“Software Is Eating the World, but AI Is Going to Eat Software”

JENSEN HUANG, CEO OF NVIDIA

Computing power and algorithm research have come to a point where software is capable of handling increasingly difficult tasks only humans could complete until recently. While artificial general intelligence is still far from achievable, applying modern AI techniques, such as deep learning, computer vision and natural language processing can make human-like or even super-human performance achievable in a scalable way. There are notable first successes in a handful of domains, but that’s just the beginning. We at Superangel believe that the true potential will be unlocked in the coming decade, disrupting almost every industry and creating several new ones.

We are especially interested in companies working with computer vision. Most decisions that can be done by a human using visual information, can potentially be done by software and cameras given enough data and computing power. That, in turn, also opens new opportunities in robotics and self-driving anything. We also expect to see breakthroughs soon in natural language understanding.

General willingness to accept bots and robots in one form or the other as workers, decreasing prices of computing power, and advancements in computer science are the main reasons why in the autumn 2019 call, Alpine House gives an edge to AI-focused startups.

We have been funding and building several AI-intensive companies at Superangel. Some of the notable ones in our family:

- Bolt — uses predictive models to improve services, estimate arrival times and find fair prices for rides.

- Veriff — uses image recognition, face comparison, and behaviour analysis for highly-automated identity verification.

- Snackable.ai — uses speech recognition and Natural Language Processing (NLP) to structure, index and summarise massive spoken audio libraries.

- Kea.ai — uses NLP to answer a restaurants customer calls and take orders automatically.

- ReportAuto — uses computer vision to detect scratches and damage during an automatic vehicle inspection.

- Hugo.legal — building a robot lawyer to provide affordable legal advice or to match with the right human lawyer.

What is Alpine House and how can we support startups working on AI?

Alpine House is an investment package on steroids, designed by partners of Superangel, who are successful entrepreneurs themselves and know how hard it is to build a successful company. Applying AI is not easy either and has extra challenges for startups. We think that Alpine House helps early-stage AI startups in Europe to overcome these challenges in 5 ways:

Startups applying AI typically need more time to develop tech and get traction. We commit for 12+ months to take your startup to the next major milestone and raise the next financing round. Startups receive personal coaching from a Superangel partner, who takes an active team member role for the entire period.

Billion dollar mentoring by Superangel partners and investors. Superangel is backed by successful entrepreneurs such as Martin & Markus Villig (Bolt), Taavet Hinrikus (TransferWise), Sten Tamkivi (Skype & Topia), Norris Koppel (Monese) and many more. They have been in your shoes and know how to build a unicorn, and many have built up amazing AI-intensive companies.

Experts & partner network helping with hiring, legal, finance, marketing, etc. This will let founders focus on the most essential aspects, hopefully make fewer mistakes and move faster. In particular, hiring AI talent can be difficult and expensive. Our HR experts know the tricks and are ready to jump in when needed. Throughout the program, there will be regular office hours & workshop sessions with great builders in the AI-space.

One-way-ticket to meet your customers. We believe in learning-by-doing. When ready we take you for a 4-week intensive customer development session to the San Francisco Bay Area or another major market. Office & housing covered. We help you to prepare so that when landing you already have meetings set up and you will get daily feedback and guidance from the Superangel team.

Computing power can become expensive when you need a lot of it. It has become affordable for many tasks and is improving every year, but more challenging tasks can incur a heavy cost. We have deals and credits from several computer providers to alleviate this cost.

The Alpine House program comes with an initial investment of up to €150k, depending on the stage and growth trajectory. We take 10% ownership in return for the program and investment. In addition, we reserve at least €500k for follow-on funding.

Before climbing the peak, there is Base Camp

To select the current cohort, we hold a 48-hour hackathon Base Camp on 27–29 September in Tallinn. This is valuable experience on its own.

Base Camp is an exclusive hackathon format, designed for early-stage startups that already have a working prototype and would like to join the 12-month Alpine House. During 48 hours they work on their existing product to advance it using guidance from Base Camp’s top-level mentor team. Also, many have found awesome new team-members among the individual applicants to Base Camp. All 24 startups who have participated so far have found it extremely useful.

This time we have invited to our team of mentors some of the brightest minds in the AI sphere such as Gholamreza Anbarjafari (Professor at Computer Vision Research Lab, University of Tartu), Kristjan Korjus (Head of Data, Starship), Markus Lippus (Data Science Lead, MindTitan) and Joonatan Samuel (Machine Learning Lead, Veriff).

All successful billion dollar startups are obvious in hindsight. But how do you know in advance as a founder, how valuable your startup could become? Maybe it is not a billion dollar start-up, but is it a 100 million dollar start-up? We summarized some guidelines for startup founders to answer the startup potential question.

How can startup founders evaluate the true potential of their startup idea?

The Superangel team is reading the early bird applications of startups to our autumn cohort of Alpine House (application deadline 30th August). We are looking for global-minded early-stage software startups, who can truly take advantage of our Alpine House investment package on steroids, leap ahead and secure a Series A round in 12 months. A question about how big these startups can grow is very valid for us. While reading applications we see that some startups have missed some key points in describing their potential.

We looked around and found for founders some great advice in the public space. Kevin Hale and Eric Migicovsky last week at YC Startup School gave a good overview of how they suggest founders evaluate and validate their start-up ideas. As it resonates well with how we in Superangel look at startups, we took a shot and summarized their wisdom. To make your life easier, we even made mind maps out of their speeches (see below). If you want to get full mind maps with Kevin’s and Eric’s answers to questions in the Q&A session, go to the Superangel Facebook page, follow us and shoot us a FB Messenger request to get the pdf of Xmind files.

How to evaluate startup ideas?

The first message of Kevin Hale’s “How to Evaluate Startup Ideas” is that your business idea is a story about why your startup could grow quickly. It should be about growth and not about product features. As a side note, Kevin also gives a hint to founders for filtering great investors out from the ocean of VC funds and angels. All successful startups had a lot of holes in their original business idea. A good investor focuses first on finding ways how a startup founders story can become a billion-dollar company. Poking holes comes later.

As with every good story, your business idea should have specific components:

- Problem: what is the setting allowing you to grow?

- Solution: what is the experiment you are running?

- Insight: what is your unfair advantage increasing the chances that your experiment is going to be successful?

Kevin lists six criteria for a good problem. The more your startup idea has them, the better:

- Popular

- Growing (at least +20%)

- Urgent

- Expensive

- Mandatory (by law)

- Frequent

Frequency is probably the most important criteria as it gives two advantages: people are constantly reminded that they have that problem and you can get frequent feedback is your solution working or not.

Nailing a problem is hard, but nailing unfair advantage is equally hard. Kevin verbalizes five unfair advantages a startup can have:

- Founder: you are one of 10 people in the world capable of solving it or you have strong IP

- Market: at least +20% growth

- Product: 10x better than alternatives

- Customer Acquisition: zero cost to acquire the next customer

- Monopoly: you are the winner taking it all

Founder and Market advantage are the trickiest out of this list.

Although Kevin claims that 99% of startups coming to YC do not have founder advantage even YC has invested into startups purely based on the founding team, who did not have founder advantages. The most famous of such investments was Airbnb, who did not have a product YC believed in nor strong founder advantage in the form of a unique capability or IP. But they had grit, resourcefulness, and some traction, which outweighed the holes in their original business idea.

At Superangel we are looking for founder team advantage in the form of the 3Hs and honey badger attitude. Rei Inamoto coined the 3H description of a dream team: hipster, hustler and hacker. Great teams have these domains covered by different people. In Superangel we also evaluate if founders are like honey badgers, who can survive anything (like snake bites) and are willing to go against much larger predators (like lions) to get their food. That said, if your only advantage is your claim that you are a honey badger, you are probably not investment ready.

Same goes with market advantage. A great market is crucial. Taking from an interview with Andy Rachleff a lousy team on growing markets wins over a great team on lousy markets, and remarkable things happen only with great teams on great markets. That said, having only a market advantage is a weak starting point as it is not sustainable in the long term, and if it remains the only advantage, competition will kick you out from the market soon enough.

How can user interviews increase the value of your startup?

No matter with which story or set of advantages you start with, there is no way around talking to users if you want to grow. Eric Migicovsky puts it nicely in his “How to Talk to Users” speech: the best companies are the ones where founders maintain a direct connection with their users. Talking to users is the only way to know – for a fact – if you are building a billion-dollar company or not.

Like Eric, we also suggest startup founders read Rob Fitzpatrick’s “Mom’s test” for getting a grip on how to get valuable information out of customers.

The most important lesson to learn is about the goal of customer interviews. The goal of customer interviews is to extract data to improve your product, marketing or positioning. Although all good sales reps use a very similar process, user interviews are not about selling. Period.

During a good customer interview, you do not talk about your current idea, do not talk about your ideas on hypothetical future product features, and spend most of your time listening to your customer.

The questions you should ask vary depending on the stage your startup is in.

In the Idea Stage you should ask questions to identify the urgency of the exact problem and your current competition:

1.What is the hardest part about the thing you’re trying to solve? Purpose: verbalizing the goal and general problem.

2. Tell me about the last time you encountered this problem? Purpose: determine the frequency of the problem.

3. Why was this hard? Purpose: identify the exact problem, get data for marketing on wording the problem and explaining the value to new customers.

4. What if anything have you done to try to solve this problem? Purpose: determine the urgency of the problem and with whom your customers are going to compare you to.

5. What do you love about the solution you have already tried? Purpose: getting data on the key features required by customers.

In the Prototype Stage you should ask numeric questions in order to identify your ideal client for whom the problem is severely painful, happens frequently and has a budget and authority to fix it:

- How much does this problem cost them? Purpose: determine urgency and monetary value of lost revenue or money wasted on partial solutions.

- How frequent is the problem? Purpose: determine the frequency (once a day, a month, a year).

- How large is their budget? Purpose: to determine if they have the authority and budget to fix the problem.

In the Launch Stage you should ask questions to identify the product-market fit. One of the most famous blog posts about product-market fit comes from Marc Andreesen, where he claims that product-market fit is the only thing that matters and you have it when customers are pulling the product off the shelves. Tren Griffin has added more angles to product-market fit in his “12 Things about Product-Market fit”. Although both are highly recommended reads, they are retrospective and give lagging definitions on product-market fit. For a founder, it is very disappointing as before a launch you cannot measure nor improve your level of product-market fit.

This frustration led Rahul Vohra, CEO of Superhuman, to develop a process for measuring and improving your product-market fit BEFORE launch. You can read about his process and journey in a blog post “How Superhuman Built an Engine to Find Product/Market Fit”. Superhuman uses four questions for validating product-market fit:

- How would you feel if you could no longer use our product? A) Very disappointed; B) Somewhat disappointed; C) Not disappointed. Purpose: you have product-market fit if at least 40% of users answer “Very disappointed”. Filter out and ignore feedback given by “Not disappointed” users.

- What type of people do you think would most benefit from our product? Purpose: what words used for describing users resonate the most with happy users?

- What is the main benefit you receive from our product? Purpose: do a word cloud from answers from “Very disappointed” users to find out why people love the product (identify one main feature, speed in the case of Superhuman).

- How can we improve Superhuman for you? Purpose: do a word cloud from answers from “Somewhat disappointed”, who shared the same main feature with “Very disappointed” (speed in the case of Superhuman). This gives you the answer to a question what holds people back from loving the product and being “very disappointed”.

The startup Superhuman uses data from these four questions to determine how to divide the time of their product development team. Half of the time goes into developing further the main features “very disappointed” people love and the rest is spent on developing the main features holding back “somewhat disappointed” customers.

Preparing for user interviews

You know the purpose of a customer interview, you have the right questions. Now what? Here are some preparation tips:

- Prepare your tools for gathering data. If you are lousy at interviewing and taking notes simultaneously either get permission from customers to record the interview or ask a co-founder or a friend to come and take notes for you.

- Aim for 10–15 minutes interviews. You can get the most important data out from customers and show that you value their time.

- Start with 3 interviews and become comfortable with the format. If you have never done customer interviews before, take it casually. You do not have to start with a 7-day plan for 100 interview slots. Start with 3 interviews, reflect on how did it go and decide then on your next steps and interviews.

- Drop by in person. Sometimes it is difficult to get appointments arranged over e-mail or phone. Choose the least busy time for your customers and drop by in person at their workplace, conference booth or during their lunch break in a restaurant. If your product is any good at solving customer problems you are doing them a favour by asking 15 minutes of their time to solve their problems forever.

Startup founders in the idea phase often ask, where do I find my first potential customer for an interview? If you had the problem yourself, start with interviewing yourself. This is a great way of testing how you might need to modify questions so that they are more natural and easier to answer.

If it is not your personal problem, but you have seen it happen, go talk to a friend who has this problem.

As suggested above, drop by to places where customers are (firefighters in fire stations, etc).

If you do not have that problem and nobody in your close network has that problem, then you have a major problem. Solving problems for (imaginary) customers to whom you have no direct contact is impossible. Find yourself a co-founder, who is a customer or who has access to customers.

In the Q&A session Kevin and Eric were asked the following questions:

- Is there any difference in doing an in-person interview or online survey?

- What to do if your user is different from your buyer?

- How to find a specific subset of users you want to talk to?

- You have MVP, have done a user interview. When do you do a sales pitch to the person you interviewed?

- Questions to Kevin Hale. Why did you write in a Startup School AMA chat that “A beta label on a product is an ultimate artificial constraint.”?

- How many interviews should you do before starting to build a product?

- When do you charge?

- How to use an open-source model, where I do not charge in the beginning?

- My MVP actually takes a lot of time to build. How to get feedback from customers and users? Should you build paper prototypes?

- It is harder to get consumer products out there as Instagram, Facebook etc. are getting much more expensive. How to do it cheaply?

Watch the video to get their answers or go to Superangel’s Facebook page, follow us and shoot us a FB Messenger request to get the pdf or Xmind files with answers to these 10 questions.

If you are a software startup founder, who feels that you would benefit from strong hands-on support and from our investment package on steroids, then apply to Superangel’s Alpine House.

Marek Kiisa, the partner of Superangel, pitched while sitting in a rally car and ice-drifting 120 km/h.

As a startup founder raising money you finally have a chance to introduce yourself during a conference coffee break to a VC you are after. She asked you to send her a pitch deck. You have tried to cram everything on to 10 slides, as suggested by guru Guy Kawasaki. You send your deck to the VC and…they say they couldn’t follow it, so they lost interest. What gives?

Within the last 5–10 years, the way VCs (and all of us) consume (and especially discover) information has moved from desktop-first to mobile-first. If your deck looks anything like the one below, and you also ignored Kawasaki’s guidelines, then getting people engaged is an uphill battle:

During the Alpine House accelerator we did a special session in order to update start-up founders knowledge and discuss what the new rules of pitch decks for VCs are.

If possible don’t send your slides in advance before a meeting, and try to set up a face to face meeting first.

Most likely you still have to send your slidedeck in advance from time to time. Here are 5 tips from Superangel to founders for creating engaging (and mobile-friendly) slide decks:

#1. Don’t waste your prime real estate for general keywords.

Assume the role of a VC swiping through your slides. The first things you see is the headline — if that’s the only thing they remember, what is the message you’d like them to remember? “Opportunity”, “Value proposition”, “Market Size” just take up very valuable real estate and if the rest is a two-paragraph text then most probably they will decide to read your slides sometime later from a laptop, which most likely means…never.

# 2. Slide titles should tell a story.

Your slide titles should be simple to understand statements explaining what is the core problem, what is your solution, and why the opportunity is NOW. This way you can build interest and make sure your message gets delivered, regardless if it’s on mobile or desktop.

Do a test: write out the titles of your slides and read them as a story. Is it a meaningful and a catchy story raising their interest in meeting you? If not, you have work to do. If you do it right, you can significantly simplify the content of your slides by reducing the noise in each slide, allowing for more than 10 slides. We’ve seen 20–30 slide decks that are engaging, proving that the slide count is just an arbitrary number.

#3. What is your Purple Cow?

Graphics and photos can be very powerful if you use them right. Avoid stock photos if it feels manufactured. Also, avoid images that have nothing to do with your message or your brand, such as a series of mountain range photos for your new accounting SaaS. General brand building and marketing tip: read Seth Godin’s book “Purple Cow”.

#4. Your second slide must be the most memorable.

Although you a have chance to get their attention span for 20–25 slides it will never happen if your second slide is not catchy and memorable. Your first slide can be your start-up’s name and logo or info graphic or catchy sentence. But your second slide must deliver a message that you might be the next unicorn.

#5. Your slides have to work without you.

If you are the only one in your start-up who can present the slides and they make sense only if you present them, you have some work to do. You do not have enough time to be present every time somebody wants to read your slides. Test and ask for feedback to validate how independent your slides actually are. Or ask your fellow founders or team mates to present your slides and see how they understand them.

Of course, as your startup grows and you have more market proof to back up your story, you will need more detailed slides in your next fundraising deck. In that case you have the freedom to include more content in your slides, as people will be putting more money into the company, and following the guidelines presented here will make even more sense.

This is it. Let us know if you have any questions about your deck. Go get them!

Are you an early stage startup founder? Do you want to get faster access to know knowledge provided by Superangel and reach to a next level? Check out our location-independent Alpine House accelerator program.

Superangel tips were summarized by Kalev Kaarna

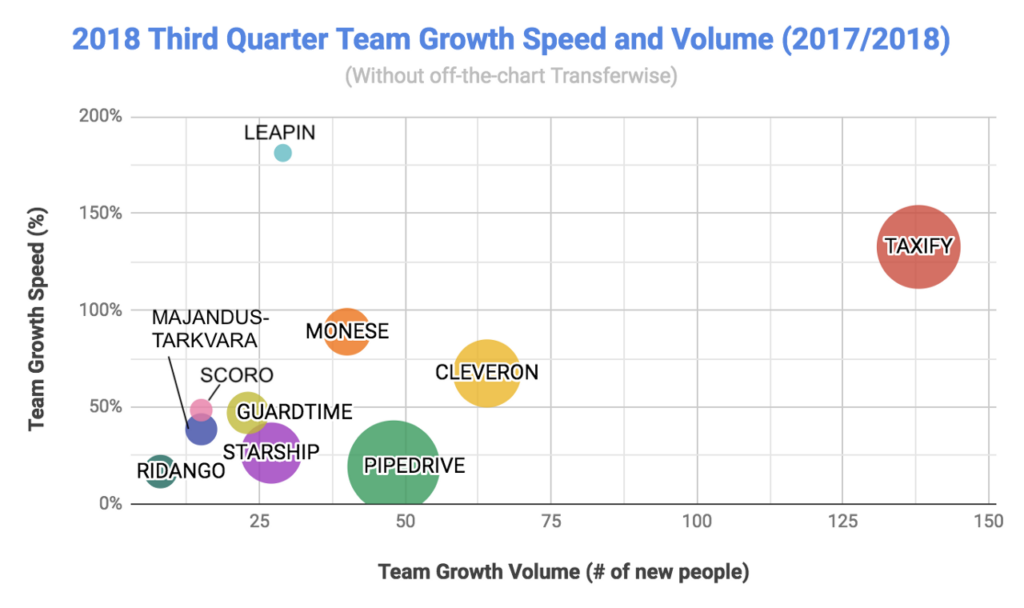

Estonian startup growth in the 3rd quarter of 2018

Recently, Q3 revenue, tax and employee statistics were published for all Estonian companies. The Superangel analysts selected 304 Estonian companies in the startup space and dived into the growth numbers. We found some of the usual suspects of fast growth, but also some not so obvious startup runners-up on a high speed growth trajectory. If you want to make your own rankings and lists, then go and play with numbers on Superangel’s Estonian startup statistics page: startuplist.superangel.io

QUICK HIGHLIGHTS

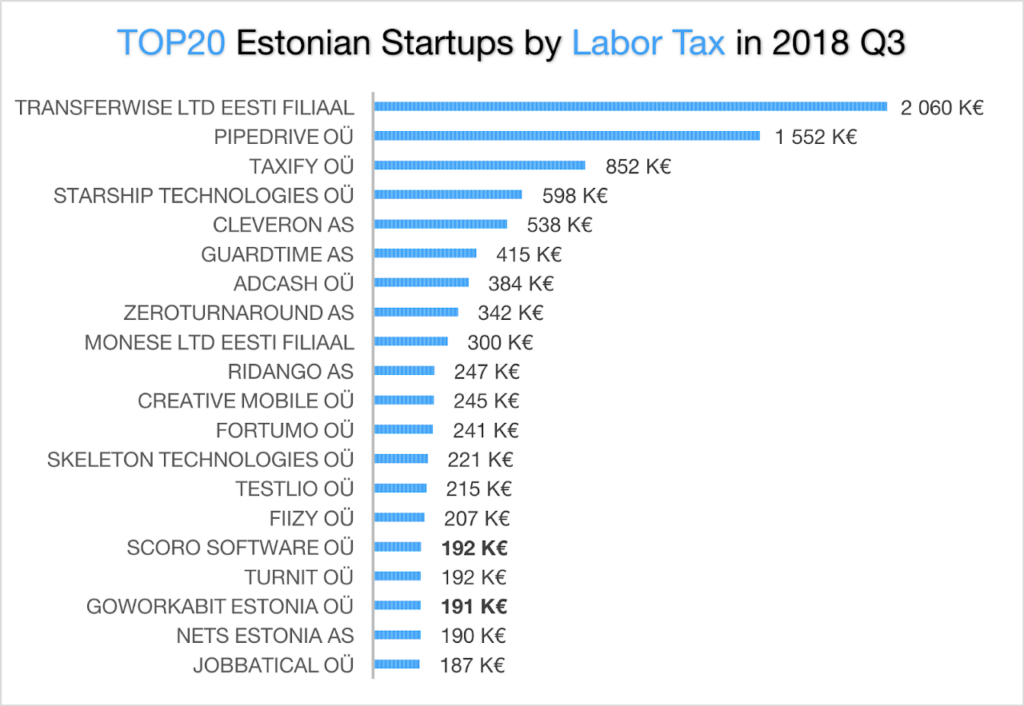

TOP startups by labor tax volume and growth

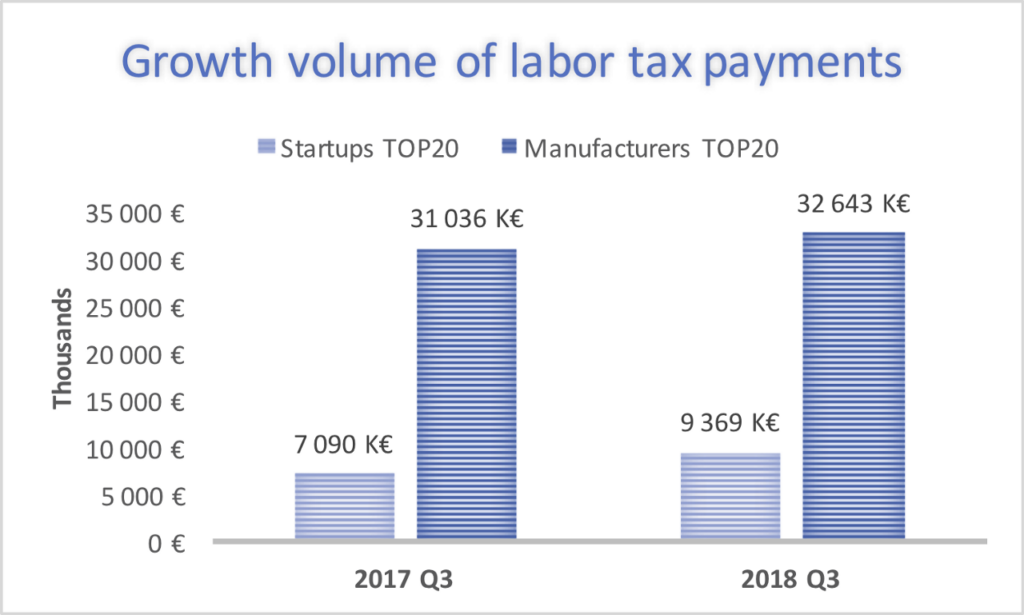

- The TOP20 startups grew the government’s labor tax budget 37% more than the TOP20 industrial manufacturers (+€2.2M vs +€1.6M).

- In 6 years the TOP20 startups total volume of quarterly labor taxes will surpass the tax Euros paid by the TOP20 industrial manufacturers.

- Newcomers to the TOP20 labor tax payers were Scoro Software and GoWorkaBit.

- Based on year-on-year (YoY) tax volume increase the less known outliers are Fiizi and Pipedrive.

TOP startups by sales volume and growth

- Two newcomers into the TOP20 startups by sales volume are Comodule and Bondora.

- Two startups in the TOP20 showed over 800% growth on their YoY quarterly sales: Comodule and Hashcoins.

- There were 9 startups, who could show both quarter-on-quarter (QoQ) and year-on-year (YoY) sales growth. The most interesting outliers among these were Comodule, Realeyes, Fiizy and Skeleton Technologies.

- Based on YoY and QoQ growth volume the runners-up reaching to the TOP20 are Fitlap, Funderbeam, and Majandustarkvara.

TOP startups by team size and growth

- The newcomers to the TOP20 startups by team size are LeapIN and Testlio.

- In YoY team growth, LeapIN has tripled their team to 45 and Monese has almost doubled their team to 85.

- Out of the TOP20 we counted 9 startups, who have been able to grow their headcount both quarterly and annually. The not so well known startups among them are Guardtime, Ridango and Starship Technology.

- Based on YoY and QoQ team growth volume the runners-up reaching the TOP20 are Veriff, Digital Sputnik Lighting, Click & Grow, SprayPrinter, and Quretec.

Based on the public data of the 2018 third quarter results of Estonian startups(18Q3) we looked for answers to the following three questions

- Who were the biggest taxpayers (most valuable startups for the Estonian government)?

- Who was selling the most (most valued among customers)?

- Who were hiring the most (fastest team builders)?

Yes, we are fully aware of all the problems of TOPs, differences in stories behind similar numbers, and gaps in data making startups not fully comparable. We have listed the main issues in the “Problems with TOPs” section (see below). That said, we will now present you the TOP20s.

In order to analyse dynamics we selected the TOP20 startups according to volume of sales or labor taxes paid or people hired. In each category we looked at year-on-year (YoY) changes comparing current 3rd quarter numbers to 3rd quarter numbers in 2017. We also looked at quarter-on-quarter (QoQ) changes comparing the 3rd quarter to 2nd quarter in 2018 among the TOP20. We also made some predictions on which runners-up will be in the TOP20 in 2019.

In order to know where TOP startups stand among the country’s growth drivers, we compared some numbers of the TOP startups to the TOP industrial manufacturing companies.

The biggest taxpayers among startups in the 3rd quarter

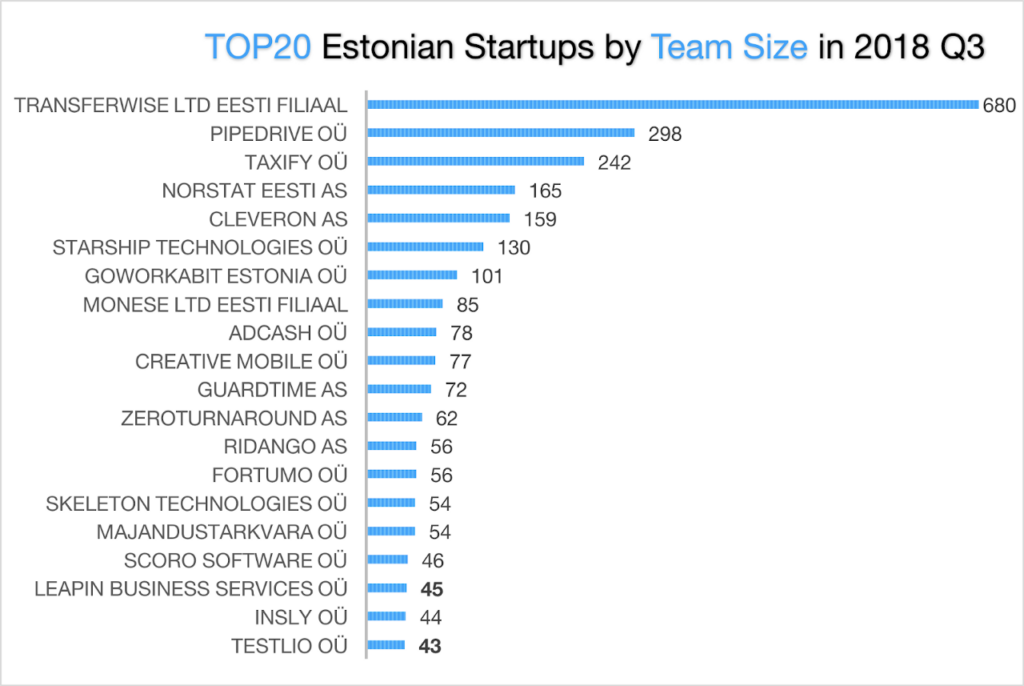

TOP5 biggest labor tax payers are the usual suspects: Transferwise, Pipedrive, Taxify, Starship Technologies and Cleveron. These 5 startups pay 60% of all taxes paid by the TOP20. This is much more concentrated compared to the manufacturing industry, where the TOP5 taxpayers pay 41% of the labor taxes of the TOP20.

There are only two newcomers among the TOP20 compared to the previous quarter: Scoro Software and GoWorkaBit Estonia. Scoro’s business management software-as-a-service solution combines project, time and team management with sales, billing, and professional services automation. GoWorkaBit has built a platform for helping retail, logistics and hospitality companies to find temporary workers. If they keep up with this growth speed, they will definitely start to get more publicity and become more known.

The most interesting tax numbers come from Adcash, who have a worldwide advertising and campaign management platform. While their labor taxes remained around 400 000€ in the 3rd quarter, their total taxes had a 5x spike and reached €2.9M. Most likely, Adcash has paid out €10M dividends in Q3, which have spiked tax payments. Yet, in their 2017 annual report there were no hints about plans to pay out dividends.

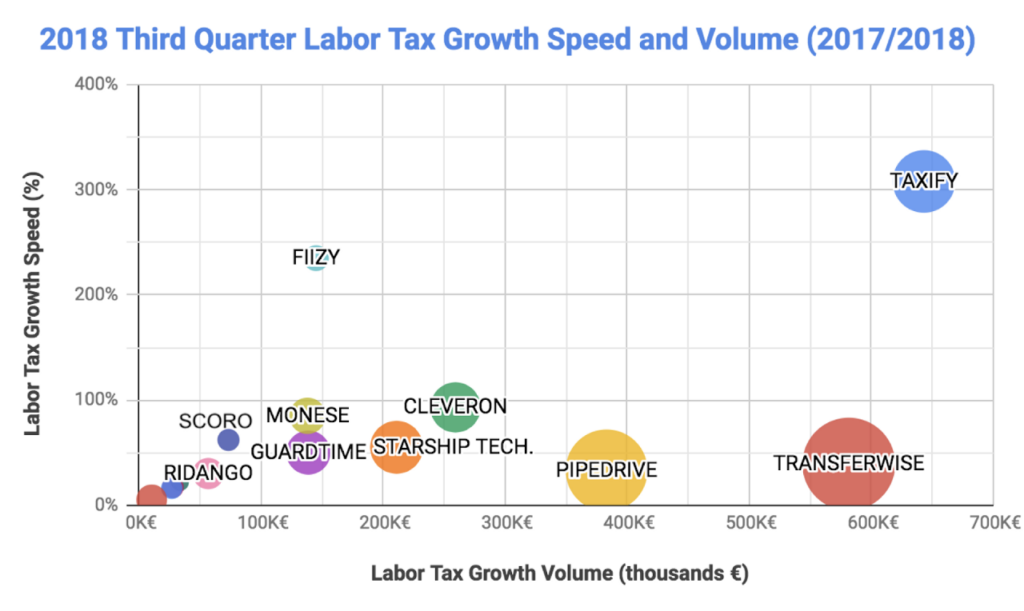

If we look at Year-on-Year (YoY) labor tax numbers growth volume and speed we have 13 startups whose quarterly taxes paid have grown at least 5%. Out of these there are four outliers. Two outliers have shown remarkable speed of tax payment growth on the yearly basis: Taxify (+308%) and Fiizy(+235%). The other two outliers are remarkable on tax payment volume growth. Transferwise’s labor tax burden has increased by 643 300€ and Pipedrive, a cloud-based sales software company, has increased the government’s tax budget by 383 000€.

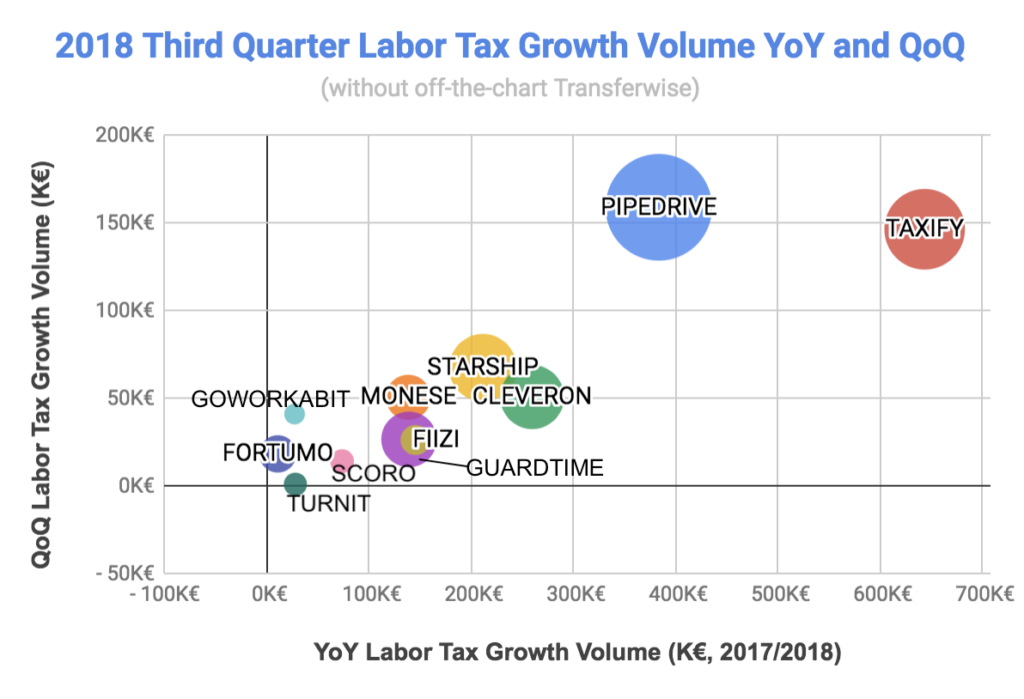

There are 10 startups, who have shown growth numbers both in Quarter-to-Quarter (QoQ) and year-on-year (YoY) tax payments. The ultimate champion is Transferwise whose numbers do not fit on the chart below (quarterly tax payment growth +248 000€ and annual +643 300€).

Estonian startups have been accused of having a lot of press, but a much lower impact on the Estonian economy and nation’s wealth compared to industrial companies. Comparing labor taxes paid in the 3rd quarter of 2018 and 2017 we see that the TOP20 startups have within a year grown their quarterly contribution to the Estonian national budget by an additional €2.2M.

Industrial manufacturing companies contribution growth in the 3rd quarter was €1.6M. Already now the TOP20 startups give a 37% bigger additional contribution to Estonia’s labor tax budget than the TOP industrial manufacturers. By total labor tax volume industrial manufacturers are still quite a bit ahead, but TOP startups are closing in fast. TOP20 startups paid in the 3rd quarter €9.4M, which is 29% of the TOP20 industrial manufacturers €32.6M contribution. If startups 3rd quarter labor tax payments YoY growth (+32%) continues then in 6 years the TOP20 startups pay more labor taxes to the government’s budget than the TOP20 industrial manufacturers.

This is all about the growth of labor tax funds. Keeping the current baseline will remain heavily on the shoulders of manufacturing companies. The comparative share of taxes paid by the 304 selected startups will in 6 years reach 30% of the labor taxes paid by all industrial manufacturing companies. In Q3, the total numbers were 209MEUR for manufacturers and 15MEUR for the 304 startups. Joint effort is needed from both the industrial and startup communities to keep the economy ticking and growing.

Startups with the fastest sales machines in the 3rd quarter

According to the tax authorities data the TOP5 startups with the highest sales volume are our usual suspects: Cleveron, Taxify, Adcash, Fortumo and Pipedrive. Two newcomers into the TOP20 are Comodule and Bondora.

Comodule are positioning themselves as a global leader in bike and scooter connectivity, digitalization and fleet management for the light vehicles industry. According to Crunchbase, by 2016 they raised €525K in 3 rounds + more in 2 rounds, of which sums raised are not available. They have skyrocketed from position #92 (80 800€) to #18 with €1.167M. We will keep an keen eye on the startup and hope that this the start of continuous growth.

Bondora is an online platform for fixed-income investments in European personal loans, and has risen from #35 to #19 in sales TOP. Their last investment round was in 2015 and in five rounds they have accumulated funding of €7.2M.

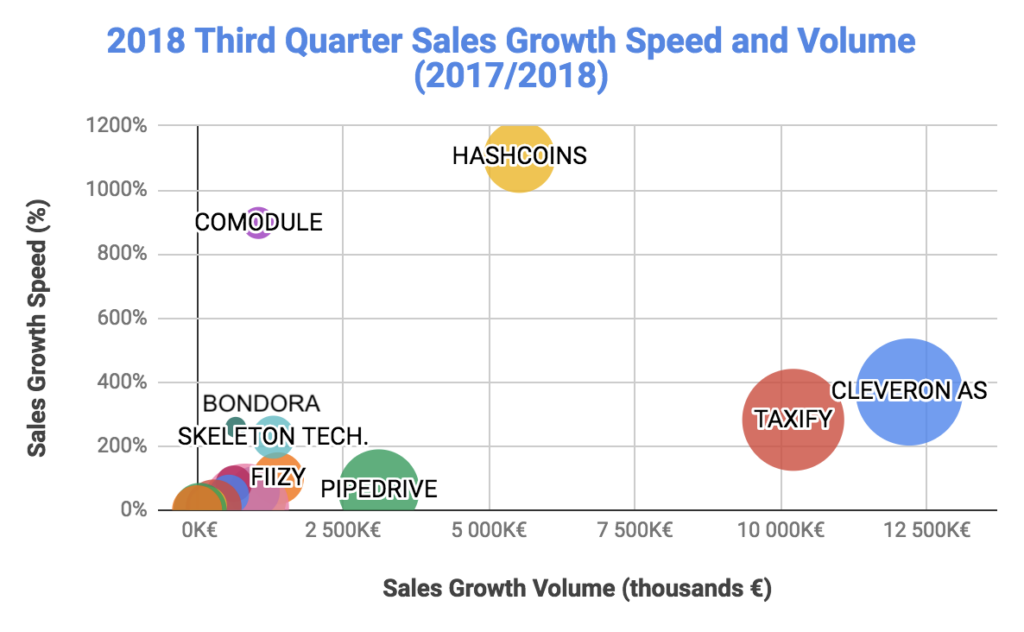

Startup sales volume is important, but not nearly as important as growth speed and volume of sales. 17 startups in the sales TOP have increased their quarterly sales on a yearly basis. There a four clear outliers in this pack.

Volume wise Cleveron and Taxify dominate the list as they have added €12M and €10M respectively to their YoY quarterly sales. The other two outliers have had over 800% growth on their YoY quarterly sales: Comodule and Hashcoins. Hashcoins builds cryptographic hardware, creates blockchain technology-based solutions and provides remote hardware access services. They have increased quarterly sales from 500 000€ in 2017 to €6M in the 3rd quarter of 2018. Still it is a drop compared to Q1 and Q2, where they were making over €8M. Let’s see how they will do in coming quarters.

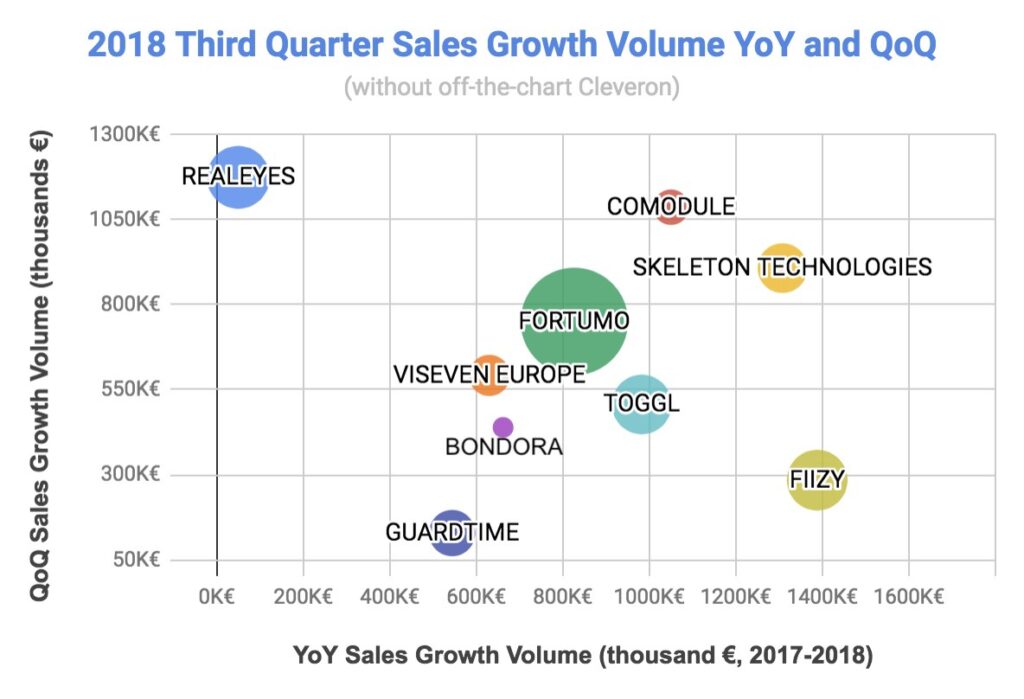

Although quarterly sales increase can be influenced by seasonality, it can also be an early indicator of a growth trajectory. There were 9 startups, who could show both quarter-on-quarter and year-on-year sales growth. Cleveron with its €2.5M quarterly sales increase compared to Q2 is a beast. It is just like they are printing money, so we took them off the chart (see below).

In addition to Comodule’s skyrocketing quarterly sales, there are three more interesting outliers: Realeyes, Fiizy and Skeleton Technologies.

Realeyes measures how people feel as they watch video content online and their reports help video marketers to create better content. In May 2018, they raised €16.2M in a series-A round from Draper Esprit. They show up on the chart because they had really weak sales in Q2 and a €2.98M all-time-high in Q3. Let’s hope that they put their investor’s money to work and Q3 was just the first quarter in a long series of all-time-high sales.

Fiizy is a financing solution giving consumers approved loan offers at the point of sale from the majority of creditors. They have made headway in Spain and have now expanded their activity to Mexico, Peru, Argentina, Poland and the United States. They have increased their sales 11% quarter-on-quarter, 100% YoY and reached €2.7M quarterly sales in Q3.

Skeleton Technologies are positioning themselves as the global technology leader in ultracapacitor-based energy storage. Their total funding amount is €46,4M and most recently they got a €15M loan from the European Investment Bank (in Feb 2017). They have put investors’ money to good use and tripled their YoY sales from 573 000€ in 2017 and doubled quarterly sales to €1.9M. Good job! Let’s see if they can keep it up and double their sales again in Q4.

We counted also 3 runner-ups, who based on their YoY and QoQ sales growth numbers could reach €1M in quarterly sales and be in TOP20 after a year. These are in alphabetic order: Fitlap, Funderbeam, and Majandustarkvara.

Fitlap has shown steady growth based on Estonian market. Can they break out? Funderbeam quarterly sales were first time in hundreds of thousands (€310K vs usual €40K). Can the keep that momentum? Majandustarkvara is an affiliate company of Erply team. Will it be able to keep up with salary surge trend and continue to find new engineers it needs for growth?

Fastest team builders in the 3rd quarter

Transferwise is still far in the lead (680 people) and has twice as many employees as Pipedrive (298 people), who is next in the TOP20. They are followed by Taxify, Norstat, and Cleveron. The least known of these 5 is Norstat founded in 2007 by Kaspar Küünarpuu, which has grown into one of Europe’s leading providers of data collection services, helping clients to understand their markets and customers.

Newcomers to the TOP20 startups by team size are LeapIN and Testlio. LeapIN is powered by Estonian e-Residency and provides services for starting and remotely running a location independent company online, in Estonia/Europe. They raised €1.3M using equity crowdfunding in October 2017 and recently hired a serial entrepreneur, executive and investor, Allan Martinson as CEO.

Testlio provides a community of highly vetted testers and an end-to-end QA management platform. They raised $7.5M by 2016.

In the speed of team’s annual growth category Transferwise still dominates the whole startup scene. They have added 216 more people, that is more than #2 Taxify and #3 Cleveron have added together. Transferwise is off the chart…literally.

On the graph there are 2 more outliers by YoY team growth metrics. LeapIN has tripled their team within a year to 45. Monese has almost doubled their team and reached a headcount of 85. They have built an online banking platform that offers super quick current account opening for all EU residents. In September 2018 they raised $60M in Series B from Kinnevik AB. With such funding they can surely keep growing.

Out of the TOP20 we counted 9 startups, which have been able to grow headcount both quarterly and annually. Transferwise and Taxify quarterly hires are again off the chart (74 and 34). Out of the other 7 there are three startups we have not mentioned yet Guardtime, Ridango and Starship Technology.

Based on QoQ and YoY numbers we have also identified a few runners-up, who most probably will be in the TOP20 startups by team size in a year. These are Veriff (YoY +500% to 40 people), Digital Sputnik Lighting (YoY +150% to 30 people), Click & Grow (YoY +144% to 36 people), SprayPrinter (YoY +200% to 27 people), and Quretec (QoQ +10% to 35 people).

Problems with TOPs

There are several problems with making such lists. Here are the ones we consider most important.

Metrics. Early stage startups growth cannot be measured in revenue, but in attraction, learning speed, etc. Ash Mauyra has written a whole book on it “Scaling LEAN”. Growth in the number of people and increase in revenue are not the earliest leading indicators, but they definitely are indicators measuring momentum of already growing startups.

Seasonality. Some markets are very seasonal, hence revenue growth quarter to quarter does not make much sense. Seasonality is most common to consumer electronics and consumer products. Most Estonian startups are not active in these markets so seasonality should not be such an issue. There are only two quarterly revenue indicators out of 8 we measure. Hence seasonality should not have too much weight in filtering out the best of the best.

Corporate structure. Several successful startups have built up their corporate structure by splitting revenue and employees into different legal entities. Most often a foreign mother company has revenues in their books and most of the employees in the Estonian subsidiary. For this reason companies such as Transferwise will not make into the high ranks in our index. Until we have figured out a way to compensate it we just have to accept this anomaly in the numbers.

Advantage of smallness. Estonia is a small country and startups are also small. If you have a low baseline then adding 5 people might skyrocket you into the TOP of the list of highest growing employers. Our current approach is to select by volume the TOP20 startups in three categories and see who are the fastest growing companies among the biggest startups. This somewhat minimizes the advantage of smallness and low baseline.

Veljo Otsason, the partner of Superangel, flew 4 km to the sky only to jump out again and reverse-pitch Superangel fund.