This blog post is for all startup marketers out there. Russian war in Ukraine is becoming more brutal with direct attacks on civilians, hospitals and refugees. We have a war in Europe. As a human being and a marketer, this was unimaginable just a few weeks ago.

In most startups, you are the only marketing person in your team. Right now, it probably feels overwhelming, and there is so much social pressure and so many hard choices to make:

- should our company make a public statement against the war or not?

- how to help employees in Ukraine?

- should we fire our employees working in Russia or not?

- for how long should we postpone our marketing activities?

- should we make a statement to our employees or not?

If this feels familiar, you are not alone.

On the 3rd of March, ten marketers gathered at Palo Alto Club for the first Growth Marketing Mastermind meeting. We shared our current dilemmas and decisions in marketing. We felt that sharing our discussion would be helpful to other marketers out there.

Posting a statement against the war

If our company says nothing, does it mean we support Russia? Even if we post, is it meaningful, or do we just litter communication space?

Your team and company have probably donated for Ukraine already, either privately or collectively. However, most of you have not announced it publicly. Should you?

The consensus in the Mastermind group was that although the pressure to say something is substantial, a statement only condemning the war or stating your donations would not help the situation in any way. If your company can do something extra for helping Ukrainians and you post about it, then anti-war statements or donations are appropriate, as a post from Index Ventures.

Do something special for Ukraine

The social pressure for companies is increasing: the other companies are doing something, should we also do something. For example, a gas station chain has already on their billboards that they donate 30% of their coffee sales revenue to Ukraine. Some companies are doing special events for Ukraine. Another service company states in their app that they will donate 5% of your bill to Ukraine.

Should you do something special?

The answer depends on a natural vs. brainstormed connection with Ukraine. The consensus in the Mastermind group was that if the activity comes naturally from your core, then do it. Do not do it if you have to start brainstorming the connection between your company’s activities and Ukraine. So, for example, companies active in cyber security or education have a natural link.

Communicating that your company is contributing a share of revenue to support Ukraine should be respectfully. It can not be a core message of a new campaign or product launch.

Doing launches and planning marketing activities

During times of war, selling a product seems so irrelevant. Sending out marketing messages seems almost inappropriate. At the same time, we can not stop building up a better world by offering value to people and companies. I personally feel that this is the best answer to any current or future dictator – we will not stop building up a better world.

People’s attention is full of war news, and they do not have the bandwidth to process anything else. Right now, no new product can be super exciting or world-changing. Several marketers in the Mastermind group saw it also in numbers: web visits have dropped drastically, online marketing has a minimal impact right now.

Did you have a new product or new campaign launch planned for the beginning of March?

The consensus of the Mastermind group was that you could do either a soft launch or postpone the launch. A soft launch would mean that you still start to offer the new service but do not spend on online paid marketing as nobody can process your message right now. One startup is doing a soft launch in Germany in the Mastermind group. The other startup, which is installing physical products to homes and offices, is switching from online marketing to offline marketing (fliers, product presentations in shopping malls etc). Some are companies postponing their campaigns.

The group also concluded that any marketing message could not feel pushy or car salesman-like. If you feel that your message might be insensitive right now, then you are most probably correct. Either tone down your message or postpone sending it out.

How long should you postpone your marketing? Two weeks, three months?

First of all, people are dying in a war and fighting for a democratic Europe in Ukraine. Losing some revenue in the coming months is a small price to pay, even for a startup with a short runway.

The group consensus was that marketers should play it by ear and plan one day ahead. We are still in a mist of war, and nothing can be predicted or planned.

Messages to employees

What message to send to your employees regarding the war, actions of your company, and future of the company?

Your company leaders set the tone for crisis management. In a bigger team, saying nothing is also a statement and sets a tone. In one company of the Mastermind group, the CEO sent a letter to all employees regarding his feelings about the war, how the war might affect the company, and what steps the company is taking. In that particular case, the company had emergency funds set aside, and they could assure that even if revenue drops significantly, they have actionable plan B, and do not have to lay off anybody. The CEO got several “thank you” messages from employees as such a letter took off a lot of emotional pressure and stress.

How to talk about the emotional state of your employees when most of them are poker-faced Nordics, who never show emotions?

Do we like it or not, the war in Ukraine increases anxiety and stress in all of us. Even if we think that we are immune. Talking about it is healthy (as long as it is not for you the only topic 24/7). In one company, a manager started a meeting saying that he is doing a survey on how people are reacting right now and asked a colleague if he is buying extra food or doing something else due to the war. This clinical and unemotional question allowed to have an open discussion about emotions such as fear, shock, horror.

What to do about your employees in Ukraine and Russia?

Help them relocate to Estonia if possible. Creandum has put together a guide for practical steps to help your team in Ukraine.

Fellow marketers, remain calm, follow your heart, continue your work, and help to build a better world.

Estonian startup growth in the 3rd quarter of 2018

Recently, Q3 revenue, tax and employee statistics were published for all Estonian companies. The Superangel analysts selected 304 Estonian companies in the startup space and dived into the growth numbers. We found some of the usual suspects of fast growth, but also some not so obvious startup runners-up on a high speed growth trajectory. If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

QUICK HIGHLIGHTS

TOP startups by labor tax volume and growth

- The TOP20 startups grew the government’s labor tax budget 37% more than the TOP20 industrial manufacturers (+€2.2M vs +€1.6M).

- In 6 years the TOP20 startups total volume of quarterly labor taxes will surpass the tax Euros paid by the TOP20 industrial manufacturers.

- Newcomers to the TOP20 labor tax payers were Scoro Software and GoWorkaBit.

- Based on year-on-year (YoY) tax volume increase the less known outliers are Fiizi and Pipedrive.

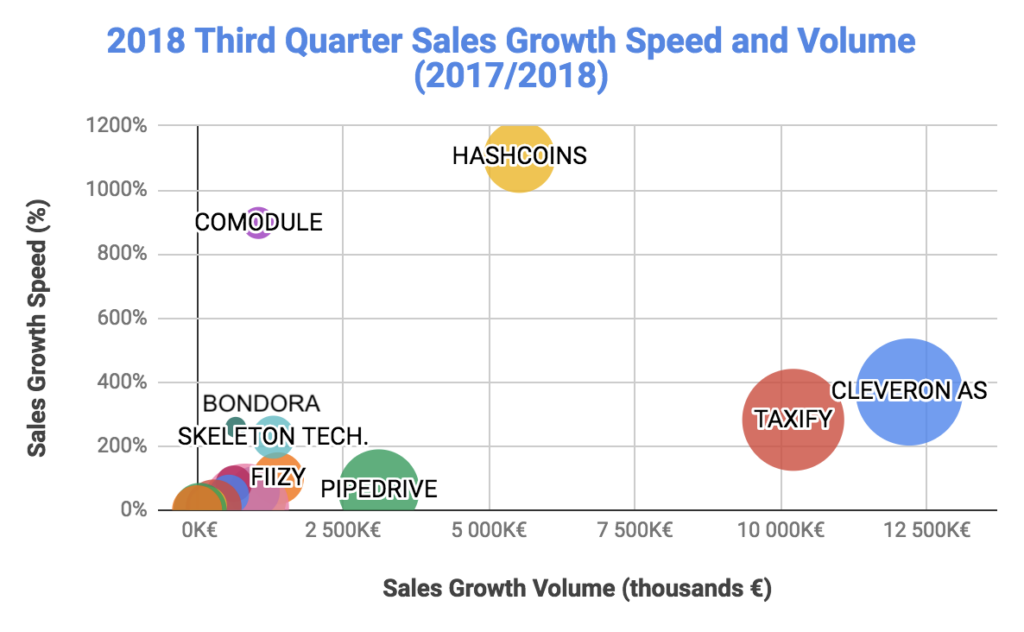

TOP startups by sales volume and growth

- Two newcomers into the TOP20 startups by sales volume are Comodule and Bondora.

- Two startups in the TOP20 showed over 800% growth on their YoY quarterly sales: Comodule and Hashcoins.

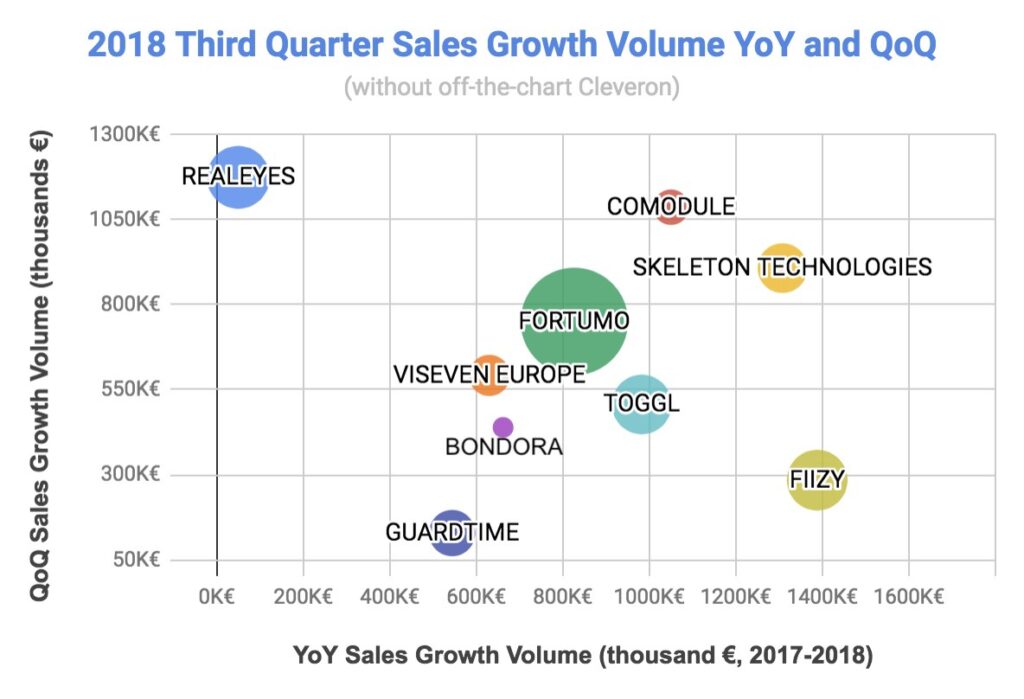

- There were 9 startups, who could show both quarter-on-quarter (QoQ) and year-on-year (YoY) sales growth. The most interesting outliers among these were Comodule, Realeyes, Fiizy and Skeleton Technologies.

- Based on YoY and QoQ growth volume the runners-up reaching to the TOP20 are Fitlap, Funderbeam, and Majandustarkvara.

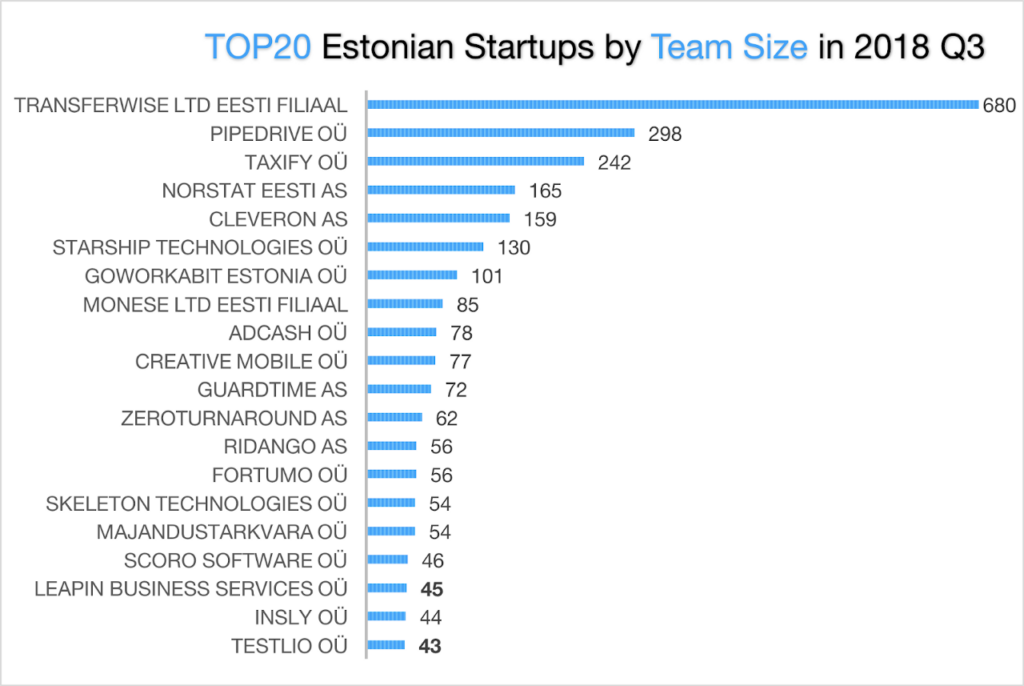

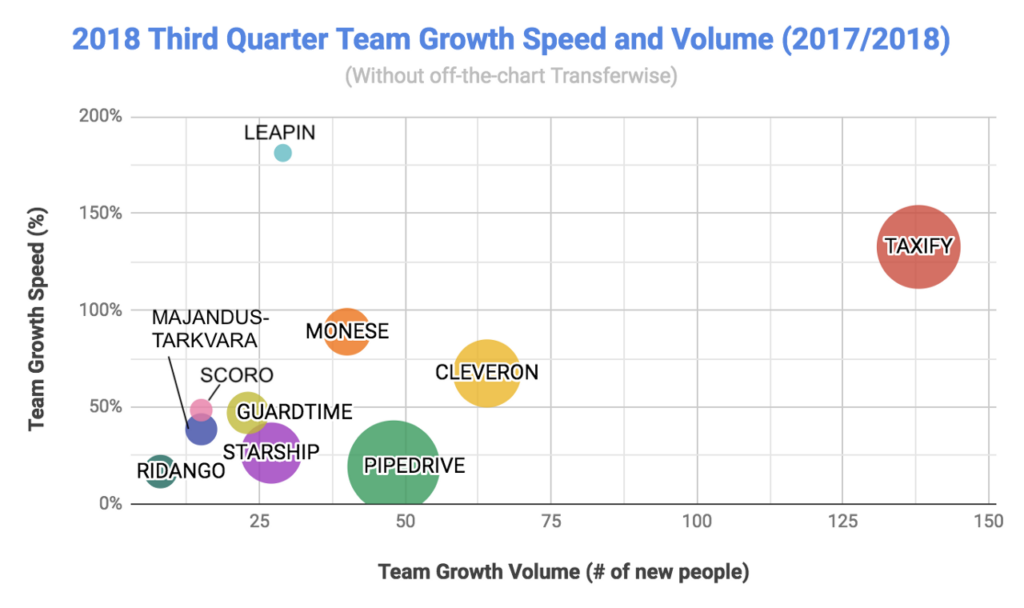

TOP startups by team size and growth

- The newcomers to the TOP20 startups by team size are LeapIN and Testlio.

- In YoY team growth, LeapIN has tripled their team to 45 and Monese has almost doubled their team to 85.

- Out of the TOP20 we counted 9 startups, who have been able to grow their headcount both quarterly and annually. The not so well known startups among them are Guardtime, Ridango and Starship Technology.

- Based on YoY and QoQ team growth volume the runners-up reaching the TOP20 are Veriff, Digital Sputnik Lighting, Click & Grow, SprayPrinter, and Quretec.

Based on the public data of the 2018 third quarter results of Estonian startups(18Q3) we looked for answers to the following three questions

- Who were the biggest taxpayers (most valuable startups for the Estonian government)?

- Who was selling the most (most valued among customers)?

- Who were hiring the most (fastest team builders)?

Yes, we are fully aware of all the problems of TOPs, differences in stories behind similar numbers, and gaps in data making startups not fully comparable. We have listed the main issues in the “Problems with TOPs” section (see below). That said, we will now present you the TOP20s.

In order to analyse dynamics we selected the TOP20 startups according to volume of sales or labor taxes paid or people hired. In each category we looked at year-on-year (YoY) changes comparing current 3rd quarter numbers to 3rd quarter numbers in 2017. We also looked at quarter-on-quarter (QoQ) changes comparing the 3rd quarter to 2nd quarter in 2018 among the TOP20. We also made some predictions on which runners-up will be in the TOP20 in 2019.

In order to know where TOP startups stand among the country’s growth drivers, we compared some numbers of the TOP startups to the TOP industrial manufacturing companies.

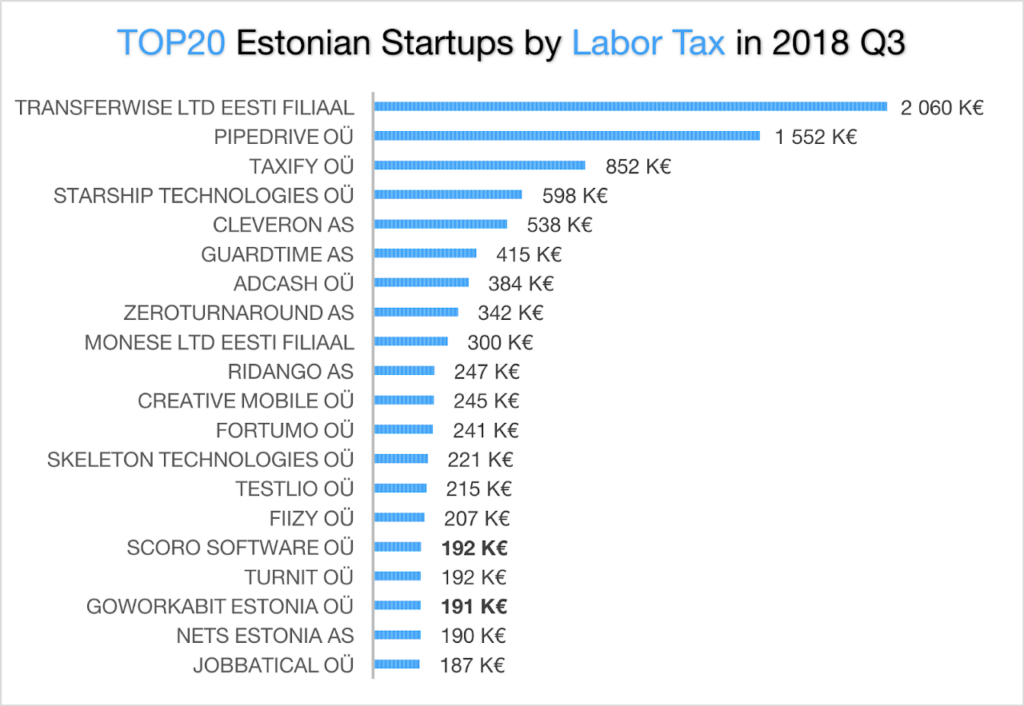

The biggest taxpayers among startups in the 3rd quarter

TOP5 biggest labor tax payers are the usual suspects: Transferwise, Pipedrive, Taxify, Starship Technologies and Cleveron. These 5 startups pay 60% of all taxes paid by the TOP20. This is much more concentrated compared to the manufacturing industry, where the TOP5 taxpayers pay 41% of the labor taxes of the TOP20.

There are only two newcomers among the TOP20 compared to the previous quarter: Scoro Software and GoWorkaBit Estonia. Scoro’s business management software-as-a-service solution combines project, time and team management with sales, billing, and professional services automation. GoWorkaBit has built a platform for helping retail, logistics and hospitality companies to find temporary workers. If they keep up with this growth speed, they will definitely start to get more publicity and become more known.

The most interesting tax numbers come from Adcash, who have a worldwide advertising and campaign management platform. While their labor taxes remained around 400 000€ in the 3rd quarter, their total taxes had a 5x spike and reached €2.9M. Most likely, Adcash has paid out €10M dividends in Q3, which have spiked tax payments. Yet, in their 2017 annual report there were no hints about plans to pay out dividends.

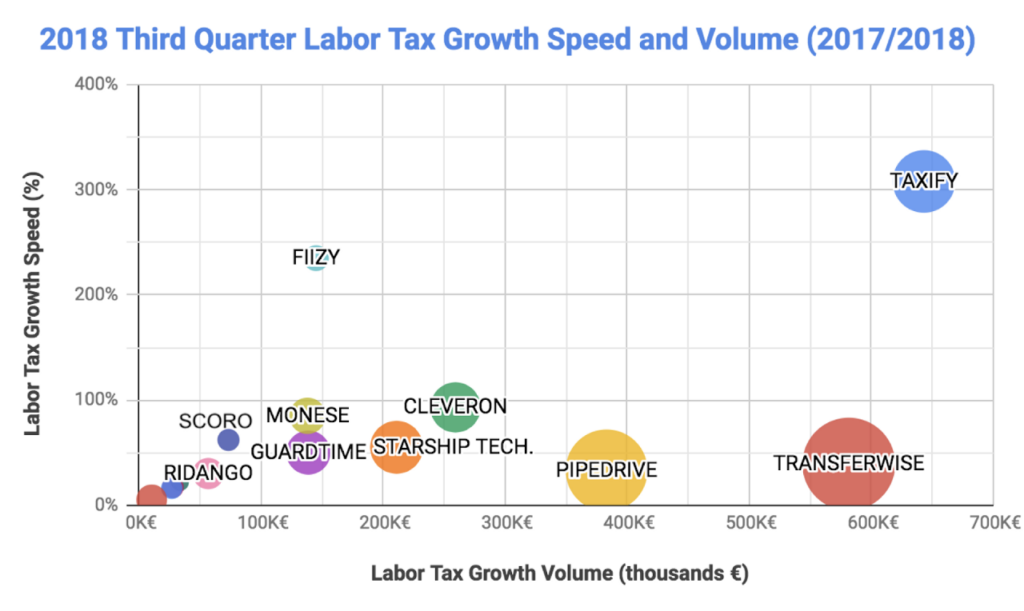

If we look at Year-on-Year (YoY) labor tax numbers growth volume and speed we have 13 startups whose quarterly taxes paid have grown at least 5%. Out of these there are four outliers. Two outliers have shown remarkable speed of tax payment growth on the yearly basis: Taxify (+308%) and Fiizy(+235%). The other two outliers are remarkable on tax payment volume growth. Transferwise’s labor tax burden has increased by 643 300€ and Pipedrive, a cloud-based sales software company, has increased the government’s tax budget by 383 000€.

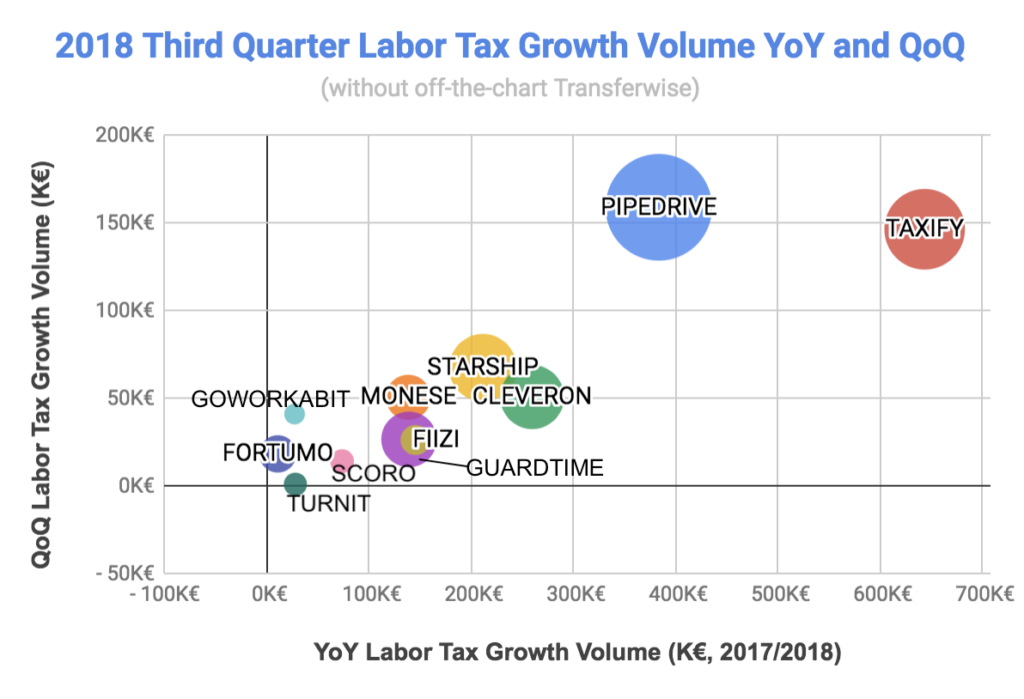

There are 10 startups, who have shown growth numbers both in Quarter-to-Quarter (QoQ) and year-on-year (YoY) tax payments. The ultimate champion is Transferwise whose numbers do not fit on the chart below (quarterly tax payment growth +248 000€ and annual +643 300€).

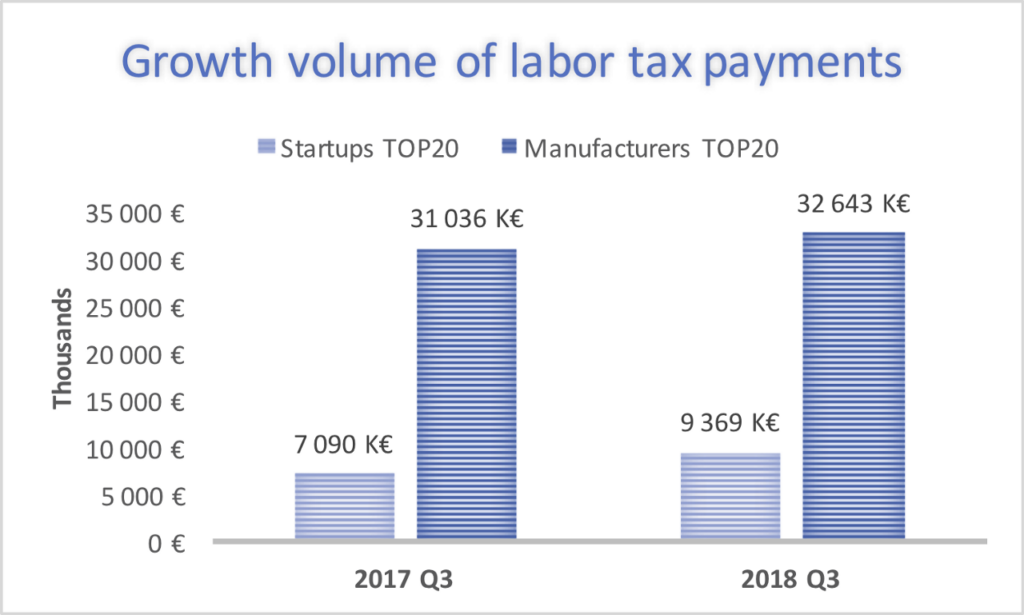

Estonian startups have been accused of having a lot of press, but a much lower impact on the Estonian economy and nation’s wealth compared to industrial companies. Comparing labor taxes paid in the 3rd quarter of 2018 and 2017 we see that the TOP20 startups have within a year grown their quarterly contribution to the Estonian national budget by an additional €2.2M.

Industrial manufacturing companies contribution growth in the 3rd quarter was €1.6M. Already now the TOP20 startups give a 37% bigger additional contribution to Estonia’s labor tax budget than the TOP industrial manufacturers. By total labor tax volume industrial manufacturers are still quite a bit ahead, but TOP startups are closing in fast. TOP20 startups paid in the 3rd quarter €9.4M, which is 29% of the TOP20 industrial manufacturers €32.6M contribution. If startups 3rd quarter labor tax payments YoY growth (+32%) continues then in 6 years the TOP20 startups pay more labor taxes to the government’s budget than the TOP20 industrial manufacturers.

This is all about the growth of labor tax funds. Keeping the current baseline will remain heavily on the shoulders of manufacturing companies. The comparative share of taxes paid by the 304 selected startups will in 6 years reach 30% of the labor taxes paid by all industrial manufacturing companies. In Q3, the total numbers were 209MEUR for manufacturers and 15MEUR for the 304 startups. Joint effort is needed from both the industrial and startup communities to keep the economy ticking and growing.

Startups with the fastest sales machines in the 3rd quarter

According to the tax authorities data the TOP5 startups with the highest sales volume are our usual suspects: Cleveron, Taxify, Adcash, Fortumo and Pipedrive. Two newcomers into the TOP20 are Comodule and Bondora.

Comodule are positioning themselves as a global leader in bike and scooter connectivity, digitalization and fleet management for the light vehicles industry. According to Crunchbase, by 2016 they raised €525K in 3 rounds + more in 2 rounds, of which sums raised are not available. They have skyrocketed from position #92 (80 800€) to #18 with €1.167M. We will keep an keen eye on the startup and hope that this the start of continuous growth.

Bondora is an online platform for fixed-income investments in European personal loans, and has risen from #35 to #19 in sales TOP. Their last investment round was in 2015 and in five rounds they have accumulated funding of €7.2M.

Startup sales volume is important, but not nearly as important as growth speed and volume of sales. 17 startups in the sales TOP have increased their quarterly sales on a yearly basis. There a four clear outliers in this pack.

Volume wise Cleveron and Taxify dominate the list as they have added €12M and €10M respectively to their YoY quarterly sales. The other two outliers have had over 800% growth on their YoY quarterly sales: Comodule and Hashcoins. Hashcoins builds cryptographic hardware, creates blockchain technology-based solutions and provides remote hardware access services. They have increased quarterly sales from 500 000€ in 2017 to €6M in the 3rd quarter of 2018. Still it is a drop compared to Q1 and Q2, where they were making over €8M. Let’s see how they will do in coming quarters.

Although quarterly sales increase can be influenced by seasonality, it can also be an early indicator of a growth trajectory. There were 9 startups, who could show both quarter-on-quarter and year-on-year sales growth. Cleveron with its €2.5M quarterly sales increase compared to Q2 is a beast. It is just like they are printing money, so we took them off the chart (see below).

In addition to Comodule’s skyrocketing quarterly sales, there are three more interesting outliers: Realeyes, Fiizy and Skeleton Technologies.

Realeyes measures how people feel as they watch video content online and their reports help video marketers to create better content. In May 2018, they raised €16.2M in a series-A round from Draper Esprit. They show up on the chart because they had really weak sales in Q2 and a €2.98M all-time-high in Q3. Let’s hope that they put their investor’s money to work and Q3 was just the first quarter in a long series of all-time-high sales.

Fiizy is a financing solution giving consumers approved loan offers at the point of sale from the majority of creditors. They have made headway in Spain and have now expanded their activity to Mexico, Peru, Argentina, Poland and the United States. They have increased their sales 11% quarter-on-quarter, 100% YoY and reached €2.7M quarterly sales in Q3.

Skeleton Technologies are positioning themselves as the global technology leader in ultracapacitor-based energy storage. Their total funding amount is €46,4M and most recently they got a €15M loan from the European Investment Bank (in Feb 2017). They have put investors’ money to good use and tripled their YoY sales from 573 000€ in 2017 and doubled quarterly sales to €1.9M. Good job! Let’s see if they can keep it up and double their sales again in Q4.

We counted also 3 runner-ups, who based on their YoY and QoQ sales growth numbers could reach €1M in quarterly sales and be in TOP20 after a year. These are in alphabetic order: Fitlap, Funderbeam, and Majandustarkvara.

Fitlap has shown steady growth based on Estonian market. Can they break out? Funderbeam quarterly sales were first time in hundreds of thousands (€310K vs usual €40K). Can the keep that momentum? Majandustarkvara is an affiliate company of Erply team. Will it be able to keep up with salary surge trend and continue to find new engineers it needs for growth?

Fastest team builders in the 3rd quarter

Transferwise is still far in the lead (680 people) and has twice as many employees as Pipedrive (298 people), who is next in the TOP20. They are followed by Taxify, Norstat, and Cleveron. The least known of these 5 is Norstat founded in 2007 by Kaspar Küünarpuu, which has grown into one of Europe’s leading providers of data collection services, helping clients to understand their markets and customers.

Newcomers to the TOP20 startups by team size are LeapIN and Testlio. LeapIN is powered by Estonian e-Residency and provides services for starting and remotely running a location independent company online, in Estonia/Europe. They raised €1.3M using equity crowdfunding in October 2017 and recently hired a serial entrepreneur, executive and investor, Allan Martinson as CEO.

Testlio provides a community of highly vetted testers and an end-to-end QA management platform. They raised $7.5M by 2016.

In the speed of team’s annual growth category Transferwise still dominates the whole startup scene. They have added 216 more people, that is more than #2 Taxify and #3 Cleveron have added together. Transferwise is off the chart…literally.

On the graph there are 2 more outliers by YoY team growth metrics. LeapIN has tripled their team within a year to 45. Monese has almost doubled their team and reached a headcount of 85. They have built an online banking platform that offers super quick current account opening for all EU residents. In September 2018 they raised $60M in Series B from Kinnevik AB. With such funding they can surely keep growing.

Out of the TOP20 we counted 9 startups, which have been able to grow headcount both quarterly and annually. Transferwise and Taxify quarterly hires are again off the chart (74 and 34). Out of the other 7 there are three startups we have not mentioned yet Guardtime, Ridango and Starship Technology.

Based on QoQ and YoY numbers we have also identified a few runners-up, who most probably will be in the TOP20 startups by team size in a year. These are Veriff (YoY +500% to 40 people), Digital Sputnik Lighting (YoY +150% to 30 people), Click & Grow (YoY +144% to 36 people), SprayPrinter (YoY +200% to 27 people), and Quretec (QoQ +10% to 35 people).

Problems with TOPs

There are several problems with making such lists. Here are the ones we consider most important.

Metrics. Early stage startups growth cannot be measured in revenue, but in attraction, learning speed, etc. Ash Mauyra has written a whole book on it “Scaling LEAN”. Growth in the number of people and increase in revenue are not the earliest leading indicators, but they definitely are indicators measuring momentum of already growing startups.

Seasonality. Some markets are very seasonal, hence revenue growth quarter to quarter does not make much sense. Seasonality is most common to consumer electronics and consumer products. Most Estonian startups are not active in these markets so seasonality should not be such an issue. There are only two quarterly revenue indicators out of 8 we measure. Hence seasonality should not have too much weight in filtering out the best of the best.

Corporate structure. Several successful startups have built up their corporate structure by splitting revenue and employees into different legal entities. Most often a foreign mother company has revenues in their books and most of the employees in the Estonian subsidiary. For this reason companies such as Transferwise will not make into the high ranks in our index. Until we have figured out a way to compensate it we just have to accept this anomaly in the numbers.

Advantage of smallness. Estonia is a small country and startups are also small. If you have a low baseline then adding 5 people might skyrocket you into the TOP of the list of highest growing employers. Our current approach is to select by volume the TOP20 startups in three categories and see who are the fastest growing companies among the biggest startups. This somewhat minimizes the advantage of smallness and low baseline.