Water and dirt bounce off your car sensors, switches turn on and off bacteria growth, predictive screening of new composites for next-level batteries, drone-delivered groceries. These were just a few exciting high-tech products developed by R&D intensive teams participating in the second edition of Science Base Camp.

Who are the most promising R&D intensive teams in Nordics and Baltics? How to get these great products as fast as possible to mass adoption and benefit our society? These questions are the reason Superangel investment fund has launched Science Base Camp, which has become the biggest investment readiness day in Nordics and Baltics.

“Science Base Camp is like a gym where your personal trainer will identify your weak points, give you a training plan, and motivate you to power through it.” – Science Base Camp participant

Designed For Technology-Based Teams To Accelerate Commercialisation

Scientific breakthroughs can help solve the most challenging problems in climate change, healthcare, or society’s development. Yet it can take a long time before science-based solutions reach the mass market.

What Superangel has learned from experience is that having meaningful discussions with investors instead of pitching to them can help teams from universities to find shortcuts and move faster. Investors’ insights into the market can help teams understand the potential use cases of their technology and how to speed up commercialization cycles.

“Talking to investors and academic audience are like speaking two different languages.” – Science Base Camp participant

Science Base Camp is designed to create the space for meaningful discussions between early-stage R&D-intensive teams and deep tech investors. To prepare the teams for the discussions and beyond, we conducted sessions on key topics:

- What do investors want from deep tech teams?

- How to tell the story of your product and startup to people who do not have your background?

- How to find first paying customers for deep tech products?

- What are the best practices for cooperating with corporations?

- What are the trends of deep tech investing in Europe?

“You should not try to please all investors.”

“You should not try to please all investors” was feedback from a venture capitalist to a young first-time founder. The investor followed it up with recommendations on which decisions the founders should make to move forward and which type of investors she should seek, and which ones to avoid.

Such honest feedback is infrequent and hard to get. At Science Base Camp, there were over 25 investors present and over 30 sessions delivered in 3-hours.

In the evening, startup teams got open to feedback from pitch coaches (thank you Wallace Green and Gleb Maltsev) and investors on their 3-minute pitch: what was memorable, confusing, and one friendly piece of advice for the next time.

“It was an excellent fresh outlook to understand what the startup world expects from us and how to orient ourselves there.” – Science Base Camp participant

Even though the main focus is on getting feedback from investors, Science Base Camp works also as a platform for fundraising. Several startups have reported continuing discussions with investors they met at Science Base Camp. One startup was able to get investment commitments already during the mentoring session.

Who Are The 21 Forward-Looking And Innovative Deeptech University Teams From Science Base Camp You Need To Keep An Eye On?

In Science Base Camp 2022, 21 teams from ten universities and science parks from Estonia, Finland, and Sweden got selected to receive insights and feedback from over 25 Pre-Seed to Series B deep tech investors. Here is the list of teams to watch in alphabetical order.

- Aerit offers sustainable drone delivery as a service.

- AIVisionEye has a Smart Damage Detection solution for the highly growing Shared Mobility Industry.

- Better Medicine builds AI-Powered tools for radiologists that enable doctors to diagnose and fight cancer in more efficient and accurate ways.

- CeLLife develops an overall solution to turn waste Li-ion batteries into stable and reliable energy storage, giving them a second life.

- Cleandet offers an AI-driven device to detect invisible contaminants, bacteria, and viruses from surfaces.

- Compular develops an intelligent computational chemistry software for speeding up the development of new batteries by automatically identifying bonds between material structures and technologically relevant properties to enable predictive screening of new compositions.

- Dry and Durable offers the world’s most durable self-cleaning super-water-repellent shields for sensors.

- Measurement Electronics Research Group at Taltech fosters a radical shift from episodic to continuous healthcare using decades of knowledge and experience in discreet and reliable medical data acquisition.

- FaradaIC Sensors has developed miniaturized breath sensors to gather biometric data and provide patients and athletes alike insight into their respiratory health and metabolism.

- GARMENT wearable platform turns daily physical activities into in-game rewards for promoting and encouraging wellbeing.

- Gearbox Biosciences makes bioproduction of chemicals more efficient and sustainable.

- Krattworks builds drones with onboard machine vision and GSM connectivity. Our drone provides fast situational awareness for firefighters, security companies, search and rescue teams, and police.

- Lightcode Photonics changes how service robots see us with the world’s first software-defined 3D camera.

- MIRO provides a Mixed Reality-based visual assistance solution for controlling heavy mobile work machines directly and remotely.

- mTMS provides an automated multi-locus magnetic brain stimulation system.

- Norgald provides cyber security software to create resilient critical infrastructure.

- Nosore develops a smart bed sheet for predicting pressure ulcer risk.

- Parkzia revolutionizes the charging of autonomous e-movers by removing fixed charging stations, charging the e-movers on the go, increasing operational time by 30 %, and saving millions in e-mover fleet investments.

- REPLICA has developed an IP block that gives CPUs 100x better processing performance in complex, real-time, parallel use cases

- Smart Materials makes polyurethane foam production with auxetic features scalable and affordable.

- Vireamed offers a VR exergame solution for remote motor function rehabilitation.

- WINSe develops power by light solutions for applications where electrical wires can’t go.

Take a peek into the Science Base Camp.

We are making public some of the content that was presented at the second Science Base Camp 2022.

- Get familiar with the trends of deep tech investing in Europe

- Port 6 story on how to raise funding for a deep tech startup as a university student

- Eyevi Tech story on how to raise €1.8M after you heard 100 times “no.”

We have three more gems for those who are interested:

- Session: What are investors looking for in R&D-intensive companies? Thank you Heidi Kakko & Sten Tamkivi!

- Session: How to launch cooperation with corporations? Thank you Matti Härkönen & Innovestor

- Session: How to find the first paying customers for deep tech products?

If you want to access it, send us a request here.

Organised Together With Leading Universities And VCs

A huge thank you goes out to all of the teams, investors, and partners whose continuous support helps us think bigger and contribute to the development of a better, more impactful society. A special shout out to Aalto Startup Centre and Joel Takala for hosting us in Helsinki.

Pictures by Eiko Lainjärv.

Warning: Undefined array key "file" in /data03/virt110260/domeenid/www.superangel.io/htdocs/wp-includes/media.php on line 1768

We’re very excited to launch the second Science Base Camp, taking place on March 18th following the first successful event last year. Together with our university and VC partners, we are bringing together some of the best teams in the Nordics and Baltics, and matching them with reputable investors.

Designed for technology-based teams to accelerate commercialisation

Science Base Camp is an investor-readiness day specifically designed for R&D intensive technology-based university teams. The teams are able to work alongside experienced investors with an understanding of deeptech and R&D, entrepreneurs and experts to validate commercialisation potential and increase investor readiness.

It can take a long time before science-based solutions reach the market. The opportunity to have meaningful discussions with investors enables teams to get exposure beyond typical dealflow calls and pitching events. Investors’ insights into the market can help teams understand the potential use cases of their technology and how to speed up commercialisation cycles.

Organised together with leading universities and VCs

We’re glad to welcome new partners to the network, including Chalmers University of Technology, Tampere University, University of Jyväskylä, Tartu Science Park, ESA BIC Estonia, Tehnopol. And of course, happy to welcome back Aalto University, University of Tartu and Taltech!

The event is organised by Nordic and Baltic venture capital funds and angel investors. Among the first participating VCs are Norrsken VC, Voima Ventures, Cottonwood, Karma Ventures, Practica Capital, Nina Capital, Butterfly Ventures, Nordic Ninja, Inventure, Possible Ventures, Innovestor, Acecap, ffVC. And the list keeps expanding!

Apply now until February 14th!

Applications are open for R&D intensive / science-based / deeptech teams and startups from universities interested in increasing investment readiness or involving venture capital.

The event happens virtually and is free of charge for the participants.

Applications are open until February 14th. More information is available on Science Base Camp website. Apply now here.

If you have any questions, please contact kaari.kink@superangel.eu

Superangel has put together an open-source database of venture capital funds investing in the Baltics. If you’re a startup founder looking for Pre-Seed – Series A funding or a fund looking to get to know the VC landscape in the Baltics, this database is meant for you.

The database reassures several points made by the recent Dealroom report on the startup scene in the CEE, namely:

- Local investors underpin the early-stage investment landscape, but at later-stage, companies look overseas for bigger cheques – this is also seen in the high saturation of local Pre-Seed / Seed funds in our list but not so much past Seed stage. 70% of the funds investing in Series A or beyond are outside the CEE.

- International investors have started to ramp up their activity in CEE in recent years – nearly 60% of the VCs listed in the database are located outside of the CEE.

Although there are already 100 VCs in the list, it is not exhaustive. The database can be completed by the community members. Here’s Google Sheets link where you can add / edit information the funds.

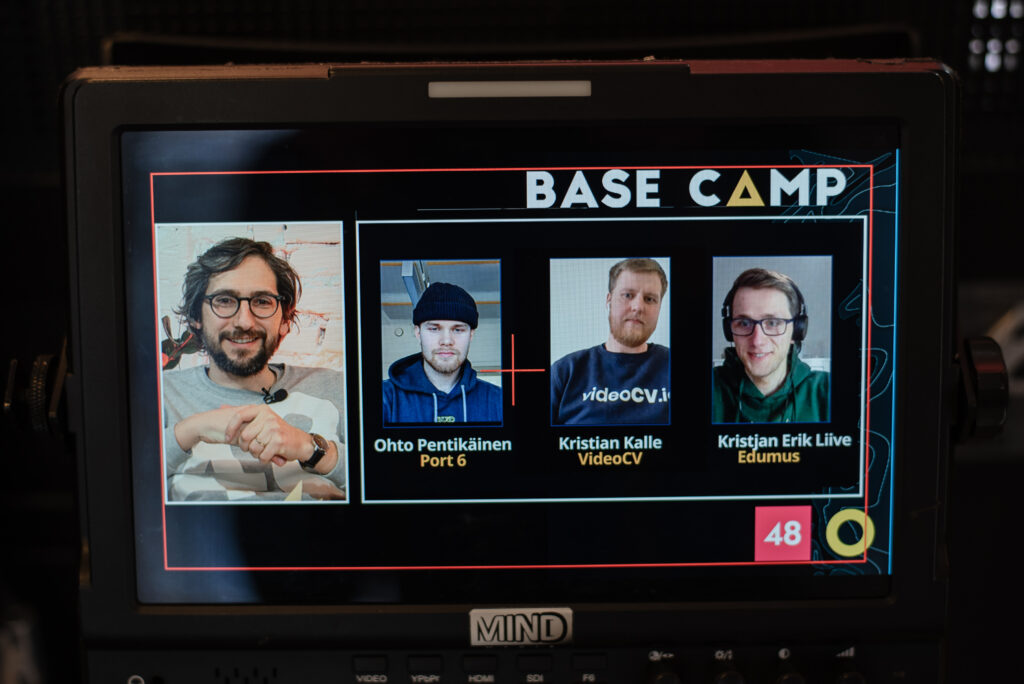

Base Camp revamped startups’ growth engines

Every single startup founder has more tasks on their hands than time for doing it. What if someone invented the time machine that allowed them to have extra days and complete all the strategic and important things on the to-do list?

This is where Base Camp comes in – a hackathon for existing startups wanting to do undistracted deep work with their team, and get weeks worth of work done in just 72-hours.

The 7th edition of the Base Camp hackathon was rather special. For the first time in a long time, we were able to host the participants in a hybrid setting, merging the positives of an online and off-site format. 16 Superangel portfolio and acceleration program startups and 5 not-yet-in-portfolio startups came together to get their growth machine going and do deep work without any distractions. What started out as a testbed for a new format of doing hackathons back in 2018, has now evolved into a community gathering of some of the most ambitious early-stage companies in the area.

“Beware! Base Camp is extremely addictive! After the first participation, it is very difficult to say no to their next hackathons. You can drop everything for the time of the hackathon and set focus on one or two goals. There’s just no time for micromanaging.” – Kelly Lilles, team Alpa Kids

Base Camp startups gained 400+ working hours

“Base Camp is a cheat code for growth.” – Darius Semper, team Ringo

21 startups jumped into Base Camp, or as some (old people) may say – a time-travelling DeLorean – and were able to gain 400+ extra working hours as a result of that. For some startups, these 72-hours gave a possibility to thoroughly discuss strategic topics that had been undecided for several months. Others managed to launch products and digital marketing campaigns to German, Polish, and Estonian markets. Tens of software products got upgraded to the next level. Feedback was gathered from 50+ customer interviews. Best of all, two startups announced that they will start doing Base Camps in their own team as this is the best way of getting deep work done. Nothing too shabby, right?

“The impact of what we did in 3 days will last for the next 6 months.” – team SquadPal

THE BLUEPRINT OF BASE CAMP

There are 3 critical components to building the 72-hour Base Camp time machine, where each element has its own nuances.

The mentors are world-class

If one thing is clear, it’s that there wouldn’t be any Base Camp without the amazing mentors who are willing to jump on board with us and share their invaluable knowledge and expertise. From design mentors who have been actively involved in the design industry for the past 20 years to digital marketing and tech experts who know everything, there is to know about marketing strategies, growth campaigns, KPI-s, engineering tech stacks, and building the MVP, the lineup of mentors was truly world-class this time.

“I’ve been part of the Garage48 hackathons since the very beginning. And this is by far my most favourite event to mentor. The quality of teams and content presented at the Base Camp is just exceptional!” – Helen Kokk, Digital Product Director at OCCO I Building a Revolutionary product for interior architects

What differentiates Base Camp 1:1 sessions from your regular hackathon mentoring sessions is that the 45-minute slots are a chance to actually go in-depth with a problem your startup is facing and get different perspectives on how to solve it. As one team jokingly put it, the 1:1 sessions are a great way to pick the industry best brains without spending money on consultancy hours and lengthen their runway in that way.

“It was just awesome. The teams were really well prepared and my first day was 100% booked with 1:1 sessions. We ended up discussing concrete problems related to user research and product designs but also what the future might bring to those teams.” – Maido Parv, Senior Product Designer at Wise

Helen Kokk, Katrin Kiviselg, Erko Risthein, Greta Pudan, Patrick Collins, Taavi Raidma, Gleb Maltsev, Kristina Randver, Maido Parv, Elar Killumets, Joanna Grudzinska, Sven Kirsimäe, Kristi Märtin, Pavel Karagjaur, Anari Hagel – we applaud you!

The speakers have been in your shoes

Getting the right advice at the right time can save startups tons of time. We listened carefully to what the most common challenges of participating startups are and brought in speakers with experiences from Bolt, Wise, Veriff, Starship and Salv, to name a few. Startups got insights on doing customer interviews and data-driven decision making, how to set up and measure the right KPIs, how to attract talent and build startup culture, how to fundraise successfully, and how the current actions of a startup can influence their exit opportunities.

Laur Läänemets, Taivo Pungas, Jeff McClelland, Marko Oolo, Käthe-Riin Tull, Reet Kaurit, Piret Saag, Sandra Verrevmägi, Karen K. Burns, Madis Lehtmets, Markus Lember, Gaspar Anton, Margus Uudam – your wisdom and insights were priceless!

The individuals bring talent and a pair of fresh eyes

Besides mentors and speakers, there’s one more secret sauce ingredient that helps startups to win time during the Base Camp hackathons and that is the talented individuals we hunt and outsource for our teams. But rather than just keeping the needs of the startups in mind, we also like to add value to the individuals- to be part of the next big thing, grow their network and break out from their everyday routine.

“I have always enjoyed being in the startup community – between those curious, smart and brave people – so joining the Base Camp hackathon as an individual participant was a no brainer for me. I wanted to experience the magic around it and develop the curious creator within myself.” – Asta Vasiliauskaite, team Clanbeat

“Participating at the Base Camp hackathon was a 10/10 experience for me and I would recommend everyone who is someone in the startup ecosystem to take part in the hackathon at least once and put their talents into use.” – Karl Aleksander Kivimägi, team Menken

the next base camp will take place in autumn 2022

Garage48 and Superangel would like to thank all startups and individuals that participated and applied and all the mentors and speakers who made the 7th edition of the Base Camp one of the most successful events we have had in the history of Base Camp hackathons.

One big applause for the organizing team or as we like to refer to ourselves, the kitchen side of the event – Merit Vislapu, Kaari Kink, Kalev Kaarna, Kairi Loomet, Tiit Tamme, Ahti Kaskpeit and Enriko Pedaksalu.

Stay tuned for the next Base Camp in 2022 and be the first one to hear when the applications open.

This blogpost is written by Merit Vislapu, Kaari Kink, and Kalev Kaarna.

Introduction

2020 was plagued by the unfortunate and unprecedented event that was COVID-19. Estonia and its startup ecosystem endured many triumphs and difficulties during the turbulent time. COVID-19 marked a turning point for the Estonian startup ecosystem as Q2 2020 marked the end of an era of high growth. While Q3 showed signs of resilience, Q4 was indicative of more than just recovery. Q4 was a triumphant quarter with possible indications of the start of another era of high growth. Q4 serves as a looking glass into the unique year of 2020 and a hopeful and optimistic preface to 2021.

Highlights

Q4 revenue was € 322.6 million

The top 5 companies with the highest revenue were Bolt, Fortumo, Pipedrive, Skype Technologies, and Playtech Estonia.

The total number of people employed in Estonian startups in Q4 was 8.4k.

The total labor tax paid in Q4 by Estonian startups was € 38.8 million.

Q4 Overview

Q4 can be characterized as an astounding success. This is especially notable given the high total startup revenue in Q4 of € 322.6 million. Revenue in Q4 hit an all-time high beating the record that was set by Q1 2020. From Q3 to Q4, revenue grew by a whopping 23%. The companies with the highest revenue in Q4 were Bolt, Fortumo, Pipedrive, Skype Technologies, Playtech, and Adcash.

The 15 companies that paid the most in labor taxes in Q4 contributed approximately 58.2% of all labor taxes. In other words, about 2% of companies pay 60% of labor taxes of the Estonian startup ecosystem.

With COVID-19 causing people all over the world to lose their jobs it was a promising sign to see Estonian startups increasing the number of those employed in the ecosystem. The total number of people employed in the ecosystem in Q4 was 8,390, a 3.2% increase from Q3. The companies with the largest team size in Q4 were Transferwise, Bolt, Playtech, Pipedrive, and Skype Technologies. The top 5 companies which hired the most people in Q4 were H2H, Pipedrive, Skype Technologies, So.FA.Dog, and Starship Technologies.

Overall Q4 saw significant improvements despite the prolonged impact many imagined COVID-19 might have on the startup economy.

Q4 Versus The Rest Of 2020

Q4 was vastly different than the previous quarters. In terms of revenue, Q4 revenue had the highest quarterly revenue in 2020. Since Q3 quarterly revenue grew by 23%. The companies which saw the highest percent increase in revenue were Sunmill, Spaceit, Nutriloop, Kraftworks, and Crystalspace.

As previously mentioned, revenue varies largely in the Estonian ecosystem making it reasonable to break the percent increase in revenue between Q3 and Q4 into light-weight, medium-weight, and heavy-weight groups. The companies with the highest percent increase in revenue in the light-weight category were Nutriloop, Kraftworks, and Ipux Diagnostics.

The companies with the highest percent increase in revenue in the medium-weight category were Sunmill, Spaceit, and Crystalspace.

Finally, the companies with the highest percent increase in revenue in the heavy-weight category were Milrem, Threod Systems, and Huum. On the flip side, the companies which saw the highest percentage decrease in revenue were Taskus, Transformative AI, Festera Bioboxes, Marjakas Eesti, and Tuenvioya.

In Q3 we noted the importance of looking at which companies rebounded from the harm of COVID-19. This remains true for Q4. To look at which companies rebounded, we employed two methods. The first being we sought to find startups that saw a large decrease in revenue between Q1 and Q2, but a large increase in revenue between Q2 and Q4. The second method was finding startups that saw a large decrease in revenue between Q1 and Q3 and a large increase in revenue between Q3 and Q4. Concerning the first mode of classification, the startups with the largest rebound were Intepia, Glocalzone, Swapsmart, Pernimo Solutions, and Votemo.

In regards to the second mode of classification, the startups with the largest rebound were Nutriloop, IPDX Diagnostics, Bizplay, Addlix, and Kwad.

In terms of team size, Q4 saw the greatest number of employees in the startup ecosystem in the year. Team size increased 2% from Q1 to Q4. Additionally, the companies that hired the most employees from Q3 to Q4 were H2H, Pipedrive, Skype Technologies, So.Fa.Dog, and Starship Technologies.

Moreover, Q2, the quarter bearing the largest brunt of COVID-19, had 7,912 employees in the ecosystem while Q4 had 8,390. The vast difference amongst the total number of employees is a promising sign for the ecosystem.

Regarding labor tax, the taxes paid in Q4 was the highest amongst all the quarters of 2020. Between Q2 to Q4, the percent increase in labor tax was 20.9%. Between Q3 and Q4 the percent increase in labor tax was 7%. Additionally, in Q2 the top 15 tax contributors contributed 54.8% to labor taxes.

In Q3 the top 15 contributed 57.6% to labor taxes, and in Q4 the top 15 contributed 58.2% to labor taxes.

Between Q3 and Q4 the new entries to the top 15 where tax contributors were Playtech, Skeleton Technologies, and Topia. Between Q3 and Q4 the company that exited the top 15 list was Topia.

The differences amongst quarters, but more importantly the increasing growth pattern from Q2 to Q3 to Q4 is indicative of a large rebound from COVID-19 restraints and towards an era of larger growth.

Q4 2019 vs. Q4 2020

From 2017 till Q4 2020, Q4s have consistently served as the year’s high point in terms of revenue. Q4 2019 and Q4 2020 are no different. In terms of revenue, Q4 2019 saw a revenue of € 224,430,461 while Q4 2020 saw a revenue of € 322,605,674. In terms of revenue growth between Q4 2019 to Q4 2020, Estonia saw the total quarterly startup revenue increase by 43.7%.

Additionally, in terms of revenue, the number of companies that could be considered lightweights in Q4 2019 was 354, the number of medium-weights was 497, and the number of heavy-weights was 34. This is different from Q4 2020 which saw 404 light-weights, 547 medium-weights, and 40 heavy-weights.

The difference between the number of startups in each category in each quarter offers the insight that not only are more startups emerging, but the size of these startups is increasing. This growth is evidence of the vitality of Estonian startups but also the growth potential that the Estonian startups have shown and will most likely continue to show.

The companies which saw the largest percent increase in revenue from Q4 2019 to Q4 2020 were Sidekick, MCF Group Estonia, CrystalSpace, Cleanhand, and Gelatex Technologies.

Additionally, in terms of taxes and team size, Q4 2020 metrics were much larger than Q4 2019. Q4 2019 saw 7,868 people employed in the startup ecosystem, while Q4 2020 saw 8,390 people employed in the startup ecosystem. Lastly, Q4 2019 saw € 33,249,297 paid in labor tax while Q4 2020 saw € 38,795,025 paid in labor tax. Overall despite Covid-19 the improvements made in KPIs between the year only go to see the hurdles the startup ecosystem was able to overcome and the strong predicted trajectory of 2021.

Estonian unicorns

Despite the hiccup that Bolt faced during Q2 2020, they were able to rebound and see immense growth. This rebound can be attributed to many reasons. Bolt doubled its number of customers and launched new services from ride-hailing, micro-mobility (scooters), and food delivery. New updates in Bolt’s products like the release of their 4th generation scooter were just a few notable moments Bolt enjoyed in Q4. Bolt’s ability to leverage its new and expanding products saved Bolt from a downward spiral post-Q2 2020.

Additionally, in December 2020, an investment led by D1 capital led to Bolt raising € 150 million, their largest funding round yet. This large funding will propel Bolt to higher gains shortly. Bolt will use the funds to further enhance the safety and quality of its products while further expanding in Europe and Africa. Additionally, in 2021 Bolt hopes to roll out additional safety features, like driver face verification and automatic trip monitoring. Despite Bolt’s Q2 struggle, Bolt left 2020 stronger than ever, expanding to 200 cities in 40 countries reaching 50 million users around the world. Bolt’s resilience during COVID-19 further shows that Bolt’s Unicorn status is not only apt but long-lasting.

Pipedrive was one of Estonia’s newest Unicorns. Pipedrive was one of 18 new 1 billion dollar plus tech startups born in Europe in 2020. Additionally, Pipedrive’s sales tools were used by more than 90,000 companies in more than 150 countries. Estonia’s fifth Unicorn, Pipedrive, won two awards during the 2020 Estonian Startup Awards. However, Pipedrive’s true impact on Q4, 2020 overall, and the future of Estonia’s startup ecosystem is the number of ex-Pipedrive employees. Previous Pipedrive employees have gone out of their way to give back to the startup economy by starting and funding new startups. Additionally, the funds from the exit have been put to good use as Vok and Woola are some of the startups benefitting from the money made from the exit. Ex-Pipedrive employees will positively impact the SaaS sector because they know how to build future success stories. Currently, ex-Pipedrivers have started more than 10 startups, many of which were SaaS companies. The impact of the success of Pipedrive helped the Estonian startup rebound throughout COVID-19 but its impact does not end at Q4. The impact of this Unicorn will continue much into 2021 and the future.

What Do We Have To Look Forward To In 2021?

Increased diversity, investments, and growth in SaaS and Greentech companies are just a few of the things that we have to look forward to in 2021. In Q4 and 2020 in general, there was a significant rise in the level of foreign founders as made evident by the increasing presence of foreign founders like Vishen Lakhiani, Avery Schrader, and Jeff McClelland. Foreign founders are increasingly important for Estonia’s startup ecosystem as it allows for innovation, more jobs, and helps grant Estonia the title of a global startup and innovation hub. In addition to the increasing number of foreign founders, Greentech/Cleantech and SaaS sectors have exciting prospects in 2021. CleanTech by Q4 of 2020 says 51 startups in the sector with 250 employees. Cleantech startups showed a 26% increase in employee count in comparison to 2019. Startups like Skeleton Technologies and Comodule are just a few of the prominent GreenTech startups. While revenue amongst the sector decreased from 2019, the climate-oriented/green-mindedness of startups seems to be in favor of Greentech/CleanTech startups and will help propel the sector in 2021 and the future.

What Lessons Have We Learned In 2020?

The lessons we have learned in Q4 2020 are more so a culmination of the lessons which we have discussed and learned in Q2 and Q3 of 2020. In Q2 we learned that the Estonian government’s response to COVID-19 was apt. The temporary measures to prevent unemployment and the earmarking of loans to support liquidity helped mitigate the negative impacts of the pandemic. Additionally, the Estonian government’s tax policies, digital capabilities, and e-Residency program helped maintain Estonia’s position as a startup hub despite COVID-19. In Q3 we learned that camels (companies that can survive in long, adverse conditions and shaky startup ecosystems) were an undeniably important part of the startup ecosystem. This is because camels were able to implement balanced growth, resilient strategies, and diversification all of which are necessary to survive during times of unprecedented crisis. Finally, in Q4 we learned a lesson similar to that of Q3. During times of great crisis, the startup ecosystem can be adaptable, flexible, and resilient during unprecedented times. Q4 was a great example that startups can continue to flourish and grow more than imagined because of the lessons learned and experiences during unexpected times.

The series of these articles have been written through an objective lens by Harshita Bhatt, who joined Superangel team through the 101 Fellowship.

Disclaimer: The numbers reported may differ from the data reported by Startup Estonia due to some differences in selection criteria.

If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

An estimated 13.4 million hotel rooms and short-stay apartments across Europe and the UK, coupled with a growing industry of online travel agencies and marketplaces, that cater to the booming rise in the mobility of people who mix business with pleasure.

Enter Niko Karstikko and Sebastian Emberger, true digital nomads, who found themselves unhappy with the poor value-added of Airbnb’s scaling hit-or-miss market. They co-founded Bob W to redo the hospitality industry, promising a five-star experience to each guest.

Superangel caught up with co-founder and CEO Niko, to talk about Bob W’s plans for their latest investment round and discover their formula for growing a startup despite the Covid-19 pandemic-triggered downturn in the hospitality industry and achieving an unlikely success at a difficult time.

Becoming Bob W

Growing up in London in a family of entrepreneurs, Niko developed a keen sense of opportunity. A move back to London shortly after his studies in the U.S. and Paris saw him take a high-paying job in finance, where he stayed for five years. Realizing that he was drawn to another path – more similar to his parents – he took to the tech industry and founded a fitness app in 2012, SportSetter, which he later sold. It was during this startup venture that Niko met Sebastian, his future co-founder.

After a period of traveling and hosting several apartments on Airbnb, Niko realized that about 50% of hotel rooms and a just fraction of short-stay rentals were branded with a quality standard. Travelling was at its peak, but up to two-thirds of the time people couldn’t be sure of what they would get when booking a stay.

The idea of creating a proper quality standard for the short-stay rental industry led to the founding of Bob W in 2018. The first apartments were set up in Helsinki, and quickly became the best ranked in the city. Around that time, the team bagged a small investment from angel investors, including an early Airbnb investor and set their sights on Tallinn, where they put up their first proper building. The guys were spending zero euros on marketing, but the customers were loving their product.

Bob W offers a lean luxury brand backed by technology that allows them to eliminate variables such as not knowing what to expect, questionable hosts, the hassle of key pick-up, or the trouble of choosing a neighborhood. Bob W apartments are always in trendy neighborhoods, offer the same amenities, are locally designed and sustainable, offer easy entry, and link to local service providers through the app.

In 2020, with the Covid-19 pandemic at full speed and the hospitality industry in a downturn, the company awed the startup community by closing a €4 million seed round led by VC fund byFounders, with participation from Superangel and United Angels, as well as leading Nordic and Baltic real estate investors, NREP and Kaamos. The investment put the company into full speed towards expanding across the Nordics, Baltics, the UK, and beyond.

Bob W building the puzzle

From the beginning the founders built and sold the product for people like themselves, having realized that there are many more potential B2B clients like them: ‘The Airbnb generation’, who are mixing business with pleasure, looking for exciting interactions and fulfilling cultural exchanges, packaged in a quality standard. Today’s B2B program includes happy customers Bolt, Pipedrive, Fotografiska and much of the tech and startup scene. Building brand awareness was backed by influencer guests and brand ambassadors, who had no problem getting behind the product whole-heartedly because of it’s great positioning and high quality.

The company’s value proposition is embedded in the name. It is built on the cross-section of hotels and short-stay rentals, which attributes the product with ‘the Best Of Both Worlds’. This positioning allows them to optimize a large playground to their advantage, using a variety of traditional marketing channels of the industry as their customer acquisition channels; marketplaces typically targeting different customer segments, like Booking.com and Expedia for hotels, and Airbnb for short-stay rentals. Furthermore, with a 78% repeat customer rate, there is little need for retention marketing. As Niko puts it: “Just build the best product on the market and you don’t need to press the right touch points too hard to get a customer converted.”

An important aspect in developing any product is the flexibility that allows it to be reused for new use cases. “For example, doctors relocating to other cities to help out during the Covid-19 pandemic, who would rather not spend 90 nights in a hotel room,” Niko explains.

Bob W caters to the needs of a wide range of target groups, from the mobile workforce of international tech companies to freelancers working remotely, expats on holiday within their home countries, and tourists that appreciate traveling like a local. For business customers booking in bulk, Bob W actually saves days of work compared to Airbnb, says Niko.

While the company promises a five-star experience for every guest, their prices range somewhere in the middle of the 3-to-4-star hotel equivalent, or an amateur-hosted apartment. All thanks to the technology that allows them to run 50 apartments with one person. Automating traditional hospitality allows an unquestionably high quality of offering with less human capital, lower costs, and more profit – a whopping three times more, compared to traditional hotels.

Bob W taking on the world

Being physically located at the Palo Alto Club – the Tallinn-based co-working space founded by early Bob W investor, VC fund Superangel – pinned the Finnish German founded startup on the Baltic startup map and earned them a nomination in the Estonian Startup Awards Foreign Founder category. Becoming well-known in Estonia later helped the founders recruit an incredible team. The largest share of which is now working out of Estonia, including the company’s German co-founder, Sebastian.

“Estonians have a great sense of opportunity and I love their startup scene,” Niko Karstikko, CEO of Bob W.

The company recently raised an A-round, increasing investments to €10 million. The founders had built a product that showed resilience during the pandemic, when many others were failing, and exhilarated the changing trends of the market. The redistribution of the real estate market provided momentum to grow, with office spaces emptying because of the pandemic, and the investors celebrated the opportunity. The new investment was raised from existing VC and angel investors and Finland’s state-owned investment company, Tesi, which invests €100-150 million in venture capital, private equity funds, and growth companies, annually.

With its clever branding and Net Promoter score (NPS) of 93 , Bob W is dramatically growing revenues. With hundreds of units signed, the company has several new buildings coming live in many parts of Europe, like London; making Tallinn and Helsinki, where it all started, the smallest markets they operate in. In the next year or two, the founders are moving towards asset-light management with technology to fill the gap in the hospitality market worldwide.

According to Niko, going international is ultimately about weighing the effort against the opportunity. To pick new markets, the team uses intuition combined with data to make even better decisions. While the fundamental directions are guided by their gut feeling, the team now replicates patterns that have worked previously. Bob W currently has a team of analysts, who are building scalable scripts on different markets, which is helping to funnel large capitals down to a few. The analysis is typically based on multiple data sources, looking at the competition, the type of customers, rental rates, demand and supply data, real estate fundamentals, compatibility with the brand and in-house skill sets.

It takes effort to grow out of one’s nearest region and comfort zone – what the Baltics and Helsinki are for Estonians and Sweden is for Finns. According to Niko, entering a new market might only, depending on the product, be about learning to operate different distribution channels, but usually, the barriers are more psychological than anything else.

“Targeting markets that are big enough, like New York, London, Paris, and Germany, makes all the difference to investors, who are above all looking at market opportunity. In London, we are much more relevant to a big part of the world,” says Niko and elaborates: “With hotels struggling for survival, there is a massive opportunity. A thousand apartments are a drop in the bucket compared to 70,000 units available.”

“Going to London, we can be a unicorn based in one city,” Niko Karstikko, CEO of Bob W.

Team Bob W

The company culture centers around problem-solving and making a change. “We are a bunch of hustlers that want to create a new benchmark for hospitality,” says Niko. The team grew from 6 to 36 people in 2020 and is now at 40 and fast-growing. The company has successfully recruited from Pipedrive, WeWork, and AirHelp to build prominent tech, real estate, and growth teams.

The company goes by hiring only the best people, investing a lot of valuable time on sniper recruiting to achieve this. “The process starts with identifying the people we want to hire and then we try to figure out how we can afford and attract them, and what we need to do to relocate them, not the other way around,” explains Niko. Rapid growth during the corona pandemic has created challenges with recruiting online, which lacks the socializing aspect necessary to read people and make the hiring decision. Building a company culture and achieving harmony, while working remotely, has required coming up with new ways of working, ideating, and connecting with people. Bob W new hires are supported by a professional onboarding program, which is now executed online.

Bob W’s team members are chosen by the same values, with radical transparency, 360-degree hospitality, and responsibility topping the list. ‘Don’t just be nice to the customers, but also to the lady in your lunch cafe, to your friends and colleagues’ has become the company mantra of sorts, according to Niko.

“We choose the people we’d like to grab a drink with,” Niko Karstikko, CEO of Bob W.

In order to cultivate success in the company, the team regularly gets together, whether it’s virtually or physically, to battle it out and make sure they are on the same page before they start something new. The founders take efforts to support the team in a way that gets the best version out of everybody. “I love having a beer on a Friday afternoon with my colleagues to ask them how they are really doing,” Niko says.

From the founders up, the widespread approach to getting more done is taking time to explore personal limitations and to be able to identify the point where actions start giving diminishing returns. “When you can’t sleep two nights in a row, you should probably be doing something differently,” Niko explains.

A ground rule for keeping the team going, according to Niko, is to always keep the door open and be both the pep rally guy and waterboy, to help people do what they do best. “The price is finding the best team. People’s abilities either match your company or not. Hire better than yourself,” Niko noted.

“We can guide and help people grow, but usually you want to hire amazing people and let them do their thing,” Niko Karstikko, CEO of Bob W.

In a team of 15 nationalities, Bob W broadly celebrates diversity of gender, nationality and skill sets in all its activities. The management makes sure that the HR strategy includes hiring polar opposites, a concept proven at the founder level. This means finding complementing skill sets and personality types, like the gibbery marketers and structural-thinking engineer-types, for different roles and encouraging these combinations in the teams. The approach brings amazing results, according to Niko, who has experienced burnout and failure in his previous ventures fueled by toxic founder combinations of too similar personalities, with clashing goals.

There is an enormous amount of respect between the two founders for each doing what the other hates and doing it on a world-class level. The founder pair is determined to replicate the pattern throughout the company to achieve success in a Zen environment.

Bob W keeping it real

Niko and Sebastian were lucky enough to choose their own investors, who have proven their value as a motivating force in terms of scaling and fundraising. Bob W uses monthly reporting in order to keep their investors in the loop, and social media apps like Whatsapp for more casual ad hoc interaction.

When asked about keeping investors on board during hard times, Niko says there are two ways: “Consider them a party that you’re trying to impress or make them a part of your team so that they feel your pain when you’re hurting.” Nine times out of ten you find that there is a lot of empathy and willingness to help solve the problem on such occasions, he adds.

“It’s all a game and we are all trying to be happy with the journey,” Niko Karstikko, CEO of Bob W.

Having recognized that financial incentives are very much an afterthought for him, Niko follows a concept of success that differs from the conventional understanding that it has something to do with a Ferrari badge. “I like the idea of not having to worry about money because, in my teens, I saw the bankruptcy of my family businesses during two economic downturns. But for me, it is more about reducing the background noise of the personal economic situation so I can do what I was born to do and enjoy the journey to the fullest,” Niko noted.

For Team Bob W, being successful means making a positive mark in the world and leaving an impact on people. Next to leading the industry in sustainable hospitality, the platform aspires to do its share to reduce prejudice and other pre-conceived notions through the meaningful cultural exchanges it opens travelers up to.

“Bob W is the avatar of the best host you’ve ever had, times ten. He is that guy who put a whole lot of love into making the apartment perfect for you, sorted your restaurant booking and remembered all the details, like leaving the toilet paper in the triangle, as he rushed off to rescue koalas from Australian fires,” concludes Niko, who without a doubt, lives his brand.

Bob W’s formula for building a successful startup:

- Avoid toxic founder combinations with clashing goals

- Build a 10x better product than what’s already out there

- Target big markets

- Choose investors who bring value and are team players

- Combine intuition with analysis

- Become a community player

- Don’t compromise with recruiting

- Choose people with the same values

- Diversify your team

- Always aim to make a positive dent in the world

This article was put together by Anari Hagel.

Speed of progress and capability of compressing time are crucial elements of success for startups. Superangel and Garage48 have learned over years from hundreds of startups the core components for compressing months into days and weeks into hours. Based on this knowledge we have created and environment where startups can learn and polish the skill of time compression – 72h Base Camp hackathon.

Each time before Base Camp kicks off, everyone wonders: what is it this time that startups can achieve in 72h? And every time, they push the limits even further.

So here’s how the 6th Base Camp went down and the TOP 11 teams that proved once again that impossible is possible.

Base Camp has boosted over 100 startups

Since 2018, Garage48 and Superangel have used the Base Camp hackathon format as a means to boost the community and give early-stage startups the final push that is needed to get their machine and growth going. Now that the Base Camp hackathon is turned into a fully online event, we’ve been able to offer a ticket to the wildest hackathon ride to more teams than ever.

“Base Camp has this magic around it that it makes you achieve anything ten times faster. But the thing is that you don´t just get value from the 72-hours. A large portion of the value is actually what comes afterwards – the open doors, the support and guidance, new team members and in our case, an advisor.” – Martin Kalamees, co-founder and CEO of Werk

Base Camp hackaton is a no-strings-attached event from entrepreneurial investors to awesome early-stage startups. Over the years, we have been a springboard for ambitious early-stage companies and boosted 109 startups. The latest edition of the Base Camp hackathon gathered close to 100 applications in which we carefully chose 33 fierce early-stage startups from Baltics, Israel, US, UK, Portugal, and more to enter the competition. These teams took up the challenge to set a laser-focus for 72-hours and to make improvements that otherwise would take weeks.

“In just 72-hours we got an insane amount of drive and work done. We were able to test 11 hypotheses. This would normally take us a couple of weeks.” – Genia Trofimova, co-founder and CEO of Introwise

Base Camp Spring 2021 had a lot of firsts

Until now, our alumni teams had collectively raised 18M€ post-hackaton but for the first time ever, a company raised 80K€ during the event! Awesome work, ROI Financial Technologies and Ida Mänty!

It was also the first time we had a startup that was participating in the hack also mentoring fellow contestants. In fact, it was Superangel portfolio company Remato, who probably has the title of ‘Most Base Camp hackathons attended’. Remato’s team didn’t come to the hack to compete. They came to use the energy and urgency from the event to smash their goals in a short amount of time. In addition to Remato, we were happy to welcome back other alumni teams such as VideoCV, Werk and Planyard. If it proves anything then it’s the fact that Base Camp caters to startups in various stages – from proof of concept to prototype to actually having a fully working business and product already out there.

Base Camp Spring 2021 showed us that the quality of the teams was higher than ever before. The 33 early-stage startups from all across the world showcased that the limit does not exist when it comes to proving to mentors and investors that they have what it takes to go beyond what they would normally do.

“The project that we chose for the weekend was planned to last 6 months and we feel that a huge portion of work got done during Base Camp. We were able to walk out of the hack with actually working solutions to publish!” – Kelly Lilles, co-founder and CEO of ALPA Kids

From closing 80k from investors, getting 200 signups to a founder fit tool, building automated brand rating data-gathering for more than 850 brands to walking out from the hackathon with a working solution that is ready to launch, an UI/UX overhaul of the product, recruiting a team member from the individual participants and achieving first revenue of 150 EUR from 4 paying customers – these are just a handful of wins that the teams managed to accomplish during the short period!

“Base Camp Spring 2021 was a perfect environment for us to start working on the product instead of continuously talking about it.” – Gregory Ovsiannykov, co-founder of Transaqt

Base Camp mentors broke the law of nature

The secret sauce of the Base Camp hackathon is the mentors and experts, who we pull in for this event to help the startups move forward. They are the people who are really ready to help the teams without any personal agenda. Our mentors and field experts, ranging from marketing, sales, fundraising, and business development to design and product development conducted close to 120 mentoring sessions with the startups. Kristina Randver, the Head of Industry at Google Baltics says: “I ended up having 9 1:1 sessions where I mainly discussed topics related to sales, marketing/communication, growth and new market expansions. It was refreshing and happy to see that the majority of the startups were well prepared and had good questions. I tried to challenge them a bit to see how deeply they had thought about certain topics.”

In addition to the 1:1 mentoring sessions and checkpoints, we delivered two workshops on storytelling and sales. Thank you to Lior Shoham, a TED and TEDx coach, and Tal Shmueli for teaching the startups how to successfully improve their storytelling capabilities. If there’s one point you should take away from this session (although it was more like 100), it’s to put your audience first. Make them care about your problem because remember: “Someone who’s wealthy will never understand hunger”.

Patrick Collins, the Head of Growth at Startup Wise Guys took startups to an insanely intense and practical sales journey by sharing the tips and tricks on how to go from 0 to 10k in 3 months. He also broke the law of nature by being at two places at once – Tenerife and Palo Alto Club in Tallinn. You don’t have to wonder how he did it – just check out the session recording. Base Camp startups said they have to watch it again about 10 times to digest all the useful information.

We also hosted 2 panel discussions on how to impress investors and deal with burnout. Thank you to Liina Laas from the Better Fund, Rainer Sternfeld from NordicNinja VC and Marek Kiisa from Superangel for an interesting discussion around what the investors are looking for in an early-stage startup. As Marek Kiisa put it, startups should be like Super Marios – full of energy and looking for shortcuts and smart ways to overcome obstacles on the 72-hour journey. Work hard but be smart about it, right?

Thank you to Aleksander Tõnnisson, Triin Kask, and Maido Janke for sharing your own stories on burnout as they are and how to protect your team against it. Burnout is a dark side of light-bringers. It’s a real condition and you’re not crazy if you feel burned out. This may be one of the most sincere, raw panels hosted in this ecosystem, and we hope that at least 1 person can find a takeaway from it, and avoid burning out.

Base Camp winner helps kids learn in their native language

The startups were assessed on 4 main criteria: team, traction, business model, and progress during Base Camp. The jury, consisting of investors and seasoned entrepreneurs, had a hard time choosing the best of the best because, in truth, all the teams deserved attention and praise.

OVERALL WINNER OF THE BASE CAMP HACKATHON – ALPA Kids. An Estonian educational technology company developing culture-based digital learning games for preschool-age children.

1st RUNNER UP – ROI Financial Technologies. A platform that provides ETF investing and financial coaching to help beginners start investing with confidence.

2nd RUNNER UP – FleetGuru. A fleet management app that does the work of an entire department.

Future Unicorn Award – Edufy. A social and educational app that creates communities right where they have to be. It connects students to a voice chat/text chat based on the grade and the subject/topic they’re in and learning.

Moonshot Award – VAAL Airships. Take advantage of the unique vantage point of high altitude platform to provide connectivity advantages and surveillance opportunities over any other technology.

Superangel AI Award – Ender Turing. The most accurate, secure, and insightful speech-to-text built for enterprises

The winner and runner-ups were in a tough competition with 8 startups in the finals:

- Electricview – Optimized energy management.

- Koble – A software platform that helps founders succeed in the early stages of building a startup.

- Dotty – Wellness app for fashion. Empowering you to buy better.

- VITS – An online platform to manage health and safety processes in your organisation.

- WiseDrive – Improving the car maintenance experience.

- VideoCV – Great people don’t stand out on paper. VideoCV interview tool helps you increase your hiring productivity by quickly revealing candidates’ social qualities without meeting them directly.

- Werk – B2B marketplace for construction work.

- sMover – sMover cures the four pains in real estate of time, money, transparency, and safety helping renters, buyers, sellers, and investors control their real estate journey entirely online.

Garage48 and Superangel would like to thank all startups that applied, participated, and made the 6th edition of the Base Camp so amazing. We’re happy to welcome back any previous teams and always keen to meet new startups. We would also like to give a big shoutout to our exclusive mentor crew. One big applause for the organizing team as well – Merit Vislapu, Kaari Kink, Kalev Kaarna, Joao Rei. And our virtual events couldn’t happen without the help of the production team – Raido and Tiit from MindMedia.

Stay tuned for Base Camp Autumn 2021 and keep following our social media channels for updates!

You have a chance to relive the event:

Panel discussion “How to impress investors in 72-hours?”

Sales Workshop by Patrick Collins

Top 11 pitches and award ceremony

Overview

By Q3 Estonian startups had already withstood a quarter of the economic challenges resulting from COVID-19. While Q2 showed signs of struggle, Q3 was representative of a more optimistic outlook with promising signs of economic recovery. Q3 also witnessed Estonian startups and the ecosystem as a whole beginning to pivot from the revenue decline of Q2 and towards the high growth trajectory of pre-COVID times. Based on publicly available data in Superangel 500 we looked for answers to the following questions:

- What did the startup environment in Estonia look like in Q3 2020?

- Which companies had the biggest rebound since Q2?

- How did Bolt fare in Q3 in comparison to Q2?

- How does Estonia’s startup ecosystem in Q3 fare in comparison to the rest of Europe?

- What have we learned from the pandemic thus far?

Quick Highlights

Startups with the highest growth in revenue from Q2 to Q3 were:

Estonian startups with the highest % increase in revenue in Q3 2020 were:

- Precision Navigation Systems

- Nordic Automation Systems

- Remotely

- New Digital

- Powerful Fuel Cells

- Transformative AI

Revenue amongst Estonian startups in Q3 2020 was 255M€.

The total amount of tax paid by Estonian startups in Q3 was 33.5M€.

The number of people employed in Estonian startups in Q3 was 7,574.

What Does The Startup Environment in Estonia Look Like In Q3 2020?

Estonia’s startup ecosystem in Q3 showed signs of recovery, while Q2 showed signs of slight economic decline. Q3 was more representative of pre-pandemic times. The total revenue was 256M€. The total paid in taxes was 34M€. The total number of people employed in Estonian startups in Q3 was 7,574. Q1 2020 saw some of the highest KPI values in the Estonian startup ecosystem. It is important to see how Q2 and Q3 differed in comparison to Q1. In terms of revenue, Q3’s revenue decreased 9M€ since Q1, but increased 30M€ since Q2. In contrast, Q2’s revenue decreased 39M€ from Q1. In terms of revenue, Q3 outperformed Q2.

Additionally, in Q3 the total number of startups with an increase in revenue between Q1 and Q3 was 239, while the number of startups with a decrease in revenue between the same quarters was 298. Furthermore, 296 Estonian startups saw an increase in revenue between Q2 and Q3, while 271 saw a decrease in revenue in the same quarters. Startups with the highest revenue in Q3 2020 were:

15 out of 20 Startups with Highest % Increase in Revenue were Early-Stage Companies

Q3’s startups and their revenue can be broken up into three quarterly revenue groups: light-weights, medium-weights, and heavy-weights. Light-weights are startups that had a quarterly revenue of less than 100,000 €. Medium-weights are startups that had a quarterly revenue ranging from 100,000 – 1,000,000 €, and heavy-weights are startups that had a quarterly revenue of more than 1,000,000 €. The total number of light-weight startups in Q3 was approximately 443. The total number of medium-weight startups was 136, and the total number of heavy-weight startups was 37. This grouping can also be applied to the 20 startups that saw the highest percentage increase in revenue between Q2 and Q3.

Of the top 20 startups with the highest % increase in revenue between Q2 and Q3, 18 of them were light-weights, 1 was a medium-weight, and 1 was a heavy-weight. Similarly amongst the top 20 companies with the highest % increase in revenue between Q1 and Q3, 15 startups were light-weight, 3 were medium-weight, and 2 were heavy-weight. This is indicative that startups that were in their initial phase, and/or startups that are focusing on more regional small-scale efforts, were growing faster and performing well despite the pandemic.

Between Q2 and Q3, the top 3 light-weight startups with the highest % increase in revenue were:

The top 3 medium-weight startups with the highest % increase in revenue were:

The top 3 heavy-weight startups with the highest % increase in revenue were:

Taxes and Employment

Taxes in Q3 also showed signs of recovery. The total amount paid in taxes by Estonian startups in Q3 was 33.5M€ which was higher than the 28.6M€ paid in Q2. The 20 Estonian startups that paid the most in taxes were:

The 15 startups that paid the most in taxes in Q3 contributed approximately 58% in total Estonian startup taxes.

In regards to employment, Q3 saw an uptake in the number of people employed in Estonian startups. In Q1 there were a total of 7,700 people employed in Estonian startups, in Q2 there were 7,400 employed, and in Q3 there were 7,574 employed.

The top 20 companies with the most employees in Q3 were:

The slight difference between Q1 and Q3 employment levels, alongside the upward trend of employment between Q2 and Q3, is another indicator of the beginning of economic recovery. However, Q3 2020’s employment numbers were not as strong as Q1 2020 which indicates that there is still room for more growth and recovery.

Which Companies Had The Biggest Rebound Since Q2?

Aside from Bolt’s rebound, many other startups showed strong signs of recovery and rebounding. To determine which startups were able to rebound we looked at two different rates of change. We first calculated the companies which had the largest percentage decline in revenue between Q1 and Q2. From the resulting list, we were able to see which companies had the largest growth rate in terms of revenue from Q2 to Q3. These companies’ upward trajectory from Q2 was indicative of which startups were able to rebound in Q3. The 20 startups that had the largest percentage decline in revenue between Q1 and Q2, but the largest percentage increase in revenue between Q2 and Q3 were:

We used this form of analysis to determine the top startups based on Q3 revenue in each category of light-weight, medium-weight, and heavy-weight startups.

A shift from a focus on Unicorns to Camels

However, based on the work of the Harvard Business Review, one of the most critical lessons from Q3 was to look for Camels instead of Unicorns. Camels are companies that can survive in long adverse conditions and shaky startup ecosystems. Camels can implement strategies that are balanced in growth, resilient and diverse. These types of startups have a higher probability of surviving market shocks and challenging times. Ultimately with the negative impacts of Covid-19 on the Estonian startup ecosystem, as well as the global startup ecosystem, it seems that a shift from a focus on Unicorns to Camels is necessary. While Estonia might be chasing new and up-and-coming unicorns, Q2 and Q3 show that maybe a new strategy, or an updated one, is needed for prolonged sustainability.

We can interpret that Camels are startups whose revenue growth from Q1-Q3 had been steady or dropped the least. Additionally, they continued to grow at a consistent rate despite a possible hiccup in Q2. These are startups that potentially lost the least in sales. We were able to find some of these camels by looking at companies whose change in revenue fluctuated by +/- 5% between Q1 and Q2. From that resulting list, we determined the companies whose change in revenue ranged from more than 0 to less than or equal to 5% between Q2 and Q3. These can be considered Camels because overall they had steady revenue streams despite the pandemic. The companies that resulted from this technique were:

Here we see two light-weight, one medium-weight, and one heavy-weight camel. This displays that in environments like that similar to Q3, it is possible for any size startup to have growth modeling that of a Camel startup. As a result, startups of different sizes have the possibility of surviving adverse conditions in the startup ecosystem.How Did Bolt Technology Fare in Q3?

Estonia’s Unicorn, Bolt, lost the largest amount of money between Q1 and Q2 in comparison to the rest of the Estonian startups. In Q2 Bolt lost 37M€, a drop of 44%. During Q2 Bolt had a large impact on the overall outlook of the Estonian startup ecosystem. If we kept Bolt’s revenue in Q2 consistent with that of Q1, the revenue of Q2 would have been 263M€ instead of 226M€. Luckily, Q3 saw a much more positive outlook for Bolt. In Q3 2020, Bolt had a total revenue of 81M€ which was a significant increase from Q2, and a value close to that of Q1’s.

This shows the resilience of Bolt. While Bolt has more issues to tackle, they were able to address the issues that were posed during Q2. During Q3 Bolt was able to adapt to new circumstances by implementing further safety measures, setting their eyes on e-scooters, and further expanding into the food delivery market. Bolt’s steps to recovery were consistent with that of the entire Estonian startup ecosystem’s recovery.

How Does Estonia’s Q3 Startup Ecosystem Fare In Comparison To The Rest Of Europe?

Both the EU and Estonia showed signs of recovery during Q3. However, the speed and sustainability of the recovery differed amongst both groups. The sustainability of the recovery seems more plausible for Estonia than that of the rest of the EU. This issue was discussed in our Q2 2020 post as well. To summarize, the reason for much of Europe’s startup ecosystems decline was due to much deeper rooted issues than that of Estonia. The rest of Europe saw a declining trajectory for their startup ecosystem much sooner than Estonia did. Additionally, with issues such as Brexit, the overall improvement of ecosystem metrics in the entire EU is not as promising as that of Estonia’s.

Regardless, both groups showed many similarities and signs of resilience. Overall the EU’s ecosystem saw sectors such as Biotech, Edtech, Health, and Fintech to be those with the highest growth and promise. The EU saw increased growth in software startups and health startups which was no surprise given the conditions that arose from COVID-19. Similarly in Estonia, the country saw growth in and promise in sectors like Business and HR Software, Fintech, and AdTech and Creative Tech. The prominence of the software startups in both groups is important because it is indicative that both groups were able to adapt and take advantage of the shift towards remote work, school, and e-commerce. Both groups also saw many funding deals continue to take place. Estonian startups signed 55 funding deals in the first nine months of the year. Similarly, European funding in Q3 saw its strongest funding since Q3 2019. The comparison between both parties gives insight into various recovery strategies and patterns during an unprecedented time and allows everyone to learn from each other, especially during times of recovery.

What Have We Learned From The Pandemic?

COVID-19 has served as a great learning experience for Estonia and other countries and their startup ecosystems. These ecosystems have learned how to become adaptable, flexible, and resilient during unprecedented times. Most importantly, crises can offer opportunities for existing startups to flourish, and new startups to emerge. Research has shown that many successful and innovative startups like Uber, Airbnb, and WhatsApp started during or right after the global financial crisis. During the SARS outbreak in China, Alibaba’s Taobao was founded. Hopefully, startups during this time have learned the importance of adapting to market demands, identifying and analyzing opportunities before it is visible to everyone else, and staying persistent in regards to securing funding. Overall, we were able to learn that in Q3 the Estonian startup ecosystem was able to adapt and begin to grow despite unprecedented circumstances.

The series of these articles have been written through an objective lens by Harshita Bhatt, who joined Superangel team through the 101 Fellowship.

Disclaimer: The numbers reported may differ from the data reported by Startup Estonia due to some differences in selection criteria.

If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

Overview

On February 27th, 2020, Estonia marked its first case of COVID-19, and by March 12th the country went into lockdown. These moments marked a turning point in the country’s startup economy. It was here where Estonia had to face the challenges that came with a global pandemic. While Q1 of 2020 showed signs of high growth and revenue, Q2 told a story of slight economic decline resulting from the pandemic. Q1 also failed to reflect the true impact of the COVID-19 pandemic. However, even in these trying times, there are significant and encouraging signs of optimism. Based on publicly available Q1 and Q2 data in Superangel 500 we looked for answers to the following questions:

- What did the startup environment in Estonia look like in Q2 2020?

- What were the pain points during COVID-19 Q2?

- Which companies were able to find some semblance of success during COVID-19?

- What were the differences between Q2 2019 and Q2 2020?

- How did Estonia’s startup ecosystem in Q2 fare in comparison to the rest of Europe?

- What signs indicate optimism for the future?

Quick Highlights

Startups in 2020 with the highest growth in revenue between Q1 and Q2 were:

1. Digitouch

2. First International Play Money Exchange

3. Vetik

4. BHC Laboratory

5. Nutriloop

6. Netnigma

7. Canese

Estonian Startups with the overall highest revenue in Q2 2020 were:

1. Bolt

2. Fortumo

3. Pipedrive

4. Adcash

5. Creative Mobile

6. Synctutition

7. Toggl

Revenue amongst Estonian startups in Q2 2020 dropped by 38.9M€

Total taxes paid were 28.6M€

The total number of people employed in an Estonian startup in Q2 2020 was about 7,400

What Did The Startup Environment In Estonia Look Like In Q2 of 2020?

Q2 2020 in Estonia’s startup ecosystem can be characterized by the pause of high levels of growth. Before COVID-19 many believed that Q2 2020 would have a strong showing given the strength and trajectory of the past years and quarters. Unfortunately, Q2 put a damper on the widespread optimism regarding Estonia’s startup ecosystem. The total revenue in Q2 was 226M€. This value marks the halt of an era that was characterized by high revenue growth seen from Q4 2017 till Q1 2020.

The graph below shows the companies with the highest revenue in Q2.

Notably, in Q2 we saw 296 companies with an increase in revenue, while 271 saw a decrease in revenue. This isn’t uncharacteristic given that many companies were facing the damage that came with COVID-19 and the subsequent economic lockdown.

Taxes also offered an interesting insight into Q2 and the startup ecosystem in Estonia. In Q2 2020, the total tax paid by Estonian startups was approximately 28.5M€. This is in contrast to that of Q1 which saw that the total paid in taxes was 30.7M€. The 20 startups that paid the most in taxes are shown in the graph below.

The 15 startups that paid the most in taxes in Q2 contributed towards 58% of overall taxes paid by Estonian startups.

The 15 startups that paid the most in taxes in Q1 contributed towards 54% of overall taxes paid by Estonian startups.

Q2 also saw new players entering the top 15 of the largest tax contributors. These companies were Onoffapp, Scoro Software, and Fortumo. In contrast, Milrem, Monese, and Fiizy left the top 15 list in Q2.

Employment statistics also provided information regarding Estonia’s startup ecosystem in Q2. The total number of employees in Q2 was approximately 7,400. The companies that had the most employees are visible in the graph below.

It is praiseworthy that companies were still able to hire new staff during challenging and historic times. There are potential reasons that some companies were still able to hire employees or retain their current employees. One of these reasons was the Estonian government’s response to COVID-19 and employment. The Estonian government took temporary measures to prevent unemployment and help struggling businesses. The Estonian Unemployment Insurance Fund declared that it would cover 70% of employees’ original wages to Estonian businesses that were struggling. The payment would go through if certain criteria were met such as:

1. The employer had suffered at least a 30% decline in turnover or revenue for the month they wish to be subsidized for as compared to the same month last year

2. The employer is not able to provide at least 30% of their employees with work

3. The employer has cut the wages of at least 30% of employees by at least 30% or down to the minimum wage.

Additionally, the government proposed additions to the budget that allowed business loans earmarked for liquidity to support companies. These government policies helped reduce the drop in employment and helped companies stay afloat. While overall indicators like revenue, taxes, and employment decreased since Q2, we were still able to see companies doing well and standing strong during the economic toll of COVID-19.

What Were The Pain Points During Q2 Amidst Covid-19?

Bolt. The significant impact Bolt had on Q2 numbers should not and cannot be ignored. Bolt is Europe’s ridesharing startup offering fierce competition to Lyft and Uber. While Bolt is Estonia’s Unicorn and generates more revenue than other Estonian startups, it greatly struggled in Q2. A large reason for its struggle was because of the nature of the business. European lockdowns due to COVID-19 reduced the number of people utilizing ridesharing apps. Additionally, Bolt was not well set up for large economic challenges. The startup has never made a profit and relies heavily on venture capital investments and European Investment Bank loans. Additionally, during the early months of the pandemic, the company requested a loan of 50 million € and became part of the government’s job retention scheme to stay afloat. Q2 statistics for Bolt did not look promising. Europe’s ride-sharing startup lost the largest amount of money between Q1 and Q2 in comparison to the other Estonian startups. Bolt lost 37M€, a drop of 44%.

Additionally, the total amount paid in taxes also decreased. It is difficult to determine the future trajectory of Bolt even after Q3 and Q4 data is analyzed. On one hand, similar players in the industry like Uber and Lyft have announced large layoffs due to COVID-19. Furthermore, with the potential of more lockdowns, it might be a while before the number of people ride-sharing resembles those of pre-pandemic. On the other hand, Bolt has many investors and the Estonian government on its side. Additionally, it occupies a large chunk of the industry space. Other sources of potential rebounding are derived from Bolt’s new partnership with Google Maps, their global expansion, and their venture into the food delivery space. The food delivery space is a large part of daily life when dine-in services aren’t available during COVID-19.

The best way to summarize Bolt’s impact on Estonia’s startup ecosystem in Q3 is to look at Bolt’s drop in revenue in conjunction with the the other startups and their losses. Bolt had a very large impact on the overall outlook of the Estonian startup ecosystem. Bolt contributed largely to the aggregate revenue loss amongst startups in Q2. If we kept Bolt’s revenue in Q2 consistent with that of its Q1 revenue (85M€), the overall revenue of Q2 would have been approximately 263M€, which would have made the drop in revenue 1.7M€ instead of 38.8M€.

Which Companies Were Able To Find Some Semblance Of Success During COVID-19?

There are several ways to determine the winners of Q2. Speaking solely from the perspective of companies with the highest growth in revenue, some of the top companies were Digiotouch, First International Play Money Exchange, Vetik, BHC Laboratory, Staycool, Threod Systems, and Bitofproperty. These companies continued to largely increase their sales despite the pandemic. Thus, these companies are some of the winners of Q2.

Given the vast differences amongst Estonian startups, especially regarding revenue, the 20 startups with the highest percentage increase in revenue in Q2 can be divided into categories based on their Q2 revenue. These categories can divide into light-weights, medium-weights, and heavy-weights. Startups with a quarterly revenue of less than 100,000 € are considered light-weights. Companies with a quarterly revenue of 100,000 – 1,000,000 € are medium-weights, and heavy-weights are companies that have a quarterly revenue of more than 1M€.

There were many light-weights that were in TOP20 regarding change in revenue. The top 3 light-weights with the highest percentage increase in revenue were:

The medium-weights in TOP20 with the significant percentage increase in revenue were BHC Laboratory (+5091%) and Cleanhand (+967%).

The heavy-weights in TOP20 with the largest percentage increase in revenue were Staycool (+1189%) and Threod Systems (+1107%).

In Q2 2020 out of the 20 fastest growing Estonian startups, 16 startups were lightweight, 2 were medium-weight, and 2 were heavy-weights. This is indicative that startups that were in their initial phase, and or startups that were focusing on more regional small-scale efforts, were growing faster and performing well despite the pandemic.

Startups founded in 2020 should also be considered winners. Another indicator of companies who were able to survive the pandemic are those who hired new employees during a rise of unemployment in Estonia. The companies that have managed to hire the most people in Q2 were Goworkabit Estonia, Skype Technologies, H2H, Modular, Mindtitan, Comodule, and Synctuition.

What Are The Differences Between Q2 2019 And Q2 2020?

Comparing Q2 2019 and Q2 2020 showed that the impact of COVID-19 on the Estonian startup ecosystem was not as drastic as some might have imagined. Q2 2020 had approximately 65 more startups than the prior year. The revenue in Q2 2020 was 225.9M €, while the revenue in Q2 2019 was 209.6M€. Regarding taxes, Q2 2020 saw approximately 28.6M€ in contrast to 25.6M€ in Q2 2019. Team sizes also differed amongst the two quarters. We saw the total number of people employed in a startup go from 6,692 to 7,400. As seen above, we can also divide the startups in these quarters up by revenue.

We divided these startups into 3 quarterly revenue groups: below 100,000 € (light-weight), 100,000 – 1,000,000 € (medium-weight), and 1,000,000 and up (heavy-weight). In Q2 2020 there were 406 light-weight startups (+68 YoY), 140 medium-weight startups (+13 YoY), and 35 heavy-weight startups (+7 YoY).

The improvement in key performance metrics from Q2 2019 to Q2 2020 shows that the hit the Estonian startup ecosystem faced was not significant. The success of the ecosystem is best seen in its ability to not fall below Q2 2019 numbers.

How Does Estonia’s Startup Ecosystem In Q2 Fare In Comparison To The Rest Of Europe?