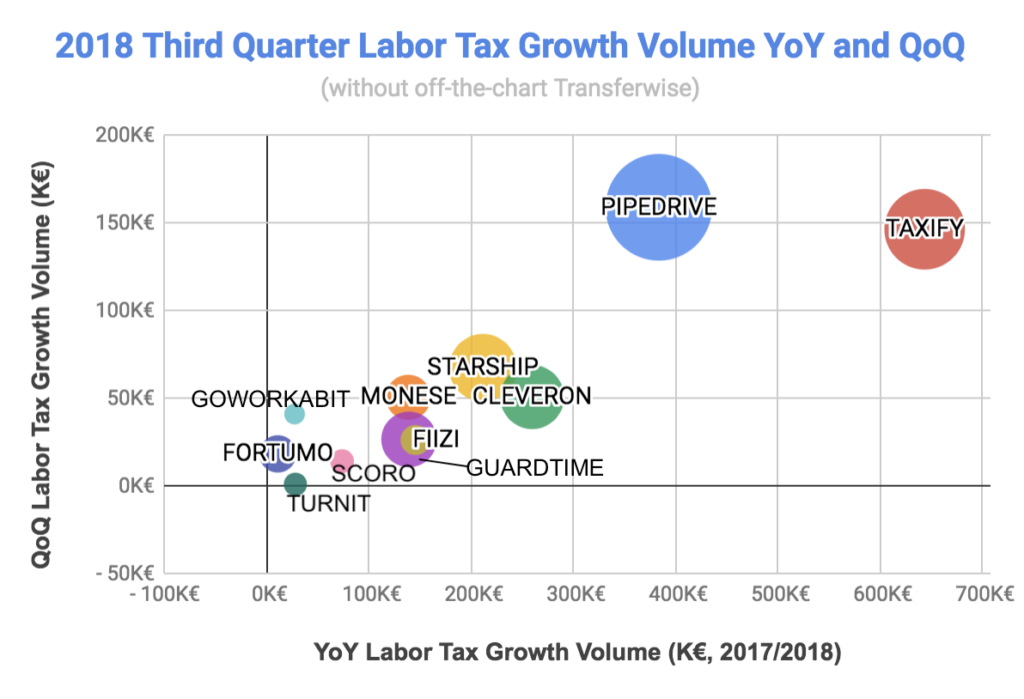

There are 10 startups, who have shown growth numbers both in Quarter-to-Quarter (QoQ) and year-on-year (YoY) tax payments. The ultimate champion is Transferwise whose numbers do not fit on the chart below (quarterly tax payment growth +248 000€ and annual +643 300€).

Estonian startups have been accused of having a lot of press, but a much lower impact on the Estonian economy and nation’s wealth compared to industrial companies. Comparing labor taxes paid in the 3rd quarter of 2018 and 2017 we see that the TOP20 startups have within a year grown their quarterly contribution to the Estonian national budget by an additional €2.2M.

Industrial manufacturing companies contribution growth in the 3rd quarter was €1.6M. Already now the TOP20 startups give a 37% bigger additional contribution to Estonia’s labor tax budget than the TOP industrial manufacturers. By total labor tax volume industrial manufacturers are still quite a bit ahead, but TOP startups are closing in fast. TOP20 startups paid in the 3rd quarter €9.4M, which is 29% of the TOP20 industrial manufacturers €32.6M contribution. If startups 3rd quarter labor tax payments YoY growth (+32%) continues then in 6 years the TOP20 startups pay more labor taxes to the government’s budget than the TOP20 industrial manufacturers.

This is all about the growth of labor tax funds. Keeping the current baseline will remain heavily on the shoulders of manufacturing companies. The comparative share of taxes paid by the 304 selected startups will in 6 years reach 30% of the labor taxes paid by all industrial manufacturing companies. In Q3, the total numbers were 209MEUR for manufacturers and 15MEUR for the 304 startups. Joint effort is needed from both the industrial and startup communities to keep the economy ticking and growing.

Startups with the fastest sales machines in the 3rd quarter

According to the tax authorities data the TOP5 startups with the highest sales volume are our usual suspects: Cleveron, Taxify, Adcash, Fortumo and Pipedrive. Two newcomers into the TOP20 are Comodule and Bondora.

Comodule are positioning themselves as a global leader in bike and scooter connectivity, digitalization and fleet management for the light vehicles industry. According to Crunchbase, by 2016 they raised €525K in 3 rounds + more in 2 rounds, of which sums raised are not available. They have skyrocketed from position #92 (80 800€) to #18 with €1.167M. We will keep an keen eye on the startup and hope that this the start of continuous growth.

Bondora is an online platform for fixed-income investments in European personal loans, and has risen from #35 to #19 in sales TOP. Their last investment round was in 2015 and in five rounds they have accumulated funding of €7.2M.

Startup sales volume is important, but not nearly as important as growth speed and volume of sales. 17 startups in the sales TOP have increased their quarterly sales on a yearly basis. There a four clear outliers in this pack.

Volume wise Cleveron and Taxify dominate the list as they have added €12M and €10M respectively to their YoY quarterly sales. The other two outliers have had over 800% growth on their YoY quarterly sales: Comodule and Hashcoins. Hashcoins builds cryptographic hardware, creates blockchain technology-based solutions and provides remote hardware access services. They have increased quarterly sales from 500 000€ in 2017 to €6M in the 3rd quarter of 2018. Still it is a drop compared to Q1 and Q2, where they were making over €8M. Let’s see how they will do in coming quarters.

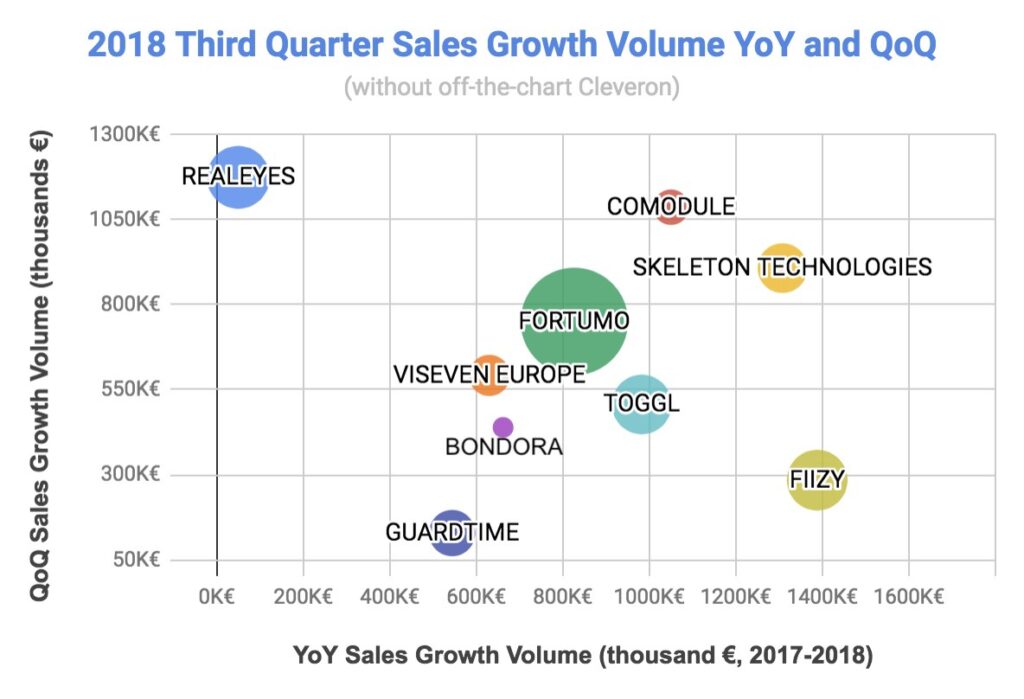

Although quarterly sales increase can be influenced by seasonality, it can also be an early indicator of a growth trajectory. There were 9 startups, who could show both quarter-on-quarter and year-on-year sales growth. Cleveron with its €2.5M quarterly sales increase compared to Q2 is a beast. It is just like they are printing money, so we took them off the chart (see below).

In addition to Comodule’s skyrocketing quarterly sales, there are three more interesting outliers: Realeyes, Fiizy and Skeleton Technologies.

Realeyes measures how people feel as they watch video content online and their reports help video marketers to create better content. In May 2018, they raised €16.2M in a series-A round from Draper Esprit. They show up on the chart because they had really weak sales in Q2 and a €2.98M all-time-high in Q3. Let’s hope that they put their investor’s money to work and Q3 was just the first quarter in a long series of all-time-high sales.

Fiizy is a financing solution giving consumers approved loan offers at the point of sale from the majority of creditors. They have made headway in Spain and have now expanded their activity to Mexico, Peru, Argentina, Poland and the United States. They have increased their sales 11% quarter-on-quarter, 100% YoY and reached €2.7M quarterly sales in Q3.

Skeleton Technologies are positioning themselves as the global technology leader in ultracapacitor-based energy storage. Their total funding amount is €46,4M and most recently they got a €15M loan from the European Investment Bank (in Feb 2017). They have put investors’ money to good use and tripled their YoY sales from 573 000€ in 2017 and doubled quarterly sales to €1.9M. Good job! Let’s see if they can keep it up and double their sales again in Q4.

We counted also 3 runner-ups, who based on their YoY and QoQ sales growth numbers could reach €1M in quarterly sales and be in TOP20 after a year. These are in alphabetic order: Fitlap, Funderbeam, and Majandustarkvara.

Fitlap has shown steady growth based on Estonian market. Can they break out? Funderbeam quarterly sales were first time in hundreds of thousands (€310K vs usual €40K). Can the keep that momentum? Majandustarkvara is an affiliate company of Erply team. Will it be able to keep up with salary surge trend and continue to find new engineers it needs for growth?

Fastest team builders in the 3rd quarter

Transferwise is still far in the lead (680 people) and has twice as many employees as Pipedrive (298 people), who is next in the TOP20. They are followed by Taxify, Norstat, and Cleveron. The least known of these 5 is Norstat founded in 2007 by Kaspar Küünarpuu, which has grown into one of Europe’s leading providers of data collection services, helping clients to understand their markets and customers.

Newcomers to the TOP20 startups by team size are LeapIN and Testlio. LeapIN is powered by Estonian e-Residency and provides services for starting and remotely running a location independent company online, in Estonia/Europe. They raised €1.3M using equity crowdfunding in October 2017 and recently hired a serial entrepreneur, executive and investor, Allan Martinson as CEO.

Testlio provides a community of highly vetted testers and an end-to-end QA management platform. They raised $7.5M by 2016.

In the speed of team’s annual growth category Transferwise still dominates the whole startup scene. They have added 216 more people, that is more than #2 Taxify and #3 Cleveron have added together. Transferwise is off the chart…literally.

On the graph there are 2 more outliers by YoY team growth metrics. LeapIN has tripled their team within a year to 45. Monese has almost doubled their team and reached a headcount of 85. They have built an online banking platform that offers super quick current account opening for all EU residents. In September 2018 they raised $60M in Series B from Kinnevik AB. With such funding they can surely keep growing.

Out of the TOP20 we counted 9 startups, which have been able to grow headcount both quarterly and annually. Transferwise and Taxify quarterly hires are again off the chart (74 and 34). Out of the other 7 there are three startups we have not mentioned yet Guardtime, Ridango and Starship Technology.

Based on QoQ and YoY numbers we have also identified a few runners-up, who most probably will be in the TOP20 startups by team size in a year. These are Veriff (YoY +500% to 40 people), Digital Sputnik Lighting (YoY +150% to 30 people), Click & Grow (YoY +144% to 36 people), SprayPrinter (YoY +200% to 27 people), and Quretec (QoQ +10% to 35 people).

Problems with TOPs

There are several problems with making such lists. Here are the ones we consider most important.

Metrics. Early stage startups growth cannot be measured in revenue, but in attraction, learning speed, etc. Ash Mauyra has written a whole book on it “Scaling LEAN”. Growth in the number of people and increase in revenue are not the earliest leading indicators, but they definitely are indicators measuring momentum of already growing startups.

Seasonality. Some markets are very seasonal, hence revenue growth quarter to quarter does not make much sense. Seasonality is most common to consumer electronics and consumer products. Most Estonian startups are not active in these markets so seasonality should not be such an issue. There are only two quarterly revenue indicators out of 8 we measure. Hence seasonality should not have too much weight in filtering out the best of the best.

Corporate structure. Several successful startups have built up their corporate structure by splitting revenue and employees into different legal entities. Most often a foreign mother company has revenues in their books and most of the employees in the Estonian subsidiary. For this reason companies such as Transferwise will not make into the high ranks in our index. Until we have figured out a way to compensate it we just have to accept this anomaly in the numbers.

Advantage of smallness. Estonia is a small country and startups are also small. If you have a low baseline then adding 5 people might skyrocket you into the TOP of the list of highest growing employers. Our current approach is to select by volume the TOP20 startups in three categories and see who are the fastest growing companies among the biggest startups. This somewhat minimizes the advantage of smallness and low baseline.