👋🏼 Hey founder, are you fundraising for your early-stage startup? I’m giving you a head start.

I find myself repeating the same things in calls with founders, and whilst it’s okay to mentor founders in the early-stage regarding fundraising, there are pitfalls that you can easily avoid in the first place.

So here are some of the resources that might become handy when raising your Pre-Seed / Seed (and even Series A) round.

before you fundraise

Before you fundraise you should keep the below in mind.

Fundraising is most often not a 1-2 month sprint, especially in the current market conditions. You should estimate at least 6 months for the process so start reaching out early.

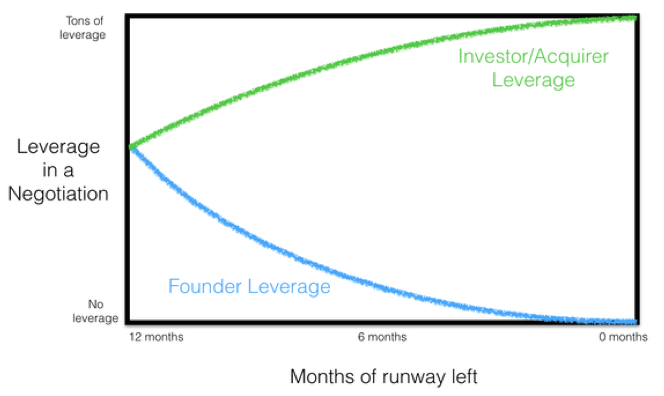

Your runway can either work for you or against you (graph below). Investors smell desperation: no runway = no leverage. And just like dating, you don’t want to come across desperate on your first date. So planning ahead is key.

Tools for fundraising

- Fundraising CRM

- Investor pipeline

- Pitch deck

- Forwardable intro

- Dataroom

📌 FUNDRAISING CRM

Putting together your next round means you are likely to speak to 50-100 funds (yes, that many). Just like managing your client pipeline, managing the investor pipeline can make the process a lot more structured. Plus you’re able to easily share it with your current investors who can help you with intros.

You can consider the following tools to help with pipeline management (example stages Pipeline, Outreach done, Connection established, In process, DD)

- Excel

- Your existing CRM (e.g. Pipedrive)

Check out Helery’s fundraising cheat sheet as well, here.

📌 INVESTOR PIPELINE

Fundraising is both an art and science. Once you understand how investors choose their investment prospects (which is strongly linked to their strategy), you’re more likely to approach relevant investors. If you take this seriously, a must read to understand how investors think is Secrets of Sand Hill Road: Venture Capital and How to Get It.

TLDR: We also have investors who have committed to our fund based on a certain strategy. In most cases, VCs have clear geographical, sector, and stage focus. We can’t go out there and invest into whatever lands on our table. As an example, as a hardware company, you should not be surprised that you got a negative response from an investor that only does software. Therefore, understanding if your company matches the strategy of the fund, should be your first priority before spending more time with them.

Here’s a list of resources of VC lists and their strategies

- 100+ VCs investing into the Baltics (& Excel)

- A major list of global deeptech investors by Hello Tomorrow

- 29 European deeptech investors by Sifted

- Climate investors

- VCs and angels investing into female founders by GoBeyond Capital

- A list of 250+ active female angels by Sifted

- A list of female VC partners by Sifted

- Most active angel investors in Estonia

- Finding angel investors in Lithuania

Please bear in mind that these databases might not be regularly updated but are a great starting point.

📌 FORWARDABLE EMAIL: Make it easy for others to do warm intros for youtive Heading

Warm intros are by far the best way to get your foot through the door. Your job is to 1) find the people that can open doors for you (LinkedIn connections are the first obvious place to start with) and 2) make it as easy for the investor to forward the information. After all, they’re spending their credit to help you.

This template on how to ask for VC intros by Raimonds Kulbergs should be a mandatory item in your toolset. It’s one of the resources I share the most.

I personally prefer if these are written in a neutral tone. If I think the company is strong, I will comment on it myself. But I almost always delete the part when founders themselves write it in the blurb. Having an obvious statement of “This amazing, fast-growing company…” is not what gets investors interested. Or, if fast growth is what sets you apart, the least you can do is to back it up with numbers.

📌 PITCH DECKS

There are sooooo many resources available to help you guide through pitch decks. Use them. It’s so unfortunate when companies do it completely wrong. It shows that you’re not resourceful. If you have existing investors, use them for feedback.

As a starting point, read these:

- Seed deck template by Creandum

- Pitch deck template by Inventure

- Pitchdeck template by DocSend and guidance on putting decks together

- Sequoia Capital pitch deck (Twitter thread)

- Research and science about pitchdecks – complementary read

PS! Design matters! Especially if your pitchdeck is the first impression you leave. So invest in design or use templates by Canva / Pitch. I mean one can argue, if you can’t design a pitch deck, what’s your product’s UX / UI like?

Superangel receives tens of cold inbound requests a week from startups that we’ve never met before. It takes up to 5 seconds to formulate an impression based on pitch deck. Having no logical storytelling is the number two reason for not proceeding with the deal (first is no strategy match). But, I recently took a meeting with a young, energetic team of Biteful without having met them before because their deck just made so much sense!

✅ Quick DOs:

- Use titles to tell a story. If investors only read the titles, they should get the big picture. After all, if you write “Market” on a slide that clearly talks about the market, you’ve just wasted important space to convey a message.

- Make it mobile friendly. No small text / crowded slides please.

- Think how you present your team. Team is number one priority in early-stage investments. But pictures and titles say little of why your team is the right one to address this problem. Don’t be modest and show how your experience matters.

- Design!!

❌ Quick DON’Ts

- State your valuation. Unless it’s determined by the lead investor of this round. Otherwise, you just shoot yourself in the foot by either proposing something way too high or even worse, too low.

- Use clients logos who are not your clients – it’s easy to check

- Not necessarily related to pitch decks, but please don’t name drop all the investors you’re speaking to. It’s obvious if you try to create FOMO. And if none of these awesome investors end up investing then you’ve undermined your own strategy.

- Set fake deadlines. If you’re closing the round because it’s oversubscribed and you need to move, then yes, communicate deadlines. But if you’re just doing it to make investors move faster, it doesn’t work. If I’m closing other deals and you say I supposedly have a week to do DD to your startup, I’ll just pass.

📌 DATA ROOM

When investors get more serious in investing in your startup, they start asking for more information, which is standard. Have them ready to make the process move faster.

Creandum just launched a Seed Data Room Template that has everything you need to be prepared for your fundraising, including metrics, financial plan, customer overview etc. You can’t avoid this, so use the resources provided to you.

—

Superangel is an early-stage VC fund located in Tallinn, Estonia. We’re investing 100k-500k€ tickets from our fresh 50M€ fund into industry-defining technology companies in the Nordics and Baltics. We’re the backers of companies like Bolt, Veriff, Starship, Montonio, BOBW, and many more.

This summer I joined the product marketing team of Estonia’s up and coming startup & Superangel portfolio company — KOOS (“together” in Estonian), a stakeholder incentivisation platform.

KOOS is founded by tech visionaries and backed by VCs like LocalGlobe and Plural VC, among other prominent angels like the CEO of Veriff and Bolt. They offer flexible, equity-like benefits to non-employee contributors of business growth, without the complexity or hassle of shareholder schemes. A new form of ownership likely to shape how businesses interact with their most valuable contributors.

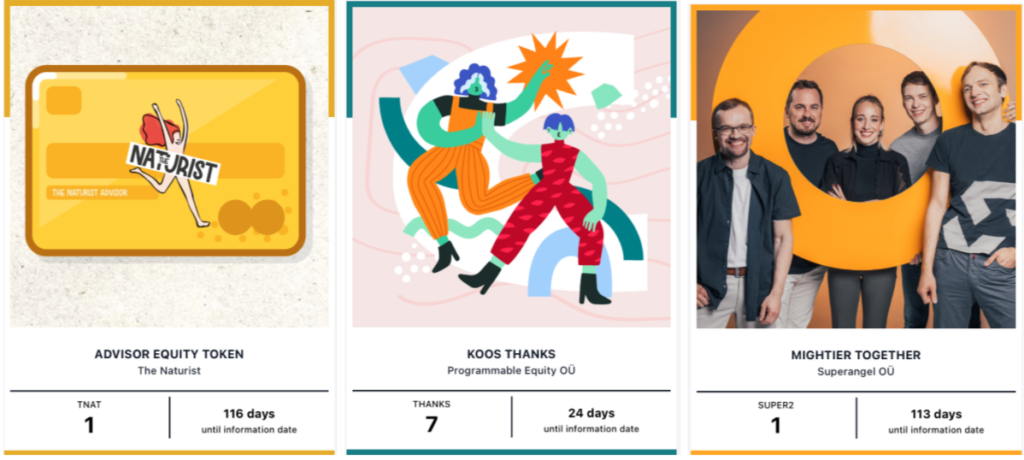

As an advisor, first adopter, community member or a valuable supporter, you can develop almost like your own portfolio of companies that you’re proud to be part of and contribute towards:

My main goal was to remind myself of the main challenges and opportunities that early-stage companies face. I spend a lot of time with many startups but I really wanted to deep-dive into one. By doing so, I can be more relevant to Superangel startups and rethink how we work with our teams. I achieved exactly that and I’m elaborating on the key challenges and good practices that I picked up from KOOS.

I Joined KOOS For 3 Main Reasons

🤝In addition to being an investor, Superangel is a client. That meant I got to develop our own strategy (we tokenised 5% of our carry) whilst providing feedback to KOOS team as a customer

👫 Epic team — KOOS was co-founded by Taavi Kotka, the first Chief Tech Officer (if you will) of the entire country, alongside several other serial entrepreneurs + domain experts

🏄🏼♀️ The trend that KOOS is riding on — a new form of ownership (i.e. engaging and rewarding the very people that drive business growth) & how the concept is leveraged by businesses is intriguing (more on that below)

*As a side note, the gender balance in the team is one of the best I’ve seen!

Becoming Relevant In Two-Months

I was most worried about whether two-months is enough to fully onboard to the company and start providing value. I know that as a small team, onboarding someone new takes a significant amount of time and effort. So I definitely felt the pressure to deliver.

The first step of becoming relevant … was to sit and listen :’) I was a silent listener to all relevant meetings and also sat down with product marketing, customer support and sales teams individually to learn about their biggest challenges. I then went on to read the materials that the teams had put together for positioning, brand development, sales etc. Thanks to that I was able to get up to speed rather quickly. It can also be useful to reflect what you heard back to the team — a fresh perspective can go a long way.

Let’s Go Chat With Our Customers & Find Out All The Answers, Sounds Very Self-Explanatory

Two months flies by so quickly you can barely scratch the surface if there are no defined goals (ooh, isn’t this true with everything?!). So we set realistic (and somewhat measurable) goals and worked up from there. For example, we agreed that by the end of two months, I’d at least have interviewed 3–4 clients and drafted the first playbook of implementing the KOOS token program. It would serve as an input for putting together sales & onboarding collateral to minimise team’s input and empower clients to use the product the most impactful way. Easier said than done.

Here’s How It Went Down:

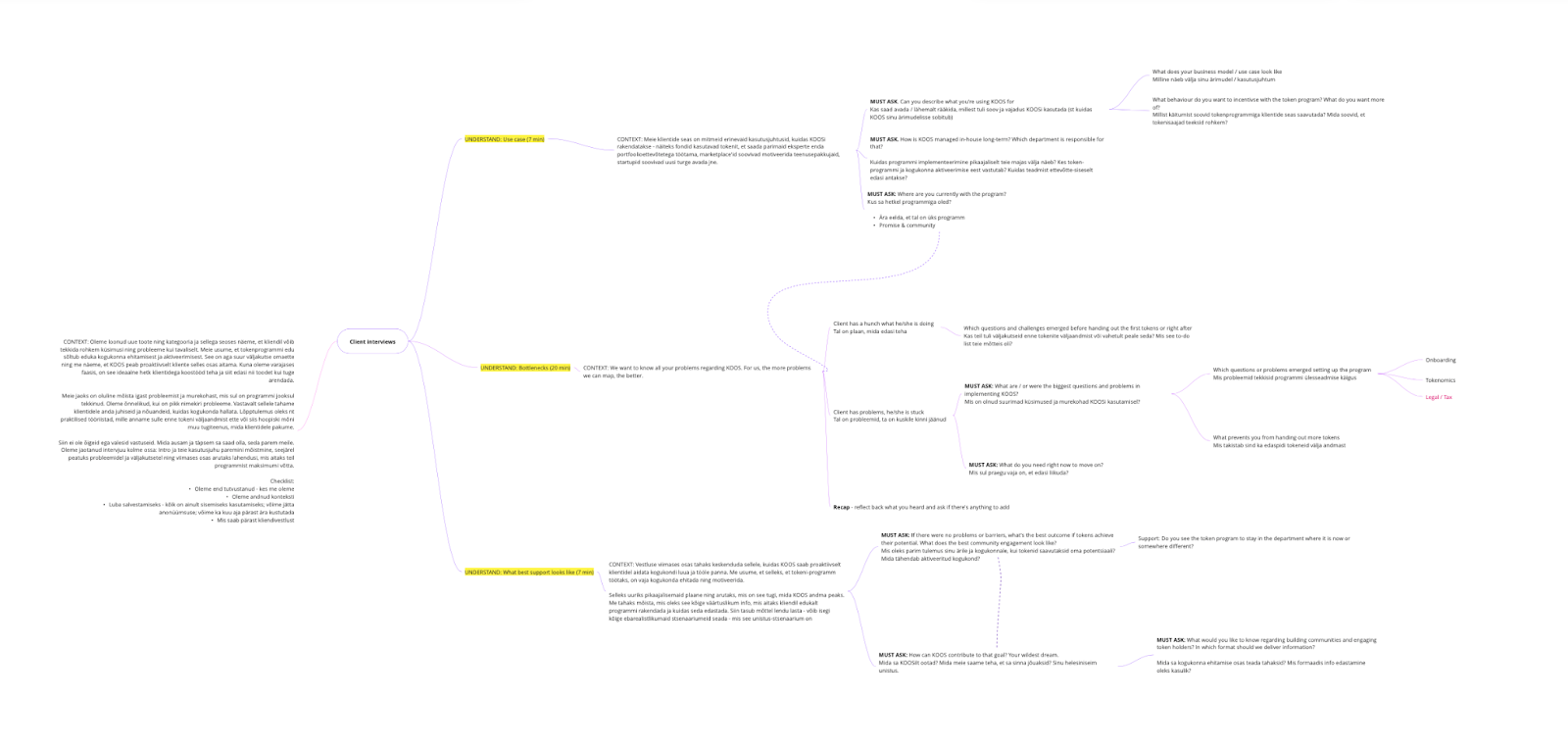

- I crafted customer interview scripts on Miro

- I defined three clear goals what I wanted to get from the interview

The goal of customer interviews was to map out all the challenges our clients faced so that we could provide better, proactive support. I also wanted to understand if there are smart hacks that they’re doing that could benefit others. Lastly, I wanted to clearly understand their use case and need for KOOS.

- Based on that I divided the interview into three core pillars with appropriate questions — must have & nice-to have questions (acknowledging that I might not have time to ask them all)

- Each pillar had their own context that I wrote down so I wouldn’t forget to add it during the interview rush

- I practiced it before with my team. Running smooth interviews is harder than it sounds. The key is to give A LOT OF context. I had to be reminded of this on several occasions because in my head I knew what I wanted to get out of it, but the customer didn’t. Therefore, during the interview I emphasised several times that the best result for me would be to map down as many problems as possible so the client wouldn’t feel they had to soften the truth.

- I asked permission to record the conversations so I could focus on running the conversations and listening rather than taking notes. After each interview, I listened it again, wrote detailed script and summarised it for other team members (I used Notion and Excel)

- I used the same conversations for client testimonials and social media content

I’ve Got All This Knowledge Now, How To Make Sense Of It All?

In an ideal world, your clients all say the same thing and you know exactly what to focus on. The reality is probably different.

KOOS has many different customer profiles (marketplaces, startups, B2B) with varying use cases (referrals, community building, supply motivation). The resources and expertise that these teams have also varies, which means the level of support KOOS needs to provide differs.

It’s an ongoing process in which you just need to continue gathering data until there’s enough for pattern recognition. Maintaining an open mind and embracing that you don’t have rock hard truths at this moment is OK. You can, however, start forming loosely held hypotheses and use new data to either strengthen or lose them. That’s what we did. The product marketing team took the data I had gathered and formulated their initial thesis.

Anyyyyhow, from my conversations with clients, I started putting together a manual or a playbook of implementing the KOOS token system internally. I wrote down what I knew and didn’t know (it’s a messy document — I sent out my warnings before handing it over). For that, I also did some heavy research on communities, community-led businesses, shared ownership, tokenisation, marketing & brand development etc.

Here Are Some Good Resources On Tokenisation, Community Capitalism, Ownership Economy And Community Building

Shared ownership & tokenisation:

- Twitter thread on how a wellness app (sweateconomy.com) uses tokenisation to grow 80% a year (this account in general is a good source of knowledge)

- One of the few reports on the Ownership Economy 2022, sharing how, for example, token incentivisation is used to boost user loyalty

- Study: Bumped: The Effects of Stock Ownership on Individual Spending demonstrating how weekly spending increased 100% for brands which individuals received stock

- Twitter: 35 business ideas of how web3 could improve or disrupt the most successful companies — i.e. how could shared ownership be leveraged today

Community capitalism & post-marketing era: Podcast & Blog — Discusses how Web3 affects marketing (i.e. — ads are not the future)

Community:

- The best playbook in my opinion on how to build community driven businesses: https://www.lennysnewsletter.com/p/building-community

- Masters of Community podcast

- Community-led businesses ABC — https://www.communityled.com (I was really surprised to learn that some of very prominent tech startups have pledged that community-driven businesses are the future)

Let’s Be A Bit Smarter Than Last Week

Aside from my own activities, I was fully immersed in the everyday life of a startup. It was refreshing to see what are the actual challenges from the inside rather than having the VC glasses on.

I think these challenges boil down to two main things: operations / communication and focus.

When things are so hectic — e.g. you’re hunting for your first customers whilst trying to understand who are the best ones, each week someone onboarding to the company, opening up new markets, figuring out positioning & messaging, launching a new website etc. — it can be challenging to ensure important topics don’t fall off the table and that information is equally available for everyone.

In an early phase like that it’s likely that you don’t have efficient processes set up for data collection & sharing, and communicating between the teams (or in the early stage, individuals). There are overlapping conversations and topics, combined with opinions and ad-hoc brainstormings. This creates noise and it’s not unusual to feel overwhelmed.

At this point, maintaining focus is the most important, and hardest, thing to do. Learning fast is of utmost importance, which is why you really have to choose your battles. The issue is not a lack of ideas, it’s saying no to most things (but not to the right things 😅).

It’s soooo easy to be drawn into a new thread of conversations and go down the rabbithole or start brainstorming ALL the good things that should be there or happen. OK… but let’s focus and come back to the thing that moves the needle the most, right now.

As Taavi put it, the goal is to be a bit smarter than last week.

Actually, We’ve Got This

This little chaos was okay for me because I fully trusted the team to figure it out. So here are the good practises that I really liked about how the team thought and worked.

- KOOS had done a really cool and relevant product positioning exercise that was the basis for the rest of the operations, be it marketing, sales or product development. Positioning is something that in my experience startups rarely think of, either because there’s a lack of data or awareness.

KOOS used https://www.g2.com to narrow down to 3 relevant categories but realised that with each of them they need to do more explaining why they’re different than to emphasise on their strengths. So category creation was the only way to go (and the way Pirjo did it was impressive but unfortunately not scalable to other startups — so try to find your own Pirjo 😜)

- The importance of brand development. Messaging, branding, informative web, social media and supportive materials are a must, especially if building a novel product. KOOS made a decision to invest in this by hiring external agencies and experts — you’ll soon enough see a result of that.

- Sales meetings were recorded and monitored in Pipedrive. Each week, sales team showed stats on how they are doing and where each client is in the process. They tracked where the leads came from and how they were converting based on their origin. Sounds self-explanatory yet often basic operations like these can seem irrelevant, especially if the team is small and everyone works independently. Although, I should point out that in the early stages it’s also completely OK to focus on discovery and hence what you track can be different.

- Having a holistic overview of sales allowed other relevant teams to chip in and contribute. For example, each week product, product marketing, customer success and sales met to discuss interesting cases and main challenges. Typically we focussed on how product marketing can better support sales, the main questions that clients ask, which client profiles emerged and their use cases, and how to optimise sales processes. Having these people in one room once per week was a great way to align the teams and ensure the company was as customer-centric as possible.

- My favourite thing was the ‘Founder Hour’ (I took the liberty of naming it myself 😁). Each month Taavi gathered the whole team to share his vision of KOOS and the greatest opportunities / challenges that the team faces. This is the lowest hanging fruit that founders should do. Hearing the CEO of the company share his passion, enthusiasm and take on the company is super inspiring. Doing it often might feel like repetition but it isn’t, especially in a time where the team is growing and new people are settling in.

- Don’t get stuck doing everything yourself but ask for help. KOOS team involved several experts on tasks that either didn’t make sense to spend too much time on but were still necessary (e.g. content creation) or where figuring everything out would’ve been too time consuming and potentially costly (e.g. new market entry). This comes down to the focus point.

- ‘Why are we doing that?’ was a refreshing question that was asked more than once. And it wasn’t meant as a skeptical after-thought but more to ensure team members spent time on things with the most impact. It’s tempting to dive into the to-do list (that in a startup is never-ending) but zooming out to the big picture is a good way to reset.

- ‘Who’s accountable for that?’ falls exactly to the same category as the previous point. Don’t finish off a discussion without agreeing who will go forward with that.

I took a lot from only two months and came back with a much clearer understanding of what we as VCs can do to help support companies like these on a very fast-moving journey.

Thanks KOOS for being so welcoming & fun to work with! Now go and talk to their team how your business could accelerate growth through stakeholder incentivisation!

Superangel has put together an open-source database of venture capital funds investing in the Baltics. If you’re a startup founder looking for Pre-Seed – Series A funding or a fund looking to get to know the VC landscape in the Baltics, this database is meant for you.

The database reassures several points made by the recent Dealroom report on the startup scene in the CEE, namely:

- Local investors underpin the early-stage investment landscape, but at later-stage, companies look overseas for bigger cheques – this is also seen in the high saturation of local Pre-Seed / Seed funds in our list but not so much past Seed stage. 70% of the funds investing in Series A or beyond are outside the CEE.

- International investors have started to ramp up their activity in CEE in recent years – nearly 60% of the VCs listed in the database are located outside of the CEE.

Although there are already 100 VCs in the list, it is not exhaustive. The database can be completed by the community members. Here’s Google Sheets link where you can add / edit information the funds.

How can a leadership and business coach help your startup grow into new markets and build strong teams?

Superangel was thrilled to have Mark Ashton as a guest speaker. Before focusing on coaching founders he has gained over 20 years’ experience in hands-on problem solving consultancy in many different businesses, and grew sales from $6 million to $20 million in a B2B high tech company in the USA. He describes it as a business leader’s baptism of fire.

His goal as a coach is to improve leaders and teams, help them make better decisions, build stronger business relationships, and grow their companies. He also helps European companies to enter and grow successfully in the USA and Canada.

In the session we covered:

- What can a coach help you as a startup founder or manager build successful teams?

- How can coaching change the way your team solves problems and brings new ideas to the table?

- How have Google, Apple, and other major success stories used a coach to help them operate in a high performing environment?

- What is Mark’s approach to coaching?

- How does he suggest to find the right coach?

Superangel was excited to host Antti Aalto, the co-founder of React & Share, a content improvement software at our Insights webinar. Antti has successfully implemented B2B sales growth principles described in famous Mark Roberge’s book “Sales Acceleration Formula” and expanded from Finland to the UK. Today they have a predictable sales model and have doubled their MRR within a year.

In the session we discussed:

- How to find ideal customers in a crowded market?

- How to understand which customers are not suitable for your business?

- How to set up a sales team in the UK?

- What should every startup learn and implement from Mark Roberge’s book “Sales Acceleration Formula”?

Insights that we found interesting from the session

- Churn is a lagging indicator for PMF. Find an indicator that works better and is specific for your business, e.g. number of seats occupied or messages sent

- Choosing to switch from long-term contracts to inital shorter contracts allowed React&Share understand, which clients are ideal for them and find PMF faster

- You can start accelerating sales when you understand your who is and is not your customer

- There’s a great difference between hiring the 1st and 5th sales person

- Test the coachability of the sales person during the interview process

- Prefer individuals who have previously shown great grit and resilience, i.e. has an athlete mindset

- Let sales people create their own action plan based on their target salary and reverse engineer from there

- If sales team cannot get hold of a lead, send your marketing team at them instead

Introduction

2020 was plagued by the unfortunate and unprecedented event that was COVID-19. Estonia and its startup ecosystem endured many triumphs and difficulties during the turbulent time. COVID-19 marked a turning point for the Estonian startup ecosystem as Q2 2020 marked the end of an era of high growth. While Q3 showed signs of resilience, Q4 was indicative of more than just recovery. Q4 was a triumphant quarter with possible indications of the start of another era of high growth. Q4 serves as a looking glass into the unique year of 2020 and a hopeful and optimistic preface to 2021.

Highlights

Q4 revenue was € 322.6 million

The top 5 companies with the highest revenue were Bolt, Fortumo, Pipedrive, Skype Technologies, and Playtech Estonia.

The total number of people employed in Estonian startups in Q4 was 8.4k.

The total labor tax paid in Q4 by Estonian startups was € 38.8 million.

Q4 Overview

Q4 can be characterized as an astounding success. This is especially notable given the high total startup revenue in Q4 of € 322.6 million. Revenue in Q4 hit an all-time high beating the record that was set by Q1 2020. From Q3 to Q4, revenue grew by a whopping 23%. The companies with the highest revenue in Q4 were Bolt, Fortumo, Pipedrive, Skype Technologies, Playtech, and Adcash.

The 15 companies that paid the most in labor taxes in Q4 contributed approximately 58.2% of all labor taxes. In other words, about 2% of companies pay 60% of labor taxes of the Estonian startup ecosystem.

With COVID-19 causing people all over the world to lose their jobs it was a promising sign to see Estonian startups increasing the number of those employed in the ecosystem. The total number of people employed in the ecosystem in Q4 was 8,390, a 3.2% increase from Q3. The companies with the largest team size in Q4 were Transferwise, Bolt, Playtech, Pipedrive, and Skype Technologies. The top 5 companies which hired the most people in Q4 were H2H, Pipedrive, Skype Technologies, So.FA.Dog, and Starship Technologies.

Overall Q4 saw significant improvements despite the prolonged impact many imagined COVID-19 might have on the startup economy.

Q4 Versus The Rest Of 2020

Q4 was vastly different than the previous quarters. In terms of revenue, Q4 revenue had the highest quarterly revenue in 2020. Since Q3 quarterly revenue grew by 23%. The companies which saw the highest percent increase in revenue were Sunmill, Spaceit, Nutriloop, Kraftworks, and Crystalspace.

As previously mentioned, revenue varies largely in the Estonian ecosystem making it reasonable to break the percent increase in revenue between Q3 and Q4 into light-weight, medium-weight, and heavy-weight groups. The companies with the highest percent increase in revenue in the light-weight category were Nutriloop, Kraftworks, and Ipux Diagnostics.

The companies with the highest percent increase in revenue in the medium-weight category were Sunmill, Spaceit, and Crystalspace.

Finally, the companies with the highest percent increase in revenue in the heavy-weight category were Milrem, Threod Systems, and Huum. On the flip side, the companies which saw the highest percentage decrease in revenue were Taskus, Transformative AI, Festera Bioboxes, Marjakas Eesti, and Tuenvioya.

In Q3 we noted the importance of looking at which companies rebounded from the harm of COVID-19. This remains true for Q4. To look at which companies rebounded, we employed two methods. The first being we sought to find startups that saw a large decrease in revenue between Q1 and Q2, but a large increase in revenue between Q2 and Q4. The second method was finding startups that saw a large decrease in revenue between Q1 and Q3 and a large increase in revenue between Q3 and Q4. Concerning the first mode of classification, the startups with the largest rebound were Intepia, Glocalzone, Swapsmart, Pernimo Solutions, and Votemo.

In regards to the second mode of classification, the startups with the largest rebound were Nutriloop, IPDX Diagnostics, Bizplay, Addlix, and Kwad.

In terms of team size, Q4 saw the greatest number of employees in the startup ecosystem in the year. Team size increased 2% from Q1 to Q4. Additionally, the companies that hired the most employees from Q3 to Q4 were H2H, Pipedrive, Skype Technologies, So.Fa.Dog, and Starship Technologies.

Moreover, Q2, the quarter bearing the largest brunt of COVID-19, had 7,912 employees in the ecosystem while Q4 had 8,390. The vast difference amongst the total number of employees is a promising sign for the ecosystem.

Regarding labor tax, the taxes paid in Q4 was the highest amongst all the quarters of 2020. Between Q2 to Q4, the percent increase in labor tax was 20.9%. Between Q3 and Q4 the percent increase in labor tax was 7%. Additionally, in Q2 the top 15 tax contributors contributed 54.8% to labor taxes.

In Q3 the top 15 contributed 57.6% to labor taxes, and in Q4 the top 15 contributed 58.2% to labor taxes.

Between Q3 and Q4 the new entries to the top 15 where tax contributors were Playtech, Skeleton Technologies, and Topia. Between Q3 and Q4 the company that exited the top 15 list was Topia.

The differences amongst quarters, but more importantly the increasing growth pattern from Q2 to Q3 to Q4 is indicative of a large rebound from COVID-19 restraints and towards an era of larger growth.

Q4 2019 vs. Q4 2020

From 2017 till Q4 2020, Q4s have consistently served as the year’s high point in terms of revenue. Q4 2019 and Q4 2020 are no different. In terms of revenue, Q4 2019 saw a revenue of € 224,430,461 while Q4 2020 saw a revenue of € 322,605,674. In terms of revenue growth between Q4 2019 to Q4 2020, Estonia saw the total quarterly startup revenue increase by 43.7%.

Additionally, in terms of revenue, the number of companies that could be considered lightweights in Q4 2019 was 354, the number of medium-weights was 497, and the number of heavy-weights was 34. This is different from Q4 2020 which saw 404 light-weights, 547 medium-weights, and 40 heavy-weights.

The difference between the number of startups in each category in each quarter offers the insight that not only are more startups emerging, but the size of these startups is increasing. This growth is evidence of the vitality of Estonian startups but also the growth potential that the Estonian startups have shown and will most likely continue to show.

The companies which saw the largest percent increase in revenue from Q4 2019 to Q4 2020 were Sidekick, MCF Group Estonia, CrystalSpace, Cleanhand, and Gelatex Technologies.

Additionally, in terms of taxes and team size, Q4 2020 metrics were much larger than Q4 2019. Q4 2019 saw 7,868 people employed in the startup ecosystem, while Q4 2020 saw 8,390 people employed in the startup ecosystem. Lastly, Q4 2019 saw € 33,249,297 paid in labor tax while Q4 2020 saw € 38,795,025 paid in labor tax. Overall despite Covid-19 the improvements made in KPIs between the year only go to see the hurdles the startup ecosystem was able to overcome and the strong predicted trajectory of 2021.

Estonian unicorns

Despite the hiccup that Bolt faced during Q2 2020, they were able to rebound and see immense growth. This rebound can be attributed to many reasons. Bolt doubled its number of customers and launched new services from ride-hailing, micro-mobility (scooters), and food delivery. New updates in Bolt’s products like the release of their 4th generation scooter were just a few notable moments Bolt enjoyed in Q4. Bolt’s ability to leverage its new and expanding products saved Bolt from a downward spiral post-Q2 2020.

Additionally, in December 2020, an investment led by D1 capital led to Bolt raising € 150 million, their largest funding round yet. This large funding will propel Bolt to higher gains shortly. Bolt will use the funds to further enhance the safety and quality of its products while further expanding in Europe and Africa. Additionally, in 2021 Bolt hopes to roll out additional safety features, like driver face verification and automatic trip monitoring. Despite Bolt’s Q2 struggle, Bolt left 2020 stronger than ever, expanding to 200 cities in 40 countries reaching 50 million users around the world. Bolt’s resilience during COVID-19 further shows that Bolt’s Unicorn status is not only apt but long-lasting.

Pipedrive was one of Estonia’s newest Unicorns. Pipedrive was one of 18 new 1 billion dollar plus tech startups born in Europe in 2020. Additionally, Pipedrive’s sales tools were used by more than 90,000 companies in more than 150 countries. Estonia’s fifth Unicorn, Pipedrive, won two awards during the 2020 Estonian Startup Awards. However, Pipedrive’s true impact on Q4, 2020 overall, and the future of Estonia’s startup ecosystem is the number of ex-Pipedrive employees. Previous Pipedrive employees have gone out of their way to give back to the startup economy by starting and funding new startups. Additionally, the funds from the exit have been put to good use as Vok and Woola are some of the startups benefitting from the money made from the exit. Ex-Pipedrive employees will positively impact the SaaS sector because they know how to build future success stories. Currently, ex-Pipedrivers have started more than 10 startups, many of which were SaaS companies. The impact of the success of Pipedrive helped the Estonian startup rebound throughout COVID-19 but its impact does not end at Q4. The impact of this Unicorn will continue much into 2021 and the future.

What Do We Have To Look Forward To In 2021?

Increased diversity, investments, and growth in SaaS and Greentech companies are just a few of the things that we have to look forward to in 2021. In Q4 and 2020 in general, there was a significant rise in the level of foreign founders as made evident by the increasing presence of foreign founders like Vishen Lakhiani, Avery Schrader, and Jeff McClelland. Foreign founders are increasingly important for Estonia’s startup ecosystem as it allows for innovation, more jobs, and helps grant Estonia the title of a global startup and innovation hub. In addition to the increasing number of foreign founders, Greentech/Cleantech and SaaS sectors have exciting prospects in 2021. CleanTech by Q4 of 2020 says 51 startups in the sector with 250 employees. Cleantech startups showed a 26% increase in employee count in comparison to 2019. Startups like Skeleton Technologies and Comodule are just a few of the prominent GreenTech startups. While revenue amongst the sector decreased from 2019, the climate-oriented/green-mindedness of startups seems to be in favor of Greentech/CleanTech startups and will help propel the sector in 2021 and the future.

What Lessons Have We Learned In 2020?

The lessons we have learned in Q4 2020 are more so a culmination of the lessons which we have discussed and learned in Q2 and Q3 of 2020. In Q2 we learned that the Estonian government’s response to COVID-19 was apt. The temporary measures to prevent unemployment and the earmarking of loans to support liquidity helped mitigate the negative impacts of the pandemic. Additionally, the Estonian government’s tax policies, digital capabilities, and e-Residency program helped maintain Estonia’s position as a startup hub despite COVID-19. In Q3 we learned that camels (companies that can survive in long, adverse conditions and shaky startup ecosystems) were an undeniably important part of the startup ecosystem. This is because camels were able to implement balanced growth, resilient strategies, and diversification all of which are necessary to survive during times of unprecedented crisis. Finally, in Q4 we learned a lesson similar to that of Q3. During times of great crisis, the startup ecosystem can be adaptable, flexible, and resilient during unprecedented times. Q4 was a great example that startups can continue to flourish and grow more than imagined because of the lessons learned and experiences during unexpected times.

The series of these articles have been written through an objective lens by Harshita Bhatt, who joined Superangel team through the 101 Fellowship.

Disclaimer: The numbers reported may differ from the data reported by Startup Estonia due to some differences in selection criteria.

If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

An estimated 13.4 million hotel rooms and short-stay apartments across Europe and the UK, coupled with a growing industry of online travel agencies and marketplaces, that cater to the booming rise in the mobility of people who mix business with pleasure.

Enter Niko Karstikko and Sebastian Emberger, true digital nomads, who found themselves unhappy with the poor value-added of Airbnb’s scaling hit-or-miss market. They co-founded Bob W to redo the hospitality industry, promising a five-star experience to each guest.

Superangel caught up with co-founder and CEO Niko, to talk about Bob W’s plans for their latest investment round and discover their formula for growing a startup despite the Covid-19 pandemic-triggered downturn in the hospitality industry and achieving an unlikely success at a difficult time.

Becoming Bob W

Growing up in London in a family of entrepreneurs, Niko developed a keen sense of opportunity. A move back to London shortly after his studies in the U.S. and Paris saw him take a high-paying job in finance, where he stayed for five years. Realizing that he was drawn to another path – more similar to his parents – he took to the tech industry and founded a fitness app in 2012, SportSetter, which he later sold. It was during this startup venture that Niko met Sebastian, his future co-founder.

After a period of traveling and hosting several apartments on Airbnb, Niko realized that about 50% of hotel rooms and a just fraction of short-stay rentals were branded with a quality standard. Travelling was at its peak, but up to two-thirds of the time people couldn’t be sure of what they would get when booking a stay.

The idea of creating a proper quality standard for the short-stay rental industry led to the founding of Bob W in 2018. The first apartments were set up in Helsinki, and quickly became the best ranked in the city. Around that time, the team bagged a small investment from angel investors, including an early Airbnb investor and set their sights on Tallinn, where they put up their first proper building. The guys were spending zero euros on marketing, but the customers were loving their product.

Bob W offers a lean luxury brand backed by technology that allows them to eliminate variables such as not knowing what to expect, questionable hosts, the hassle of key pick-up, or the trouble of choosing a neighborhood. Bob W apartments are always in trendy neighborhoods, offer the same amenities, are locally designed and sustainable, offer easy entry, and link to local service providers through the app.

In 2020, with the Covid-19 pandemic at full speed and the hospitality industry in a downturn, the company awed the startup community by closing a €4 million seed round led by VC fund byFounders, with participation from Superangel and United Angels, as well as leading Nordic and Baltic real estate investors, NREP and Kaamos. The investment put the company into full speed towards expanding across the Nordics, Baltics, the UK, and beyond.

Bob W building the puzzle

From the beginning the founders built and sold the product for people like themselves, having realized that there are many more potential B2B clients like them: ‘The Airbnb generation’, who are mixing business with pleasure, looking for exciting interactions and fulfilling cultural exchanges, packaged in a quality standard. Today’s B2B program includes happy customers Bolt, Pipedrive, Fotografiska and much of the tech and startup scene. Building brand awareness was backed by influencer guests and brand ambassadors, who had no problem getting behind the product whole-heartedly because of it’s great positioning and high quality.

The company’s value proposition is embedded in the name. It is built on the cross-section of hotels and short-stay rentals, which attributes the product with ‘the Best Of Both Worlds’. This positioning allows them to optimize a large playground to their advantage, using a variety of traditional marketing channels of the industry as their customer acquisition channels; marketplaces typically targeting different customer segments, like Booking.com and Expedia for hotels, and Airbnb for short-stay rentals. Furthermore, with a 78% repeat customer rate, there is little need for retention marketing. As Niko puts it: “Just build the best product on the market and you don’t need to press the right touch points too hard to get a customer converted.”

An important aspect in developing any product is the flexibility that allows it to be reused for new use cases. “For example, doctors relocating to other cities to help out during the Covid-19 pandemic, who would rather not spend 90 nights in a hotel room,” Niko explains.

Bob W caters to the needs of a wide range of target groups, from the mobile workforce of international tech companies to freelancers working remotely, expats on holiday within their home countries, and tourists that appreciate traveling like a local. For business customers booking in bulk, Bob W actually saves days of work compared to Airbnb, says Niko.

While the company promises a five-star experience for every guest, their prices range somewhere in the middle of the 3-to-4-star hotel equivalent, or an amateur-hosted apartment. All thanks to the technology that allows them to run 50 apartments with one person. Automating traditional hospitality allows an unquestionably high quality of offering with less human capital, lower costs, and more profit – a whopping three times more, compared to traditional hotels.

Bob W taking on the world

Being physically located at the Palo Alto Club – the Tallinn-based co-working space founded by early Bob W investor, VC fund Superangel – pinned the Finnish German founded startup on the Baltic startup map and earned them a nomination in the Estonian Startup Awards Foreign Founder category. Becoming well-known in Estonia later helped the founders recruit an incredible team. The largest share of which is now working out of Estonia, including the company’s German co-founder, Sebastian.

“Estonians have a great sense of opportunity and I love their startup scene,” Niko Karstikko, CEO of Bob W.

The company recently raised an A-round, increasing investments to €10 million. The founders had built a product that showed resilience during the pandemic, when many others were failing, and exhilarated the changing trends of the market. The redistribution of the real estate market provided momentum to grow, with office spaces emptying because of the pandemic, and the investors celebrated the opportunity. The new investment was raised from existing VC and angel investors and Finland’s state-owned investment company, Tesi, which invests €100-150 million in venture capital, private equity funds, and growth companies, annually.

With its clever branding and Net Promoter score (NPS) of 93 , Bob W is dramatically growing revenues. With hundreds of units signed, the company has several new buildings coming live in many parts of Europe, like London; making Tallinn and Helsinki, where it all started, the smallest markets they operate in. In the next year or two, the founders are moving towards asset-light management with technology to fill the gap in the hospitality market worldwide.

According to Niko, going international is ultimately about weighing the effort against the opportunity. To pick new markets, the team uses intuition combined with data to make even better decisions. While the fundamental directions are guided by their gut feeling, the team now replicates patterns that have worked previously. Bob W currently has a team of analysts, who are building scalable scripts on different markets, which is helping to funnel large capitals down to a few. The analysis is typically based on multiple data sources, looking at the competition, the type of customers, rental rates, demand and supply data, real estate fundamentals, compatibility with the brand and in-house skill sets.

It takes effort to grow out of one’s nearest region and comfort zone – what the Baltics and Helsinki are for Estonians and Sweden is for Finns. According to Niko, entering a new market might only, depending on the product, be about learning to operate different distribution channels, but usually, the barriers are more psychological than anything else.

“Targeting markets that are big enough, like New York, London, Paris, and Germany, makes all the difference to investors, who are above all looking at market opportunity. In London, we are much more relevant to a big part of the world,” says Niko and elaborates: “With hotels struggling for survival, there is a massive opportunity. A thousand apartments are a drop in the bucket compared to 70,000 units available.”

“Going to London, we can be a unicorn based in one city,” Niko Karstikko, CEO of Bob W.

Team Bob W

The company culture centers around problem-solving and making a change. “We are a bunch of hustlers that want to create a new benchmark for hospitality,” says Niko. The team grew from 6 to 36 people in 2020 and is now at 40 and fast-growing. The company has successfully recruited from Pipedrive, WeWork, and AirHelp to build prominent tech, real estate, and growth teams.

The company goes by hiring only the best people, investing a lot of valuable time on sniper recruiting to achieve this. “The process starts with identifying the people we want to hire and then we try to figure out how we can afford and attract them, and what we need to do to relocate them, not the other way around,” explains Niko. Rapid growth during the corona pandemic has created challenges with recruiting online, which lacks the socializing aspect necessary to read people and make the hiring decision. Building a company culture and achieving harmony, while working remotely, has required coming up with new ways of working, ideating, and connecting with people. Bob W new hires are supported by a professional onboarding program, which is now executed online.

Bob W’s team members are chosen by the same values, with radical transparency, 360-degree hospitality, and responsibility topping the list. ‘Don’t just be nice to the customers, but also to the lady in your lunch cafe, to your friends and colleagues’ has become the company mantra of sorts, according to Niko.

“We choose the people we’d like to grab a drink with,” Niko Karstikko, CEO of Bob W.

In order to cultivate success in the company, the team regularly gets together, whether it’s virtually or physically, to battle it out and make sure they are on the same page before they start something new. The founders take efforts to support the team in a way that gets the best version out of everybody. “I love having a beer on a Friday afternoon with my colleagues to ask them how they are really doing,” Niko says.

From the founders up, the widespread approach to getting more done is taking time to explore personal limitations and to be able to identify the point where actions start giving diminishing returns. “When you can’t sleep two nights in a row, you should probably be doing something differently,” Niko explains.

A ground rule for keeping the team going, according to Niko, is to always keep the door open and be both the pep rally guy and waterboy, to help people do what they do best. “The price is finding the best team. People’s abilities either match your company or not. Hire better than yourself,” Niko noted.

“We can guide and help people grow, but usually you want to hire amazing people and let them do their thing,” Niko Karstikko, CEO of Bob W.

In a team of 15 nationalities, Bob W broadly celebrates diversity of gender, nationality and skill sets in all its activities. The management makes sure that the HR strategy includes hiring polar opposites, a concept proven at the founder level. This means finding complementing skill sets and personality types, like the gibbery marketers and structural-thinking engineer-types, for different roles and encouraging these combinations in the teams. The approach brings amazing results, according to Niko, who has experienced burnout and failure in his previous ventures fueled by toxic founder combinations of too similar personalities, with clashing goals.

There is an enormous amount of respect between the two founders for each doing what the other hates and doing it on a world-class level. The founder pair is determined to replicate the pattern throughout the company to achieve success in a Zen environment.

Bob W keeping it real

Niko and Sebastian were lucky enough to choose their own investors, who have proven their value as a motivating force in terms of scaling and fundraising. Bob W uses monthly reporting in order to keep their investors in the loop, and social media apps like Whatsapp for more casual ad hoc interaction.

When asked about keeping investors on board during hard times, Niko says there are two ways: “Consider them a party that you’re trying to impress or make them a part of your team so that they feel your pain when you’re hurting.” Nine times out of ten you find that there is a lot of empathy and willingness to help solve the problem on such occasions, he adds.

“It’s all a game and we are all trying to be happy with the journey,” Niko Karstikko, CEO of Bob W.

Having recognized that financial incentives are very much an afterthought for him, Niko follows a concept of success that differs from the conventional understanding that it has something to do with a Ferrari badge. “I like the idea of not having to worry about money because, in my teens, I saw the bankruptcy of my family businesses during two economic downturns. But for me, it is more about reducing the background noise of the personal economic situation so I can do what I was born to do and enjoy the journey to the fullest,” Niko noted.

For Team Bob W, being successful means making a positive mark in the world and leaving an impact on people. Next to leading the industry in sustainable hospitality, the platform aspires to do its share to reduce prejudice and other pre-conceived notions through the meaningful cultural exchanges it opens travelers up to.

“Bob W is the avatar of the best host you’ve ever had, times ten. He is that guy who put a whole lot of love into making the apartment perfect for you, sorted your restaurant booking and remembered all the details, like leaving the toilet paper in the triangle, as he rushed off to rescue koalas from Australian fires,” concludes Niko, who without a doubt, lives his brand.

Bob W’s formula for building a successful startup:

- Avoid toxic founder combinations with clashing goals

- Build a 10x better product than what’s already out there

- Target big markets

- Choose investors who bring value and are team players

- Combine intuition with analysis

- Become a community player

- Don’t compromise with recruiting

- Choose people with the same values

- Diversify your team

- Always aim to make a positive dent in the world

This article was put together by Anari Hagel.

Superangel was thrilled to host our webinar with Paavo Räisänen, the Investment Director at Maki vc on ‘What are Investors Looking for in Startups? Insights from Maki.vc’.

Maki.vc is a Nordic 80M€ seed-stage VC firm partnering with deep tech and brand-driven companies obsessed with challenging category norms.

In the webinar we discussed:

- How do VCs choose startups? Maki VC examples

- How can VCs offer value-add to your startup in addition to investment?

- Suggestions to startups looking for funding

For sales people the ocean of online webinars can be a nightmare. So many events but no way to network and get new contacts. In this Superangel Insights we were thrilled to have Piia Sander from Messente to share her experiences how she has solved that challenge.

You’ll find answers to the most burning questions, including:

- How to select the events that are actually relevant to sales?

- How to prepare for online events?

- How to approach people?

- How to follow-up?

- What not to do?

Our key takeaways are shared below.

- Choose events that match your Ideal Customer Profile profile

- Choose events with enough participants that your sales team can handle the preparation work and the meetings

- At the event approach people in a more casual, chatty way – less ’emaily’ and more LinkedIn style. Mention the value to them by explaining why you’re approaching.

- The focus needs to be on “YOU” and how I can help you. And by YOU, we mean your customer!

- Use the Sales Navigator at LinkedIn as a due diligence opportunity and homework tool to find out about for latest activity – learn the company’s news and latest insights

- Keep the focus of the call on listening to the client

- Set up a timeline when you’re getting back to them for a higher chance of reply

- Attendee lists are usually public on social media. Use that for prospecting and sending out a LinkedIn message

- Don’t start talking about yourself and not asking questions

Piia Sander works as a business development manager for Messente Communications, a global smart messaging gateway. Prior to Messente, she worked for over 7 years as a sales manager for Äripäev. With years of experience in active sales, sales management and coaching, Piia has the theoretical know-how and the practice to back it up.

Superangel is proud to have a Superangel Insights session with Hedi Mardisoo, co-founder and CEO of Cachet.

Hedi is among TOP15 women to watch in European fintech by Sifted and her startup Cachet is listed as a future unicorn prediction by prominent Estonian investors. She is going to share insights on building a network of 120+ key people and using it to prepare for a market entry.

In the session we covered:

- How to build a network of key people in your industry?

- How to prepare for meetings with mentors?

- How to prepare entering a new market?

- How to ask help so that it brings results and the intros you need?

Main takeaway from the session: Ask for help and you’ll be served.

- Personal follow-up email is a long term investment. Put together an email that makes sense even when looking back at it a year from now

- Successful ask is a key thing to successful networking. To ask well, you need to make it as easy for the other person to help you and spend their social credit

- Figure out whose problem your product is solving on the other side of the intro

- Start with markets that are not heavily saturated. Where are your key clients today?

- Tap into embassies and use local organisations to help get your foot through the door in new markets

- Hunger to grow, experience in the sector, good network and ability to solve problems, eagerness to build – formula for hiring a country manager in Cachet

- Have a specific person in mind you want in your company? Be bold and ask directly.

- Entering new markets and cultures means listening first and not pushing your ways only

- Check out Global Entrepreneurs Program if you want to relocate and take your HQ to UK

Thank you Hedi for an insightful session! Best of luck building Cachet!